The startup and enterprise markets are coming again to sq. one • TechCrunch

[ad_1]

What goes up should come down” is a cliche that can also be a bastardization of Newton’s third regulation. It’s additionally a superb reminder that when it appears to be like just like the enterprise market has modified essentially, we’re typically actually simply seeing a short lived aberration.

This idiom rings true once we contemplate the cycle of tech valuations (up after which down), enterprise capital (up after which down), and the tempo at which new unicorns are being minted (additionally up after which down). These three tendencies are linked, clearly, however what gave us pause just lately was the conclusion that we haven’t merely seen declines in current quarters: as an alternative, there’s been a whole-cloth return to pre-COVID norms.

The Alternate explores startups, markets and cash.

Learn it each morning on TechCrunch+ or get The Alternate e-newsletter each Saturday.

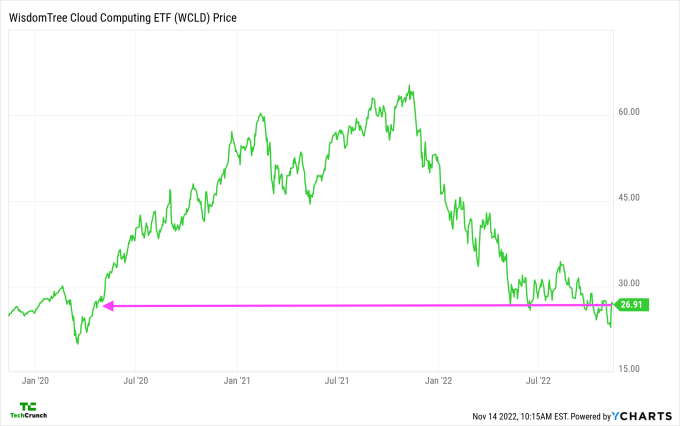

Take tech valuations, for instance: It struck us this morning whereas drafting the weekly kick-off Fairness episode that the worth of tech shares — measured by way of our favourite software-company monitoring index — is at the moment buying and selling across the worth it had in early 2020, simply earlier than and after the large COVID-induced sell-off hit American shares:

Please excuse our annotation technique — it’s Monday.

It’s clear that the 2020-2021 growth in software program valuations was extra of an anomaly than a new-normal. Apart from, the truth that the businesses within the index grew over the previous few years however are price much less at the moment implies that they may have been overvalued even pre-COVID. If at the moment’s costs maintain up, they may indict not solely the surplus of the current previous, however the overvaluations of the 2010s as effectively.

Source link