State of Realized Volatility: Forward of Thursday’s CPI print

[ad_1]

Artit_Wongpradu

Market volatility (VIX) ranges hinder forwards and backwards as Wall Avenue awaits Thursday’s CPI print. Whereas the Fed raised charges by 75-basis factors final week and remined hawkish, the monetary group seems in the direction of Thursday’s report to realize even additional future perception to how the Fed will method upcoming price selections.

PriceVol Indicator

PriceVol ranges stay elevated with a rolling five-day common studying of 10.5. Furthermore, PriceVol, which is a measure of realized volatility within the S&P 500, ended October at 10.1. That is the primary time in 2022 that PriceVol has concluded north of its risk-off threshold of 10, which normally happens throughout bear markets.

ASYMmetric ETFs highlighted in an investor notice: “Realized volatility of the S&P 500 remained compressed in the course of the early levels of the Nice Recession. PriceVol didn’t measure realized volatility above its risk-off or bear market threshold of 10 till roughly 8 months into the bear market of 2007-2009.” Some argue that markets are already in a recession whereas others don’t, however PriceVol ranges would counsel that markets are.

The place has volatility been seen?

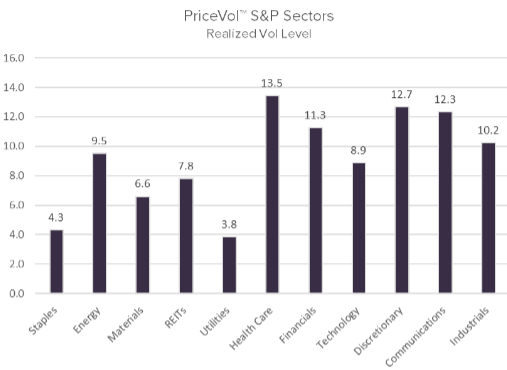

Whereas the broader S&P (SP500) and its mirroring ETFs (NYSEARCA:SPY), (VOO), and (IVV) skilled elevated PriceVol ranges, from a sector standpoint the areas that observed the very best ranges of elevated volatility included 5 particular areas. The segments that notched PriceVol readings above 10 included Well being Care (XLV) at 13.5, Client Discretionary (XLY) at 12.7, Communication Companies (XLC) at 12.3, Financials (XLF) at 11.3, and the Industrials (XLI) sector at 10.2.

See a breakdown of every sector’s PriceVol degree over the previous week under:

The ASYMmetric S&P 500 ETF (NYSEARCA:ASPY) is fund designed as an offshoot to the PriceVol indicator. The fund works as a quantitative lengthy/quick hedging technique that seeks to supply traders a backstop towards bear market selloffs by being internet quick, whereas additionally seeks to seize the vast majority of bull market positive factors, by being internet lengthy.

In different ETF associated information, the issuer of the PriceVol indicator additionally filed for 2 new “Good ETFs” with the SEC.

Source link