Over one-third of U.S. small enterprise unable to pay full lease in October: survey (SP500)

[ad_1]

Luis Alvarez/DigitalVision by way of Getty Pictures

U.S. small companies’ lease delinquencies jumped in October as persistent inflation pressures ate away at their earnings. Particularly, 37% of SMBs could not pay their full lease final month, up from 30% in September, in accordance with a current survey from Alignable, an internet referral community of 7M small enterprise members.

That is probably the most fast M/M improve in 2022, hovering round “fairly excessive” ranges in comparison with different readings prior to now 2.5 years, it added.

The survey, of which Alignable inquired 4,789 randomly chosen SMBs between October 15-27, confirmed that the majority SMBs (51%) had been negatively affected from larger rents. And much more respondents (59%) cited much less client spending in the course of the month as inflation decreased their buying energy.

One other main impediment that prevented companies from paying their lease in full included pandemic-related provide chain disruptions, spelling bother for auto-related corporations, particularly, as automotive components had been briefly provide, for example. That being mentioned, 49% of auto SMBs had been unable to pay their lease in October, as per the survey.

Training SMBs had been group struggling probably the most in assembly their lease in the course of the month, at 57%, adopted by autos (49%), eating places (49%), transportation (46%), retail (43%), fitness center (41%), magnificence (39%) and development (39%).

Towards the backdrop of stubbornly excessive client worth inflation, the restaurant business has been stung by decreased demand. “Some restaurateurs have shared that they’re seeing fewer folks consuming out, largely as a result of their clients haven’t got the additional disposable revenue to cowl frequent eating at eating places,” Alignable defined.

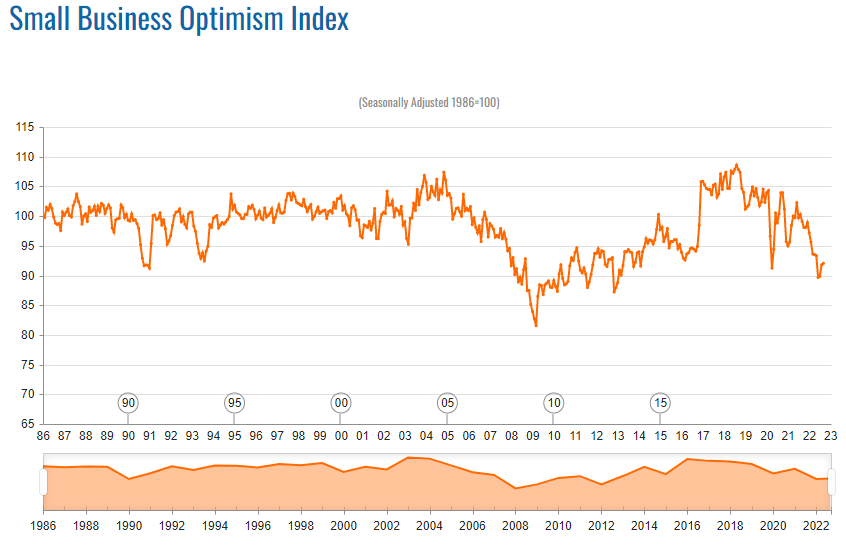

In one other measure of how SMBs proceed to wrestle from an array of deteriorating macroeconomic situations, the Nationwide Federation of Unbiased Enterprise (NFIB) Small Enterprise Optimism Index inched up 0.3 factors in September to 92.1, making it the ninth straight month beneath the 48-year common of 98, as seen within the chart beneath. The sentiment survey signaled that inflation remained an enormous concern as 30% of householders indicated inflation was their greatest downside when working their enterprise.

Of be aware, small companies are an essential gauge for the general well being of the home financial system since they make use of 46.4% of all personal employees, in accordance with the U.S. Small Enterprise Administration Workplace of Advocacy.

As SMBs discover it more and more exhausting to fulfill their lease funds, some retail (SP1500-60101070), workplace (SP500-60101040) and industrial (SP500-60101020) REITs may see decrease assortment charges. Taking a look at this chart, all of these REIT benchmarks fared poorly together with the broader inventory market (SP500)(-21.4%) year-to-date, with retail REITs (-18.7%) performing the most effective among the many group whereas workplace REITs (-38.7%) tanked probably the most.

On the patron entrance, bank card delinquency charges continued to extend in September, although nonetheless beneath prepandemic ranges.

Source link