Opinion: This week’s huge rebound in shares means the bear market is alive and nicely

[ad_1]

Nhac Nguyen/Agence France-Presse/Getty Pictures

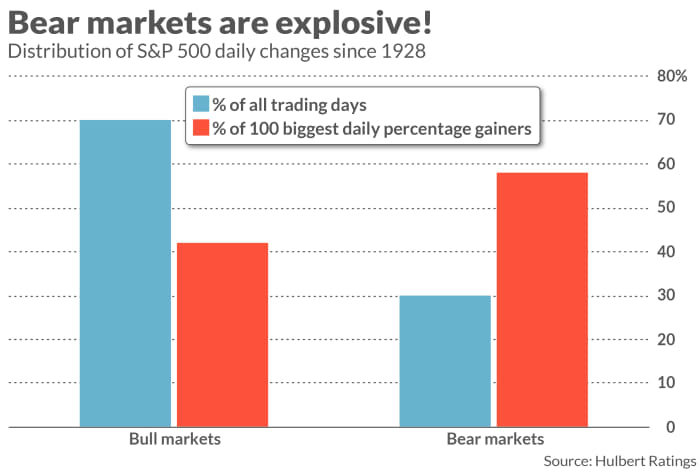

Warning: The inventory market’s explosive rise previously two days doesn’t essentially imply the bear market is over.

If something, the rally means that the bear market is alive and nicely.

How so?

It’s as a result of day by day spikes occur extra regularly throughout bear than bull markets. So when you needed to wager available on the market’s main pattern whereas realizing nothing greater than the very fact of the Dow Jones Industrial Common’s

DJIA,

700-plus-point will increase in every of Monday and Tuesday’s buying and selling classes, your wager must be that the pattern stays down.

Contemplate what I discovered upon analyzing the distribution of the 100 greatest day by day proportion S&P 500

SPX,

beneficial properties since 1928. You’d be excused for pondering that such huge buying and selling days happen randomly, since day by day market gyrations are sometimes thought of to be little greater than statistical noise.

But when they did happen randomly, you’d anticipate that, statistically, solely 30 of these 100 will increase would have taken place throughout bear markets.

In actual fact, 58% have occurred throughout bear markets. That’s practically twice what you’d anticipate if such beneficial properties occurred randomly, as you’ll be able to see from the accompanying chart, under.

‘Excellent examples’

This bear-market focus of massive day by day beneficial properties is much more pronounced for the Nasdaq Composite Index

COMP,

in keeping with a report from Cornell Capital.

The agency centered on the final three Nasdaq bear markets previous to this 12 months: These are the bear markets that occurred from 2000 to 2002, 2007 to 2009, and from February to March 2020. Simply 8% of the buying and selling days for the reason that Nasdaq Composite Index was created in 1971 have occurred throughout these three bear markets.

Nonetheless, in keeping with Cornell Capital’s evaluation, 80% of the 40 greatest one-day rallies within the Nasdaq Composite occurred throughout a kind of three bear markets. That’s 10 occasions what you’d anticipate on the idea that rallies happen randomly.

The implications of this Cornell Capital report for at the moment’s market are disturbing. In an e mail, Bradford Cornell, an emeritus finance professor at UCLA and a senior adviser to the agency, instructed me that the rallies on Monday and Tuesday of this week are “good examples” of what he wrote about in that report.

The rally “doesn’t essentially imply that the unhealthy occasions are over,” he mentioned.

Mark Hulbert is a daily contributor to MarketWatch. His Hulbert Scores tracks funding newsletters that pay a flat charge to be audited. He might be reached at mark@hulbertratings.com.

Source link