The State of Realized Volatility: No panic promoting but

[ad_1]

champc

Main market averages remained beneath strain on the week as they led to detrimental territory. Whereas markets closed decrease on the week, they did so in a comparatively orderly trend as panic promoting nonetheless has not been noticed. Regardless of a rising charge surroundings, a hawkish Federal Reserve, and rising yields, Wall Road appears calm and collective as benchmark indices slide.

PriceVol Indicator

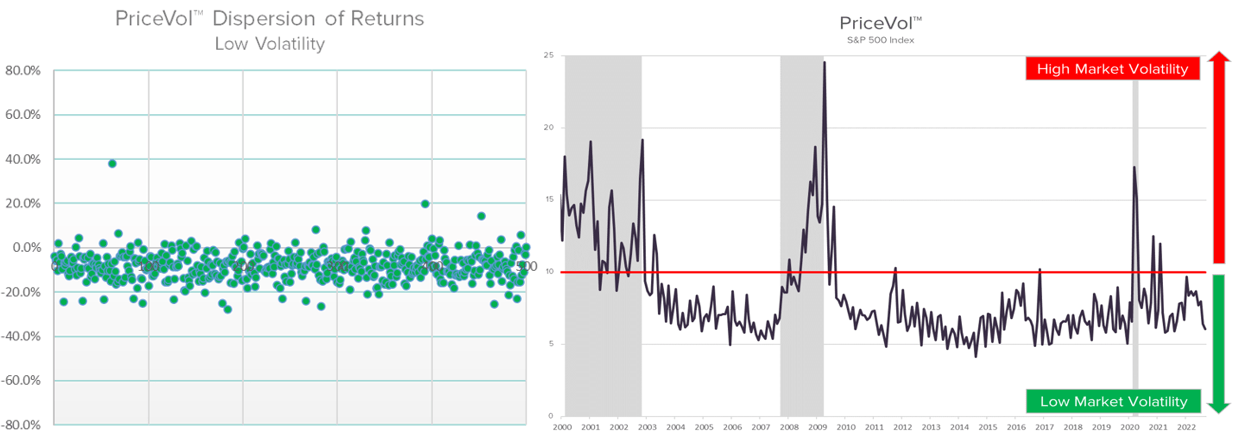

PriceVol, shouldn’t be exhibiting indicators of panic promoting as knowledge pointed to a 5-day common degree of 6.3, a far cry from the ten deal with which signifies a excessive market volatility sign. The 6.3 studying is barely elevated from the earlier week’s 6.0 mark, however it seems reasonably calm.

Moreover, PriceVol, a branded buying and selling device created by ASYMmetric ETFs goals to calculate the entire panorama of the volatility mirrored in all the S&P 500. See beneath a side-by-side chart outlining the dispersion of returns in comparison with the historic PriceVol historical past. Buyers will discover that the compact readings within the dispersion chart lend themselves to a low volatility surroundings, as excessive volatility setting blow aside as buyers panic promote.

The place was volatility seen?

Change traded funds that monitor the strikes of the S&P 500 just like the world’s largest fund SPDR S&P 500 ETF Belief (NYSEARCA:SPY) and its competitor ETF, the Vanguard 500 Index Fund (NYSEARCA:VOO) closed out the buying and selling week decrease by almost 3% because the S&P VIX Index (VIX) completed the week decrease by 2%.

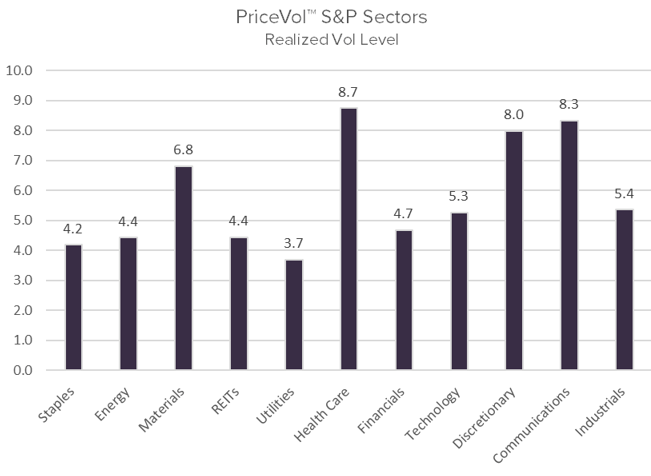

On a sector-by-sector foundation, the Well being Care (XLV) phase of the S&P noticed the best degree of realized volatility at 8.7, whereas the Utilities (XLU) sector was seen on the opposite finish with the bottom weekly realized volatility ranges at 3.7.

When analyzing the speed of change in PriceVol, buyers may have seen that the Communications (NYSEARCA:XLC) sector of the market skilled the most important W-o-W enhance of 47%. On the finish of the week the Communication’s area concluded as the realm with the second highest PriceVol studying at 8.3. See a breakdown of every sector’s PriceVol degree for the week:

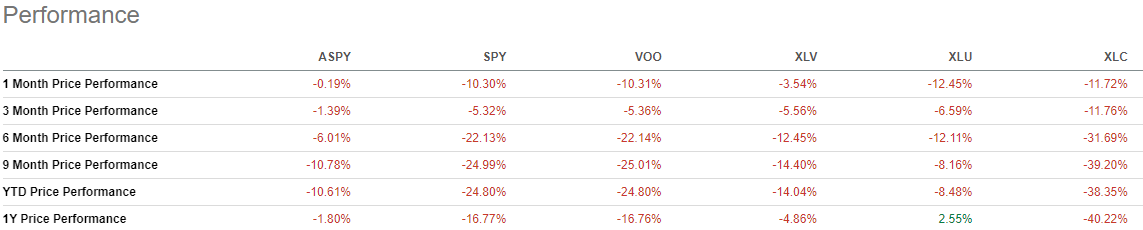

ASYMmetric S&P 500 ETF (NYSEARCA:ASPY) is an ETF that was created from the PriceVol indicator. ASPY works as a quantitative lengthy/quick hedging technique that seeks to supply buyers a backstop in opposition to bear market selloffs by being internet quick, whereas additionally seeks to seize nearly all of bull market positive aspects, by being internet lengthy.

See beneath the performances of all 5 ETFs mentioned throughout a number of time frames.

Source link