The Fed could have to tug a Financial institution of England with cash provide within the ‘hazard zone’

[ad_1]

drial7m1/iStock Unreleased through Getty Photographs

The sturdy U.S. greenback (USDOLLAR) is presently problematic for a bunch of nations, however could show a difficult nearer to house quickly, in response to Morgan Stanley.

“Former US Treasury Secretary John Connally’s well-known citation, ‘The greenback is our forex nevertheless it’s your drawback,’ continues to ring true, and that is one motive why some international locations have been working so laborious to de-dollarize over the previous decade,” fairness strategist Mike Wilson wrote in a word.

The Financial institution of England confronted historic weak spot in pound sterling (FXB) towards the dollar final week and as yields skyrocketed over the mini-budget it was pressured to step in and purchase long-dated debt, QE, and delay QT to stabilize the markets.

“Some could argue that the UK is in a novel state of affairs and so this doesn’t portend different central banks doing the identical factor,” Wilson stated. “Nonetheless, that is the way it begins. In different phrases, traders can’t be as adamant that the Fed will select to or be capable to observe via on its steering.”

The greenback (USDOLLAR) (UUP) is little modified this morning.

Discuss to me, Jay

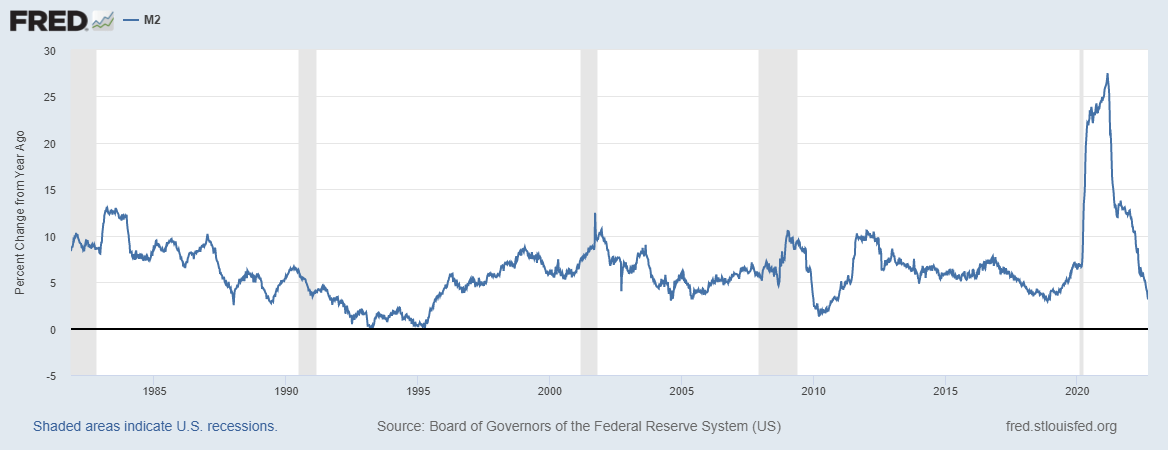

“The US greenback is essential for the path of danger markets and this is the reason we monitor the expansion of M2 so carefully,” Wilson stated. “The truth is, the first motive for our midcycle transition name in March 2021 was our remark that M2 progress had peaked.”

“Certainly, that is precisely when essentially the most speculative property within the market peaked and started to endure – i.e., crypto currencies (BTC-USD) (ETH-USD) (COIN), SPACs (SPCX), current IPOs (FPX) (IPO), and profitless progress shares buying and selling at extreme valuations,” he added. “Now, we discover M2 progress in what we name the ‘hazard zone’ – the realm the place monetary/financial accidents are likely to happen.”

“In some ways, that’s precisely what occurred within the gilts market final week, forcing the BoE’s hand. Some could argue that the fiscal coverage announcement from the brand new administration was the true offender. Nonetheless, the response in monetary markets was so excessive because of the tightening of liquidity within the world system, in our view.”

What this implies for shares

Wilson stated two questions come up from the evaluation of M2.

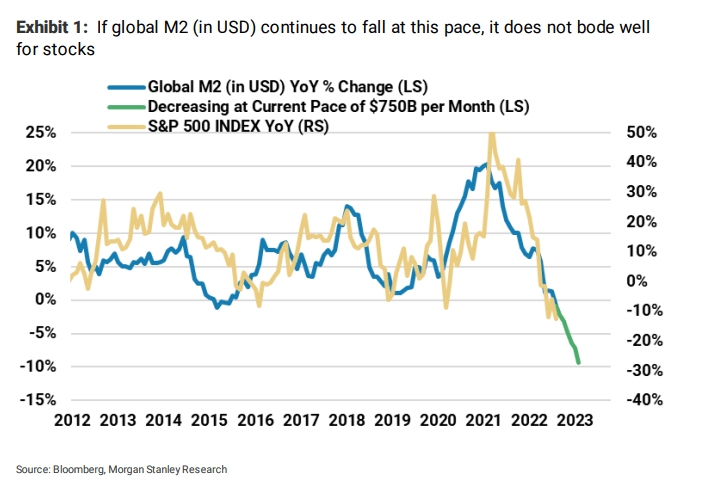

“The primary query to ask is, when does the US greenback change into a US drawback?” he stated. “No one is aware of, however extra value motion of the type we’ve been experiencing will ultimately get the Fed to again off.”

“The second query to ask is, will slowing or ending QT be sufficient, or will the Fed have to restart QE? In our opinion, the reply often is the latter if one is on the lookout for shares to rebound sustainably.”

A Fed pivot “is probably going in some unspecified time in the future given the trajectory of worldwide M2 (in USD),” he stated. “Nonetheless, the timing is unsure and gained’t change the trajectory of earnings estimates, our major concern for shares at this level.”

“Backside line, within the absence of a Fed pivot, shares (SPY) (QQQ) (DIA) (IWM) are seemingly headed decrease. Conversely, a Fed pivot, or the anticipation of 1, can nonetheless result in sharp rallies.”

Dig deeper into why the greenback index is named a globalization barometer.

Source link