REITs proceed to say no in worth in Q3, however analysts constructive on outlook (NYSEARCA:XLRE)

[ad_1]

Dzmitry Dzemidovich

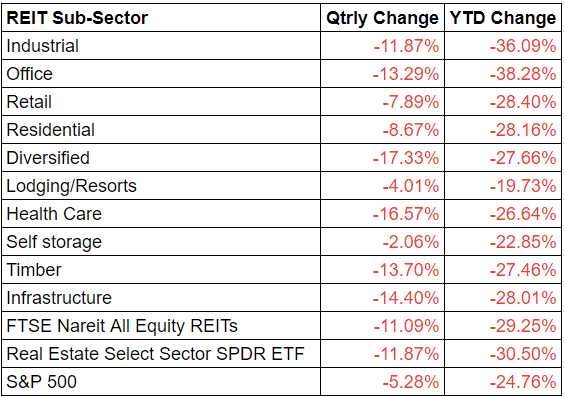

The actual property continued to bleed in Q3 with FTSE Nareit All Fairness REITs index falling 11.1%, Actual Property Choose Sector SPDR ETF (NYSEARCA:XLRE) fell 11.87%, whereas the broader index S&P 500 (NYSEARCA:SPY) fell simply 5.28%.

All actual property sub-sectors declined. Self-storage and Lodging resorts had been the relative outperformers, whereas diversified was the noticeable laggard.

YTD, FTSE Nareit All Fairness REITs index fell 29.25%, Actual Property Choose Sector SPDR ETF (XLRE) fell 30.5%, whereas the broader index S&P 500 (SPY) fell 24.76%. Industrial was the key dragger, whereas Self-storage and Lodging resorts had been the relative outperformers.

Actual property has been beneath strain within the quarter because the Fed raised rate of interest by 150 bps throughout two conferences to the three%-3.25% vary. Fed’s aggressive battle towards inflation is anticipated to push rates of interest to 4.4% by December, placing a damper on the true property market.

Here’s a have a look at the efficiency of the subsectors.

REITs are down closely within the latest previous. They’ve dropped primarily on account of rising rates of interest, and the Federal Reserve has made it clear that they count on to hike charges once more within the close to time period, in response to Looking for Alpha Creator Jussi Askola.

It could appear as if REITs are more likely to drop much more within the close to time period. Nevertheless, the share costs can get well simply as quick as they dropped, and the shift in market course is at all times sudden, Askola famous.

Many traders expect that prime inflation and rates of interest will suppress the red-hot actual property market, and consequently, they’re fast to imagine a 2008-style-kind-of-crash for REITs, Creator Riyado Sofian stated, including that his opinion differs.

REITs have traditionally outperformed the markets throughout occasions of excessive inflation. It is because REITs have excessive working margins of round 60%. Moreover, greater rents will be an inflation buffer, in response to Sofian.

Additionally, REITs’ stability sheets are the strongest they’ve ever been, the analyst famous.

Fairness REITs have outperformed broad equities year-to-date, Creator International X ETFs stated.

We’re constructive on the outlook for REITs given their now engaging yields and yield pick-up relative to conventional mounted earnings and fairness, in response to the creator.

Listed here are some ETFs to maintain a watch on: Vanguard Actual Property ETF (NYSEARCA:VNQ), Actual Property Choose Sector SPDR ETF (XLRE), Vanguard International ex-U.S. Actual Property ETF (NASDAQ:VNQI), iShares Mortgage Actual Property Capped ETF (BATS:REM), iShares Residential Actual Property Capped ETF (NYSEARCA:REZ), iShares U.S. Actual Property ETF (IYR), Pacer Funds Belief – Pacer Benchmark Industrial Actual Property SCTR ETF (INDS), ETF Sequence Options – NETLease Company Actual Property ETF (NETL), SPDR Homebuilders ETF (XHB), IndexIQ ETF Belief – IQ U.S. Actual Property Small Cap ETF (ROOF) and ETF Sequence Options – Hoya Capital Housing ETF (HOMZ).

Source link