Wells Fargo says you’ll know the market has hit backside when this occurs (VIX)

[ad_1]

naphtalina/iStock through Getty Photos

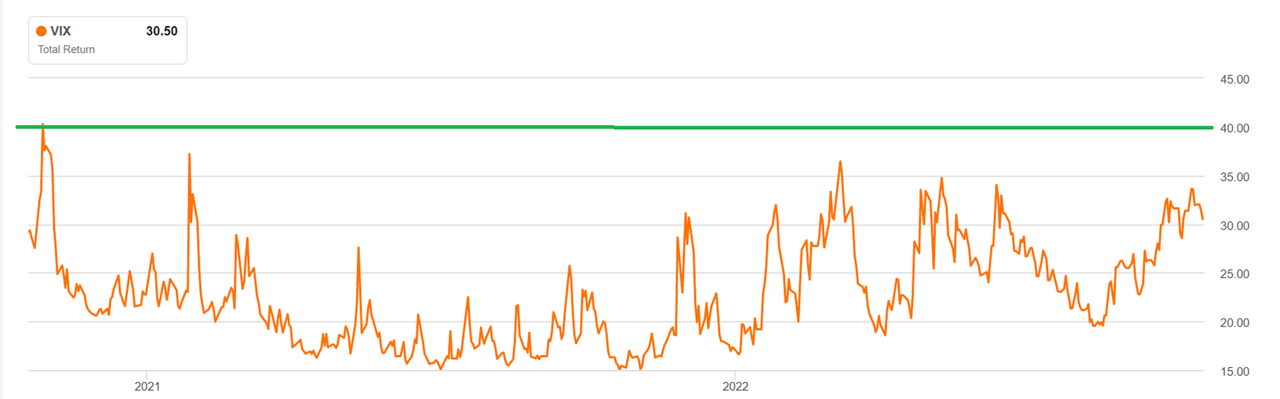

Shares ought to see a “buyable backside” when the CBOE Volatility Index (VIX) tops 40 from at present’s ~30 studying – a spike prone to coincide with the Fed returning to price cuts and making a “Powell put,” Wells Fargo strategists say.

“Search for a 40 deal with [on the VIX],” Wells Fargo Securities Fairness Analyst Christopher Harvey and his colleagues wrote in a current observe. “A VIX > 40 has traditionally coincided with SPX -4% (common 1-day) and helped set off the ‘Powell put.’ In different phrases, the atmosphere must worsen earlier than a monetary-policy pivot marks a longer-term buyable fairness backside.”

The analysts checked out VIX knowledge going again greater than 20 years and located that at any time when the volatility index topped 40, the Federal Reserve normally was about to start out reducing charges or had already begun doing so.

Looser financial coverage is normally a optimistic for shares as a result of weak rates of interest make equities look extra engaging than bonds or money-market accounts. Some name this the “Fed put” or “Powell put,” after present Federal Reserve Chairman Jerome Powell.

Harvey and his colleagues wrote that whereas the U.S. central financial institution doesn’t formally issue inventory costs into its interest-rate choices, “historical past reveals an uncanny relationship between [VIX] spikes and Fed exercise. When the VIX (VIX) has breached 40 (e.g., Sep ’01, Jul ’02, Sept ’08, Feb ’20, Oct ’20), the Fed was about to start out (or already in) an easing cycle.”

A 40+ VIX Preceded 2008-09’s Ultimate Backside

For instance, the Wells Fargo analysts famous that the market moved towards its 2008-09 backside as soon as the VIX (VIX) shot as much as 47 on Sept. 29, 2008, after Congress initially voted down the Nice Recession’s Troubled Asset Aid Program.

The VIX spike occurred when the Fed was effectively right into a rate-cut cycle, and 40+ studying coincided with the beginning of one of many ultimate 2008-09 legs down for the S&P 500, which bottomed out some 5 months later.

The Sign Has Failed Simply Three Instances Since 2001

The analysts stated a 40+ VIX (VIX) has solely did not overlap with a Fed rate-cutting cycle simply thrice since 2001.

The primary occasion got here in Could 2010 when the central financial institution’s Quantitative Easing I program had simply ended, whereas a second case occurred in August 2011 when the Fed funds price was already at 0%. Markets noticed a 3rd occasion in August 2015, when volatility spiked and the S&P 500 (SP500)(SPY) fell 9% in two weeks as a result of the Individuals’s Financial institution of China had simply devalued the yuan.

No 40+ VIX in Two Years

As for current occasions, the VIX (VIX) hasn’t topped a 40 studying since October 2020 − greater than a yr earlier than the S&P 500’s present downturn started:

The Wells Fargo analysts wrote that the shortage of a 40+ VIX spike in at present’s market cycle signifies that the market possible has but to have bottomed out.

“A lot to the chagrin of volatility merchants, the VIX (VIX) has been well-behaved yr thus far,” they wrote. “Volatility expectations − particularly on far-downside choices − have stored the ‘concern gauge’ considerably suppressed … for now.”

VIX ETFs Have Been Crushing It

Nonetheless, ETFs and ETNs primarily based on the Volatility Index (VIX) have had a very good yr to this point. As an illustration, the iPath Sequence B S&P 500 VIX Mid-Time period Futures ETN (VXZ) is up a category-leading 16.7% yr thus far.

In the meantime, the ProShares VIX Mid-Time period Futures ETF (BATS:VIXM) has gained 16% YTD and the iPath Sequence B S&P 500 VIX Brief-Time period Futures ETN (BATS:VXX) is +11.2%.

For extra macro-market information and evaluation, click on right here.

Source link