Sabra Well being Care REIT down after Q3 outcomes miss

[ad_1]

sturti/E+ by way of Getty Pictures

Healthcare-focused Sabra Well being Care REIT (SBRA) was down ~11% after its Q3 outcomes missed consensus.

Income of $140.76M (9.47% Y/Y) misses by $16.70M.

Q3 GAAP EPS was -$0.22.

FFO stood at $0.28, whereas adjusted FFO was $0.34.

As of Sep. 30, the corporate had ~$887.7M of liquidity, consisting of unrestricted money and money equivalents of $26.3M and obtainable borrowings of $861.4M.

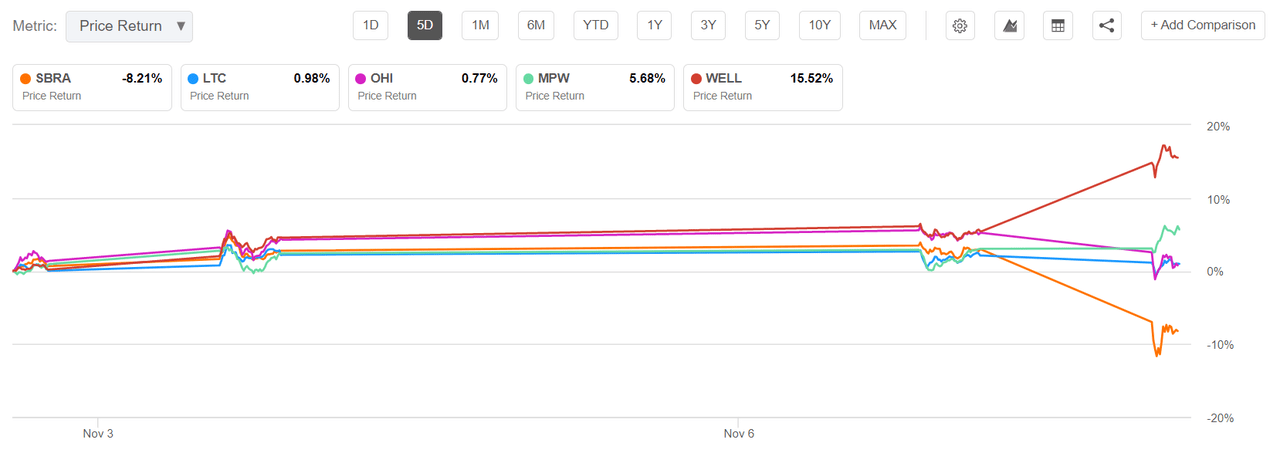

The outcomes come at a time when friends Omega Healthcare Buyers and Welltower beat estimates. Here’s a take a look at the corporate’s inventory worth actions within the final 5 days, when in comparison with friends:

SBRE had additionally missed consensus in Q3’21 on the impression of the delta variant, although total occupancy had improved.

The REIT had stated it’ll transition 24 of its properties to 2 of its present tenants, The Ensign Group (ENSG) and Avamere. The deal makes Ensign one among Sabra’s largest relationships, representing ~8% of annualized money NOI, whereas Avamere will stay one among its largest relationships, additionally accounting for roughly 8% of annualized money NOI.

As a part of the opposite enterprise updates, it stated that two senior housing managed communities have been acquired for $71.7M throughout the quarter.

SBRE generated $23.1M of gross proceeds from the disposition of three services throughout the interval.

Source link