This dealer sees a 43% drop for the S&P 500 and says to take shelter in these ETFs as a substitute.

[ad_1]

Buyers could have gotten overly excited this week about feedback from Fed Chairman Jerome Powell.

The Fed chief’s suggestion of a 50 foundation level hike vs. 75 bp in December wasn’t new, says the founder & CEO of BullAndBearProfits.com, Jon Wolfenbarger. However his dovish tone may result in looser monetary situations, bringing with it larger inflation, and extra price hikes to regulate that, he tells MarketWatch in an interview.

In our name of the day, the previous Wall Road funding banker warns that the playing cards are stacked in opposition to fairness markets for the foreseeable future, and affords charts to again that up.

From his newest weblog put up is that this one displaying the CBOE Volatility Index, or the VIX

VIX,

bouncing off a development line that previously has proven prior bottoms for that index and peaks within the S&P 500 this 12 months:

BullandBearProfits.com

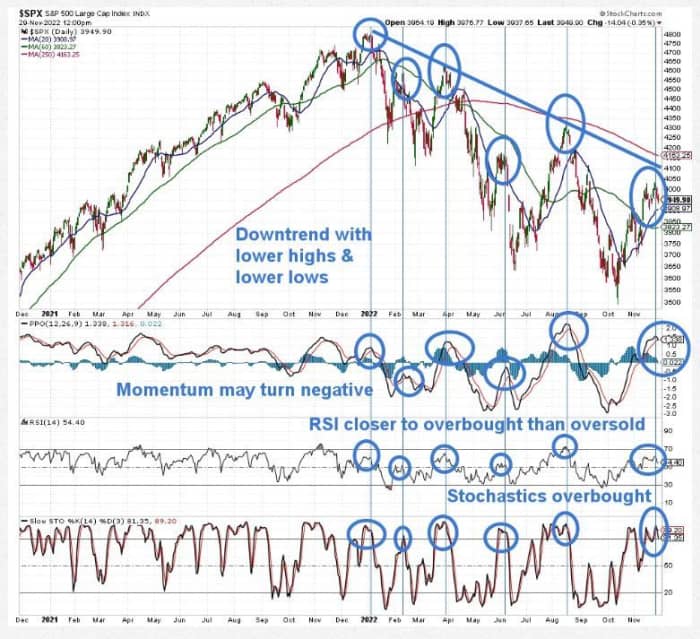

The following chart exhibits the S&P 500 in a “clear bear market downtrend with decrease highs and decrease lows” and buying and selling beneath its 250-day transferring common (pink line) and downtrend line (blue line), he says:

BullandBearProfits.com

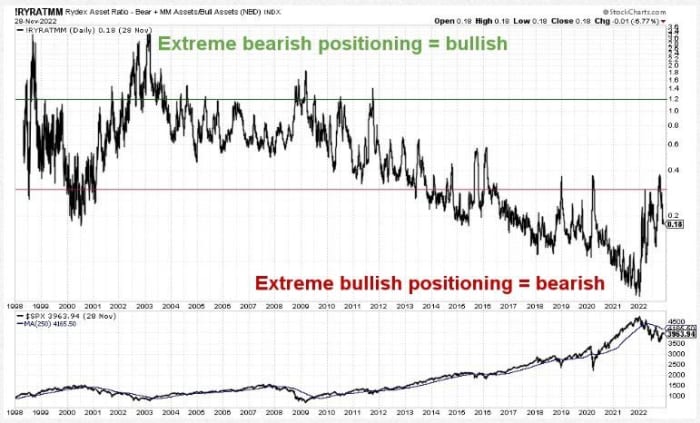

Then there’s all that bullishness, regardless of an almost year-long bear market, That bull/bear ratio reached traditionally bullish ranges on the early 2022 market peak and stays in very bullish territory, he stated.

BullandBearProfits.com

“This bearish technical setup for the inventory market, mixed with overly bullish investor sentiment within the face of the Fed mountaineering charges right into a recession, means that the inventory market is prone to begin one other main bear market selloff quickly,” stated Wolfenbarger, who sees that recession beginning any day and ending round late 2023 or early 2024.

Removed from extra optimistic forecasts seen elsewhere on Wall Road, the cash supervisor is focusing on 2,250 for the S&P 500, a 43% tumble from present ranges, although a bottoming in mid-2023. That bear market will final a complete of 18 months, not far off the 17-month bear market seen within the World Monetary Disaster.

However don’t rev up the buying carts simply but. “Primarily based on present valuation ranges for the inventory market which are close to the 2000 Tech Bubble and 1929 peaks, the S&P 500 is prone to be at the very least 25% decrease in 10 to 12 years,” he predicts.

His recommendation? Promote “danger on” property like shares, commodities (together with power shares, which is able to drop together with oil as a recession kicks in) and cryptocurrencies — extremely correlated with tech shares. Treasury bonds will likely be riskier than regular throughout a recession owing to excessive inflation, he provides.

“For many who are risk-averse and need to wait this bear market out till the subsequent bull market begins, you should buy protected and comparatively excessive yielding Treasury payments and floating price notes,” stated Wolfenbarger, who suggests ETFs, such because the SPDR Bloomberg 3-12 Month T-bill ETF

BILS,

and the WisdomTree Floating Fee Treasury Fund ETF

USFR,

For aggressive buyers seeking to revenue extra considerably from a bear market, he suggests inverse ETFs that rise when shares fall, akin to ProShares Quick S&P 500 ETF

SH,

and ProShares Quick QQQ

PSQ,

Those that need to be much more aggressive, should purchase double inverse ETFs akin to ProShares UltraShort S&P 500

SDS,

and ProShares UltraShort QQQ ETF

QID,

An investor seeking to revenue from falling oil costs may purchase double inverse oil ETF ProShares UltraShort Bloomberg Crude Oil

SCO,

“After the Fed begins chopping charges and the recession turns into well-entrenched, we’ll search for shares to turn out to be very oversold (we concentrate on key technical indicators for this akin to Weekly & Month-to-month RSI and Bollinger Bands) to take earnings from this bear market after which place for the subsequent bull market with particular person shares and lengthy and levered-long ETFs,” he says.

Learn: Certainly one of Wall Road’s largest bulls now sees shares falling early subsequent 12 months as Fed ‘overtightens’

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Enterprise Every day.

Better of the online

Sam Bankman-Fried stated he cares most about serving to humanity in attempting to clarify the FTX collapse.

Elon Musk says his Neuralink mind implants could possibly be prepared for human trials in six months. Curing paralysis is without doubt one of the targets.

The advantages of “freudenfreude” — discovering happiness in one other particular person’s luck

The chart

Random reads

Kanye West’s month-to-month little one assist payments? $200,000

UNESCO Heritage standing lastly arrives for the French baguette

Have to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your e-mail field. The emailed model will likely be despatched out at about 7:30 a.m. Japanese.

Take heed to the Greatest New Concepts in Cash podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.

Source link