‘Volatility vortex’ slams into $24tn US authorities bond market

[ad_1]

The $24tn US Treasury market has been hit with its most extreme bout of turbulence for the reason that coronavirus disaster, underscoring how large swings in worldwide bonds and currencies and jitters over US price rises have spooked traders.

The Ice BofA Transfer index, which tracks mounted earnings market volatility, has reached its highest degree since March 2020, a time when deep uncertainty about how the pandemic would have an effect on the world financial system set off huge fluctuations in US authorities bonds.

“Proper now it’s all about market volatility,” mentioned Gennadiy Goldberg, a strategist at TD Securities. “You might have traders staying away due to the volatility — and traders staying away will increase volatility. It’s a volatility vortex.”

Mounted earnings traders’ nerves have been frayed by a sequence of occasions mostly seen throughout market crises. Japan, the world’s third-biggest financial system, final week stepped in to defend the yen after the foreign money quickly tumbled to a 24-year low towards the greenback. Simply days later, plans for large tax cuts by the UK authorities ignited a historic sell-off in Britain’s foreign money and sovereign debt markets.

These worldwide occasions have added to a robust pullback within the US Treasury market that accelerated after the Federal Reserve final week delivered its third-straight 0.75 proportion level price rise and signalled considerably tighter financial coverage to come back.

The ten-year Treasury yield, a key benchmark for world borrowing prices, has surged to just about 4 per cent from 3.2 per cent on the finish of August, leaving it set for the largest month-to-month rise since 2003. It’s on observe for its sharpest ever annual rise. The 2-year yield, extra delicate to fluctuations in US financial coverage, has leapt 3.55 proportion factors this 12 months, which might additionally mark a historic enhance.

The large worth actions have left traders cautious of buying and selling in a market that acts because the bedrock of the worldwide monetary system and is often thought-about a haven throughout occasions of stress.

With traders on the sidelines, liquidity within the Treasury market — the convenience with which merchants purchase and promote — has deteriorated to its worst degree since March 2020, in response to a Bloomberg index. Poor liquidity tends to exacerbate worth swings, worsening volatility.

In an indication of how the fraught circumstances are holding some fund managers away, the US has drawn lacklustre demand at gross sales this week for a mixed $87bn in new debt.

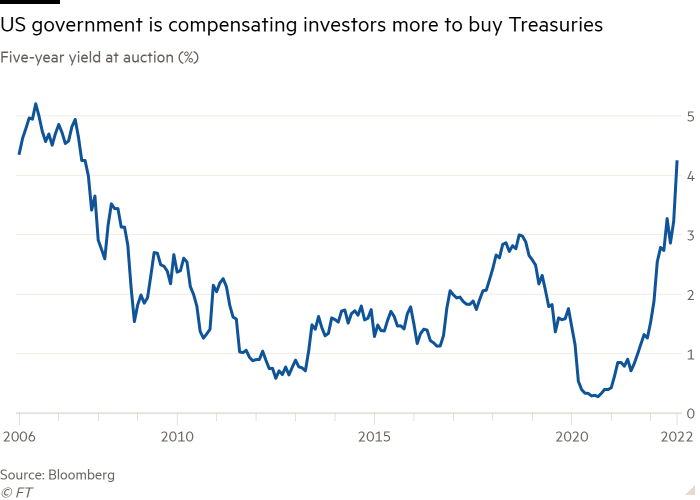

A two-year issuance on Monday priced at a excessive yield of 4.29 per cent, whereas a five-year deal someday later priced at 4.23 per cent — each marking the very best borrowing prices for the federal government since 2007.

The 2-year debt was offered with the widest distinction — or “tail” — between what was anticipated simply earlier than the public sale and the place it truly priced for the reason that 2020 Covid-induced market ructions, mentioned Tom Simons, a cash market economist at US funding financial institution Jefferies.

The Treasury division will public sale off $36bn in seven-year notes on Wednesday. The seven-year word has struggled to draw demand in much less risky moments, so the surroundings this week might pose a problem.

“Till there’s extra certainty I believe we’ll proceed to have this ‘consumers’ strike,’” Simons mentioned. “The markets are so loopy that it’s laborious to cost any sort of new [longer-dated bonds] coming into the market.”

A divergence between the Fed’s personal outlook for rate of interest and market expectations has added to the sense of uncertainty.

In line with their newest projections, most Fed officers now count on the federal funds price to rise from its present goal vary of 3-3.25 per cent to 4.4 per cent by year-end. By the top of 2023, Fed officers count on rates of interest to face at 4.6 per cent.

In the meantime, traders are betting that the Fed will likely be pressured to chop rates of interest subsequent 12 months — with expectations within the futures market of a peak of 4.5 per cent in Could of 2023, with a fall to 4.4 per cent by year-end.

Given persistent and broad-based worth pressures, there’s important uncertainty about whether or not that quantity of financial tightening will likely be ample to deliver inflation again right down to the Fed’s 2 per cent goal. Recession dangers have additionally risen markedly, additional clouding the outlook.

Robust rhetoric adopted by Fed officers in regards to the central financial institution’s battle towards inflation has stoked additional angst available in the market. Many officers now agree that rates of interest must rise to a degree that actively constrains the financial system and keep there for an prolonged interval.

“The one different time I’ve seen us this united was at first of the pandemic, once we knew we needed to act boldly to help the financial system by means of the pandemic and thru the downturn,” mentioned Neel Kashkari, president of the Minneapolis department of the Fed, in an interview with the Wall Avenue Journal on Tuesday.

“We’re all united in our job to get inflation again right down to 2 per cent, and we’re dedicated to doing what we have to do with a purpose to make that occur.”

Source link