Opinion: Do not cheer but — rising gold costs are prone to reverse

[ad_1]

Lengthy-suffering gold bugs will possible need to undergo some time longer.

That’s as a result of gold merchants on the entire haven’t thrown within the towel and thereby given up on the yellow steel

GC00,

Solely when this so-called capitulation happens will contrarians be assured {that a} backside is at hand. Although there have been a number of events this 12 months when it appeared that capitulation was imminent, gold merchants stepped again from the cliff each time.

At the moment seems to be one more event.

Although gold bullion dropped this week to its lowest degree since April 2020, short-term gold timers seem comparatively sanguine about bullion’s near-term prospects. For the reason that regular sample is for gold timers to develop into extra and fewer bullish together with the market, you’d count on the common gold timer to be extra bearish now than at some other time since April 2020. However that’s not the case. In reality, the common timer is extra bullish at present than in 24% of the buying and selling days since then.

That isn’t what capitulation seems to be like.

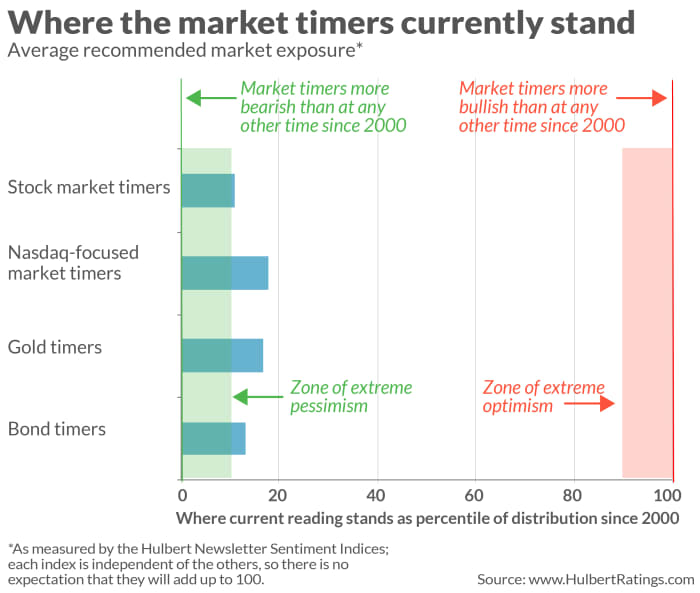

Contemplate the common really helpful gold-market publicity degree amongst a subset of short-term gold timers monitored by my agency. (This common is what’s represented by the Hulbert Gold E-newsletter Sentiment Index, or HGNSI.) Relative to all buying and selling days since 2000, versus simply the final two-and-a-half years, the present common stands on the 19th percentile of the historic distribution.

In prior columns dedicated to a contrarian evaluation of gold market sentiment, I’ve outlined extreme bullishness and bearishness to be the highest and backside deciles of the HGNSI’s distribution, respectively. These deciles are shaded within the accompanying chart. Discover that over the lpast three months, the HGNSI has dipped solely briefly into this backside decile.

True capitulation can be indicated by the HGNSI dropping into this backside decile and staying there for greater than only a few days. At among the extra main bottoms in previous years, for instance, this sentiment index remained on this zone of extreme bearishness repeatedly for a month or extra. In distinction, over the latest month, the HGNSI has been within the backside decile simply two days.

The function of the greenback

One comeback to contrarians may be that the power of the U.S. greenback is the actual cause why gold has been struggling. Sentiment might need nothing to do with it.

To check for that risk, I measured the relative explanatory roles performed by the greenback and the HGNSI. As anticipated, adjustments within the U.S. greenback’s international alternate worth do play a powerful function in explaining gold’s short-term actions. However even after controlling for the greenback, gold-timer sentiment nonetheless performed a powerful explanatory function by itself.

So merchants can’t blame gold’s disappointing efficiency solely on the sturdy greenback. Their bullish enthusiasm was additionally an element.

What about market timers in different arenas?

The gold market is simply one of many arenas through which my agency tracks market timers’ common publicity ranges. Apart from the Hulbert Gold E-newsletter Sentiment Index, my agency additionally constructs comparable indices that target the broad U.S. inventory market (as represented by the S&P 500

SPX,

or the Dow Jones Industrial Common

DJIA,

), the Nasdaq inventory market (as represented by the Nasdaq Composite

COMP,

or the Nasdaq 100 indices), and the U.S. bond market.

The chart under summarizes timers’ views.

Mark Hulbert is an everyday contributor to MarketWatch. His Hulbert Scores tracks funding newsletters that pay a flat price to be audited. He might be reached at mark@hulbertratings.com.

Source link