W. P. Carey to report Q3 outcomes amongst robust earnings season for internet lease REITs

[ad_1]

putilich

W. P. Carey (NYSE:WPC) is scheduled to announce Q3 earnings outcomes on Friday, November 4th, earlier than market open.

The consensus FFO estimate is $1.26 (-12.93% Y/Y) and consensus income estimate is $370.17M (+13.63% Y/Y).

The outcomes come amid a robust quarterly earnings season for internet lease REITs.

STORE Capital, CTO Realty Development, Alpine Revenue Property Belief, American Property Belief and Empire State Realty Belief reported a snug Q3 earnings and income beat.

Important Properties Realty Belief, World Web Lease and Broadstone Web Lease reported a miss in income, however FFOs have been in-line with estimates.

Ranked among the many largest internet lease REITs, W. P. Carey is anticipated to put up a beat tomorrow.

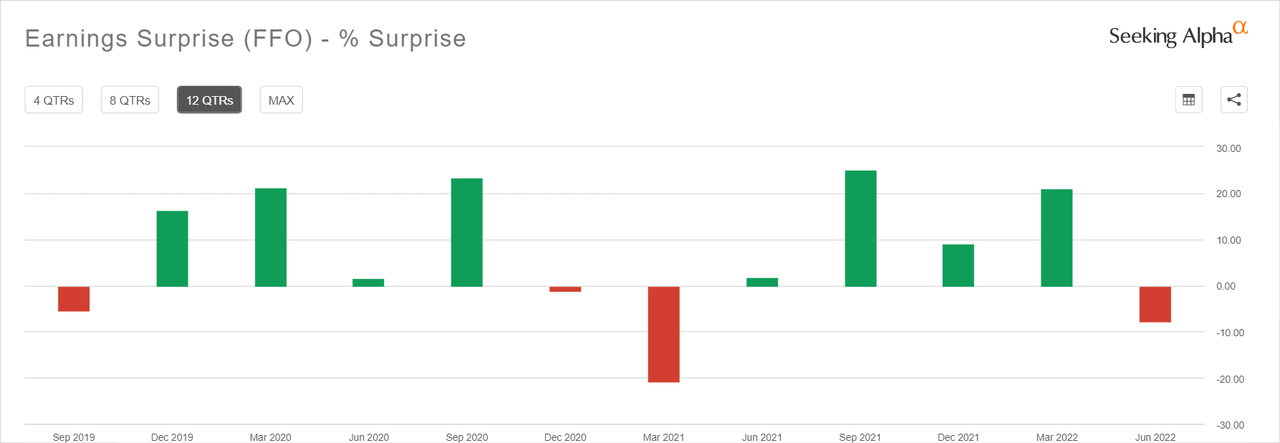

During the last 2 years, WPC has crushed FFO estimates 63% of the time and income estimates 100% of the time. Here’s a have a look at the earnings surprises within the final 12 quarters:

The corporate posted a robust Q2 end result, having raised the decrease finish of its steerage vary.

The credit score high quality was robust and no credit score deterioration was seen, Managing Director & Head, Asset Administration, Brooks Gordon mentioned throughout the firm’s Q2 earnings name.

WPC usually owns single-tenant properties leased to excessive credit-quality tenants below long-term leases, Looking for Alpha writer Hoya Capital mentioned in a current report, the place the writer ranks the corporate slightly below Realty Revenue when it comes to tenant credit score high quality.

The web Lease subsector is extra “bond-like” and rate-sensitive, however have surprisingly been among the many best-performing property sectors this 12 months regardless of the difficult macroeconomic atmosphere, the writer famous.

Source link