REITs again to downward trajectory after final week’s rise

[ad_1]

Becart/E+ by way of Getty Photos

REITs are again to their downward trajectory after final week’s rise because the Q3 earnings season involves an finish for many of the firms within the sector.

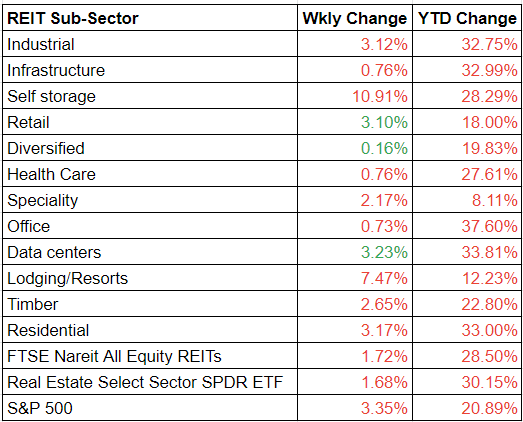

Knowledge heart REITs, retail REITs and diversified REITs have been an exception, having completed greater W/W.

Most REITs completed decrease than final week, with self storage REITs and resort REITs being the most important laggards.

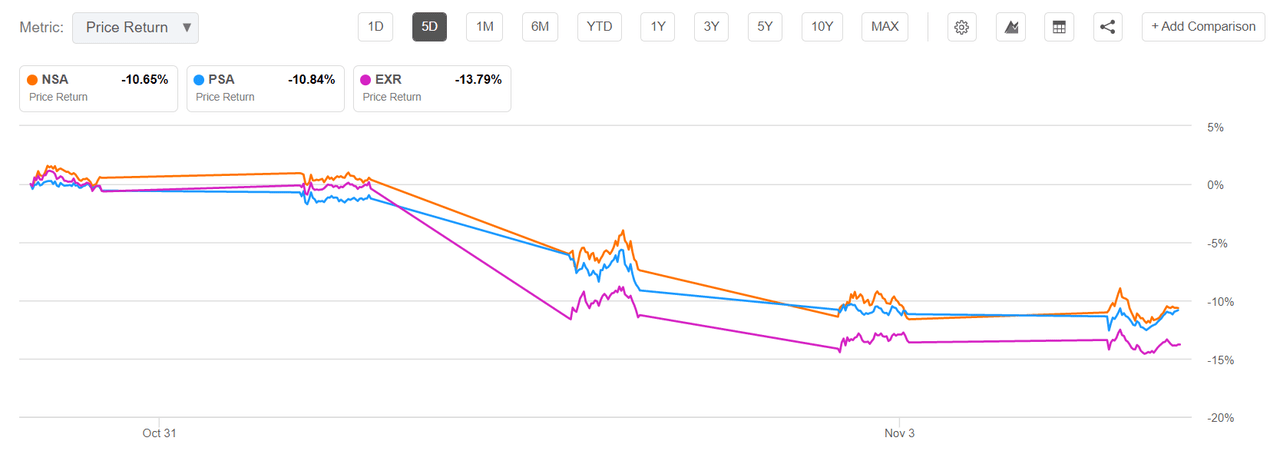

Three main self storage REITs, Nationwide Storage Associates (NSA), Further House Storage (EXR) and Public Storage (PSA), posted a decline in inventory costs within the final 5 days, regardless of largely reporting a beat of their quarterly outcomes.

All of the three reported declines of their occupancy charges, with a not-so-positive outlook within the occupancy entrance. Here’s a take a look at the inventory worth actions of the three shares.

Resort REITs noticed an ~8% decline this week, opposite to the subsector’s robust efficiency in the previous few weeks.

Analysts are skeptical over the sustainability of the post-COVID restoration within the resort REITs sector, particularly the restoration of the Income Per Out there Room metric.

A pent-up home leisure journey and surging room charges play a major function in driving the metric, somewhat than an underlying occupancy restoration, Searching for Alpha Writer Hoya Capital stated.

Source link