State of Realized Volatility: Volatility eases forward of subsequent week’s Fed assembly

[ad_1]

Michael M. Santiago

Ranges of market volatility between the S&P VIX Index (VIX) and the PriceVol indicator have come down over the previous week as buyers eye subsequent week’s CPI print and Fed assembly which may also help affirm peak inflation or not.

PriceVol Indicator

The PriceVol indicator supplies a measurement of market volatility in the direction of your complete S&P 500 and had a median each day studying final week of 8. The extent was decrease than the marker of 10, which signifies to buyers that markets are in bear market territory. Moreover, PriceVol ranges have swung decrease after just a few weeks again the information confirmed that the broader markets had been in bearish territory with readings north of 11.

ASYMmetric ETFs, the developer of the PriceVol indicator, highlighted in a current funding notice the significance of constructive skew and the way it pertains to market volatility. “Constructive Skew happens when realized volatility is excessive and the S&P 500 is transferring up. Constructive Skew could also be an indicator of fine volatility and an early indicator of bear to bull market inflection factors.”

The place has volatility been seen?

The broader S&P (SP500) together with its monitoring ETFs (NYSEARCA:VOO), (IVV), and (NYSEARCA:SPY) concluded the week primarily flat after every week that offered remarks from Fed Chair Powell and a payrolls report.

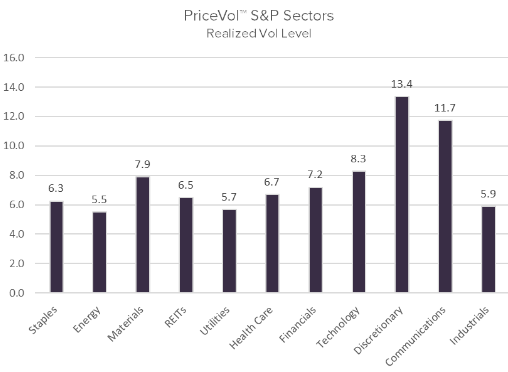

Whereas the VIX and PriceVol drifted decrease, two sectors remained to expertise increased ranges of volatility they usually had been the Shopper Discretionary (XLY) sector and Communications Providers (XLC). On the similar time the Power (NYSEARCA:XLE) phase noticed the bottom ranges of volatility.

See a breakdown of every sector’s PriceVol stage over the previous week under:

The ASYMmetric S&P 500 ETF (NYSEARCA:ASPY) is a fund designed as an offshoot to the PriceVol indicator. The fund works as a quantitative lengthy/brief hedging technique that seeks to supply buyers a backstop towards bear market selloffs by being internet brief, whereas additionally seeks to seize nearly all of bull market positive factors, by being internet lengthy.

In broader monetary information, inventory index futures pointed to a decrease open Monday in what is anticipated to be a comparatively quiet week for shares forward of subsequent week’s Fed assembly.

Source link