Thomson Reuters to accumulate tax automation firm SurePrep for $500M • TechCrunch

[ad_1]

Thomson Reuters has introduced plans to accumulate SurePrep, a tax automation software program firm based mostly in Irvine, California.

The transaction, which Thomson Reuters mentioned it expects to shut in Q1 2023, values SurePrep at $500 million, which will likely be paid completely in money.

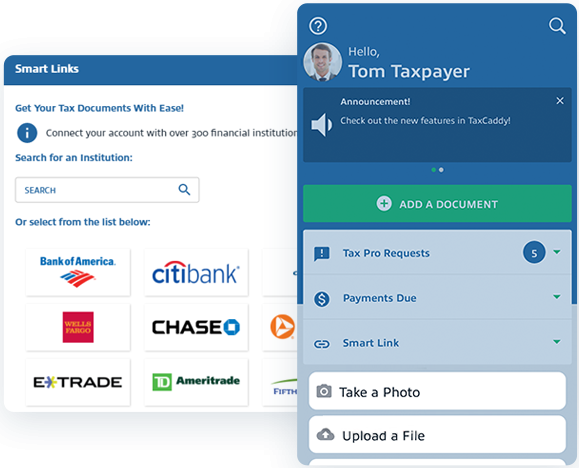

Based in 2002, SurePrep is certainly one of quite a few software program suppliers that assist tax professionals and accountants collect and file 1040 tax returns on behalf of their purchasers. Integrating with current tax software program methods, SurePrep provides numerous merchandise that help importing paperwork at common intervals via the yr through automated doc requests, with help for cellular scanning, esignatures, and extra. Constructed-in AI smarts additionally robotically extracts and repopulates knowledge in firms’ tax compliance software program of selection, eradicating most of the handbook paperwork steps concerned.

SurePrep’s TaxCaddy product

SurePrep is the most recent in a protracted latest line of tax administration software program firms to be acquired. In August, Vista Fairness Companions introduced plans to accumulate automated tax compliance firm Avalara for $8.4 billion, whereas earlier this month non-public fairness agency Cinven revealed it was shopping for on-line tax preparation software program supplier TaxAct for $720 million. Final yr, Stripe purchased TaxJar for an undisclosed quantity.

Thomson Reuters, although maybe finest recognized for its information company, has plenty of enterprise items together with authorized, authorities, and tax and accounting. Certainly, it has been partnering with SurePrep for the previous six months, in line with Thomson Reuters, “offering complementary options” for tax and accounting employees — this has successfully meant Thomson Reuters serving as a reseller for SurePrep’s software program.

For SurePrep, the deal will give it intensive attain into Thomson Reuters’ current buyer base, whereas for Thomson Reuters it will get an arsenal of automated instruments to bolster its current tax merchandise.

Source link