The place will it’s deployed? • TechCrunch

[ad_1]

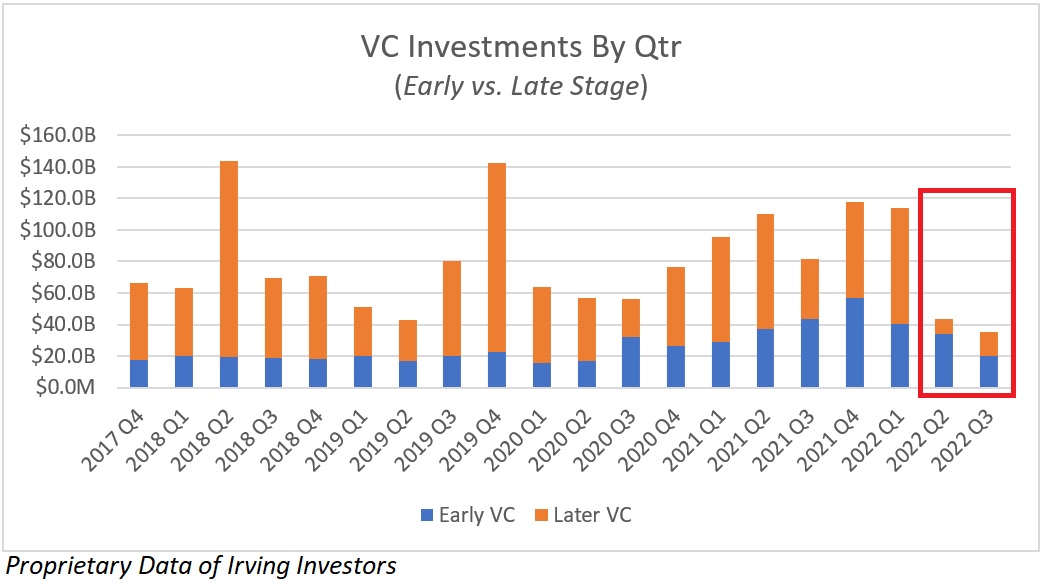

Enterprise fundraising has continued at a strong tempo, however a lot much less money is being deployed.

Let’s begin with just a few headlines:

- Bessemer in September raised about $3.85 billion for early stage startups, the biggest car within the agency’s 50-year existence.

- Perception Companions in February raised over $20.0 billion, double its predecessor fund (closed in April 2020 at $9.5 billion).

- Lightspeed in July raised greater than $7 billion throughout 4 funds for seed to Sequence B rounds.

- Battery Ventures in July raised over $3.8 billion with a broad mandate.

- Founders Fund in March raised over $5 billion throughout enterprise ($1.9 billion) and progress ($3.4 billion) funds.

- a16z in Might raised about $4.5 billion in its fourth fund concentrating on blockchain, bringing its complete funds raised for blockchain-related firms to greater than $7.6 billion.

- a16z individually closed $9 billion in contemporary capital in January, with $1.5 billion allotted to biotech investments.

- Tiger World is rumored to be elevating PIIP 16 in what might be an round $10 billion car and its second largest fund ever.

The general public markets have seen an excessive valuation recalibration, and it’s successfully trickling down into the non-public markets. All of the whereas, crossover funds and VCs have been watching from the sidelines — capital deployment is in considerably of a “wait and see” mode.

The online/internet: Extra {dollars} being raised with much less deployed equals materially larger money balances.

Picture Credit: Irving Buyers

What the numbers inform us

Capital elevating

Enterprise capital fundraising has remained considerably fixed this 12 months. VC companies have raised a complete of $122 billion to date this 12 months, and are on tempo to complete the 12 months with $172 billion.

Brief-term valuation “work arounds” can grow to be a lot larger long-term issues.

That’s 20% lower than 2021 ($214 billion), a contact beneath 2020 ($180 billion), and about 11% lower than the $194 billion common raised yearly since 2019.

This robust stage of fundraising is in stark distinction to the poor efficiency of high-growth names within the public markets. As an illustration, our high-growth SaaS bucket has suffered losses of about 60% to 80% or extra.

Picture Credit:

Capital deployment

Whole capital deployed by VCs in Q2 2022 and Q3 2022 has quickly declined and now averages simply $39 billion per quarter. That is on observe to be the bottom studying since we will pull the info from 2017.

Presently, capital deployed in Q3 2022 (lower than $40 billion) is on tempo to be about 70% beneath This autumn 2021 ranges (about $118 billion).

Source link