Pioneer Pure Assets: Purchase, Promote or Maintain?

[ad_1]

Shares of Pioneer Pure Assets (PXD) have been buying and selling decrease Friday following an earnings and income miss. Ought to we promote? Stand pat? Or look to be a purchaser?

In our October 18 evaluation of PXD we wrote that “Merchants who have been stopped out of their PXD longs may rebuy shares at present ranges or on power above $260. Danger to $220. The $373 space is our new worth goal.”

Let’s test the charts once more.

On this up to date every day bar chart of PXD, beneath, we are able to see a big outdoors day and possibly a decrease shut for PXD. This in the future reversal sample is extra broadly adopted within the futures group than the fairness market. Nonetheless, costs are pulling again and Actual Cash readers have requested for an replace.

Even with right now’s correction, PXD continues to be above its rising 50-day and 200-day transferring averages. The every day On-Steadiness-Quantity (OBV) line reveals enchancment from late September. The Shifting Common Convergence Divergence (MACD) is above the zero line however beginning to slender.

On this weekly Japanese candlestick chart of PXD, beneath, we are able to see an higher shadow telling us that merchants are rejecting the highs. The 40-week transferring common line continues to be going up and beneath the market however it is a lagging indicator.

The weekly OBV line is general optimistic and the MACD oscillator was turning upwards.

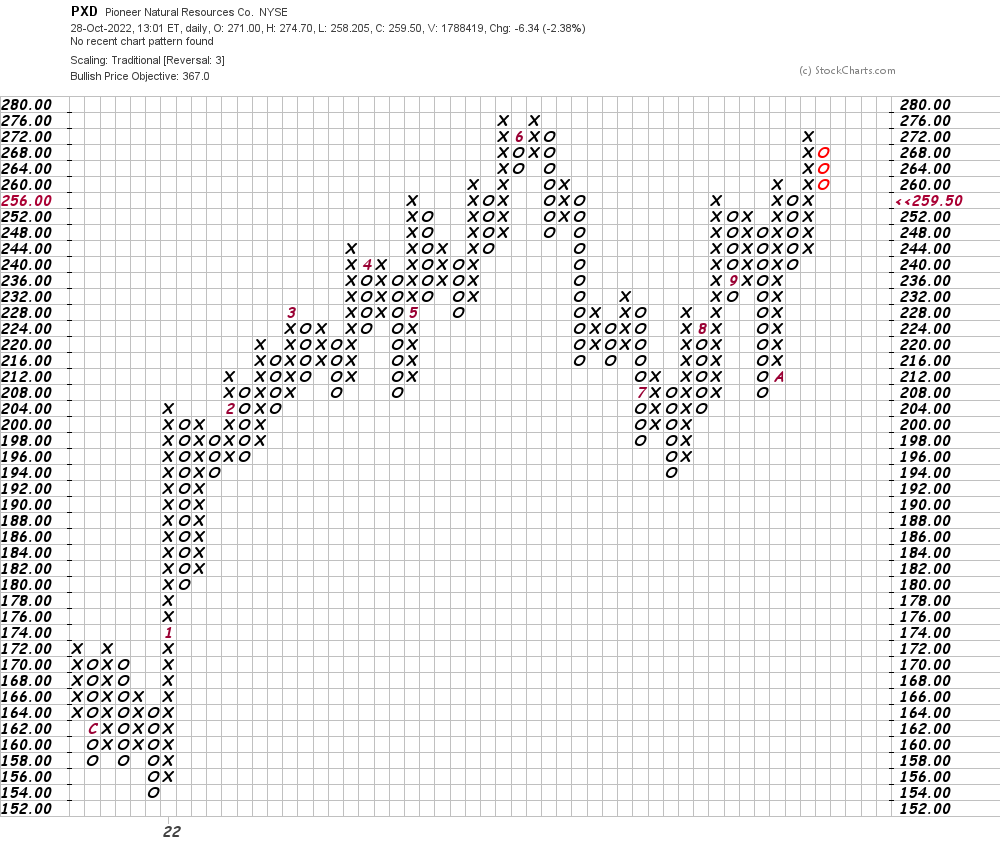

On this every day Level and Determine chart of PXD, beneath, we are able to see the newest worth motion with a column of “O’s”. A commerce at $280 will refresh the uptrend and a commerce at $240 could also be wanted to show the chart bearish.

Backside line technique: What ought to merchants do? It’s too quickly to inform in my view, however merchants ought to elevate promote stops to $238.

Get an e mail alert every time I write an article for Actual Cash. Click on the “+Comply with” subsequent to my byline to this text.

[ad_2]Source link