Uncommon Choice Exercise in Tesla: Bears Hit it Large

[ad_1]

Lately, Market Rise up recognized a sequence of large bearish bets being made towards EV darling, Tesla. It began simply two weeks in the past, on September twenty ninth. Market Rise up recognized 4,171 bearish put unfold spreads purchased on the $260-$240 vary for $5.98 per unfold.

Whole commerce worth: $2.5 million {dollars}.

On the time, with Tesla buying and selling at $275.56, shares would have needed to fall by roughly 13% in only one month for the unfold to succeed in full profitability (which might increase the worth of this $2.49M guess to greater than $8.3M).

Spoiler alert: It took per week, not a month, for Tesla to fall under $240.

Prepared to begin buying and selling the technicals? Attempt Insurgent Weekly. Journey the waves of market momentum with two actionable commerce concepts designed to seize technical break outs and break downs — delivered to your inbox each week.

Why?

Regardless of these spreads having greater than tripled in worth since their preliminary buy, bears weren’t completed with Tesla inventory. On October third, Market Rise up recognized yet one more huge bearish guess towards the EV big.

Inarguably, this guess was even bolder. This dealer picked up 18,000 lengthy put choices for a median contract worth of $8.28.

Whole commerce worth: $15 million {dollars}.

To ensure that these put choices to interrupt even, Tesla shares would have needed to fall an further 2.46%. Upping the ante even additional: These put choices had been set to run out in simply 5 days.

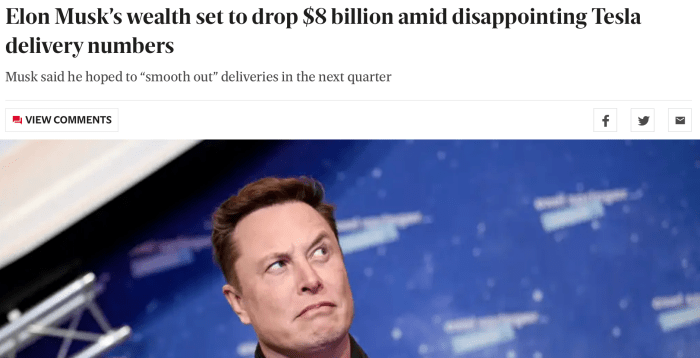

Then, simply in the future later, the information broke:

Prepared to begin buying and selling? Attempt Uncommon Choice Exercise Important. Study how one can observe the “good cash” with a contemporary UOA commerce thought every week – together with technical ranges in order that you recognize the place to enter and exit!

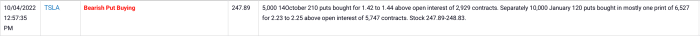

Inside minutes of the information breaking, Tesla bears had been again as soon as once more with two extra actually outlandish out-of-the-money bets towards Tesla.

With Tesla buying and selling at $247.89, Market Rise up recognized a purchaser of 5,000 $210 strike put choices expiring 10 days from the preliminary commerce — and 10,000 $120 strike put choices expiring in January.

Whole commerce worth: $2.96 million {dollars}.

Whereas this commerce wasn’t as massive because the bearish $15M commerce made the day earlier than, this commerce caught out for a distinct motive: This commerce was calling for Tesla to drop one other 16% by the top of the next week, and greater than 50% by January. This, with the inventory having already fallen by greater than 10% that week.

In response, one twitter person stated:

What occurred subsequent?

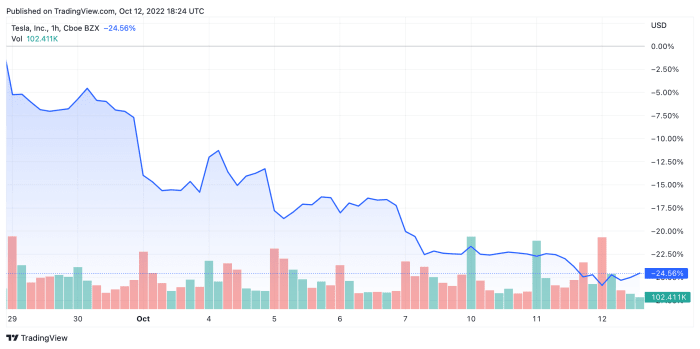

Tesla fell once more. By October twelfth, these $210 put choices expiring on 10/14 (you would possibly bear in mind it because the “completely moronic guess” traded as excessive as $5.55 — a 288% worth appreciation from the preliminary commerce worth. And people $120 strike January put choices? Tesla didn’t must fall 50% to ensure that these to show a revenue — simply eight days after their buy, these $120 strike put choices traded for as excessive as $3.80 — a 69.6% worth appreciation.

The Backside Line

If somebody is prepared to stake extra money on a two-week-to-expiration guess than Ariana Grande spends to purchase a mansion, it’s most likely price paying consideration. You may need your opinion on what’s and isn’t “a moronic guess”, however on the finish of the day, most individuals who’ve amassed multi-million greenback fortunes out there aren’t within the enterprise of throwing it away. Chances are high, there’s motive why they’re making that guess.

[ad_2]

Source link