State of Realized Volatility: Uncertainty swirls round after a shortened vacation week

[ad_1]

Altayb

Volatility ranges out there notched greater on Monday morning as protests in China continued over COVID lockdowns, which carried with it some danger ranges to world indicies. The S&P VIX (VIX) sits above the 22 degree after the vacation shortened buying and selling week.

PriceVol Indicator

Trying in the direction of PriceVol, which is an indicator aimed to measure the whole market volatility of your entire S&P 500 it had a median day by day studying final week of 9.8. The 9.8 degree was simply shy of the ten deal with, which signifies to traders that markets are in bear market territory.

Trying forward, this week volatility figures can be targeted on employment and inflation information in an effort to get a learn on the Fed’s subsequent rate of interest transfer.

The place has volatility been seen?

Despite the fact that the S&P (SP500) and its mirroring ETFs (NYSEARCA:SPY), (NYSEARCA:VOO), and (IVV) tracked greater final week, PriceVol ranges have been seen to be elevated in particular sectors.

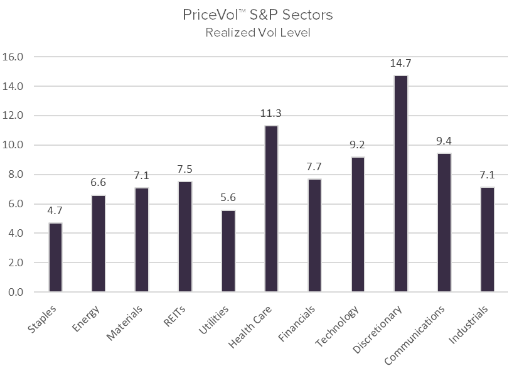

The 2 segments that skilled PriceVol readings above 10 have been the Shopper Discretionary (XLY) phase with a 14.7 marker and the Well being Care (XLV) house, which had a degree of 11.3. Shopper Staples (XLP) alternatively had the bottom PriceVol degree on the week at 4.7.

See a breakdown of every sector’s PriceVol degree over the previous week under:

The ASYMmetric S&P 500 ETF (NYSEARCA:ASPY) is an ETF constructedas an offshoot to the PriceVol indicator. The fund works as a quantitative lengthy/quick hedging technique that seeks to supply traders a backstop towards bear market selloffs by being web quick, whereas additionally seeks to seize nearly all of bull market good points, by being web lengthy.

In different volatility information, volatility-based ETFs and ETNs have lately come down over the previous month, because the VIX eased to its lowest degree in three months.

Source link