OPEC+ imposes deep manufacturing cuts in a bid to shore up costs

[ad_1]

Oil costs have fallen to roughly $80 from over $120 in early June amid rising fears in regards to the prospect of a world financial recession.

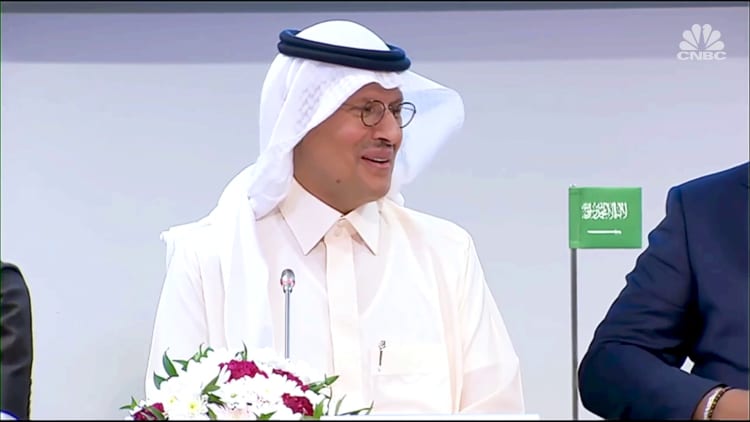

Bloomberg | Getty Pictures

A gaggle of a number of the world’s strongest oil producers on Wednesday agreed to impose deep output cuts, in search of to spur a restoration in crude costs regardless of calls from the U.S. to pump extra to assist the worldwide financial system.

OPEC and non-OPEC allies, a bunch sometimes called OPEC+, determined at their first face-to-face gathering in Vienna since 2020 to cut back manufacturing by 2 million barrels per day from November.

Vitality market members had anticipated OPEC+, which incorporates Saudi Arabia and Russia, to impose output cuts of someplace between 500,000 barrels and a couple of million barrels.

The transfer represents a serious reversal in manufacturing coverage for the alliance, which slashed output by a report 10 million barrels per day in early 2020 when demand plummeted as a result of Covid-19 pandemic. The oil cartel has since step by step unwound these report cuts, albeit with a number of OPEC+ international locations struggling to satisfy their quotas.

Oil costs have fallen to roughly $80 a barrel from greater than $120 in early June amid rising fears in regards to the prospect of a world financial recession.

The manufacturing lower for November is an try to reverse this slide, regardless of repeated stress from U.S. President Joe Biden’s administration for the group to pump extra to decrease gas costs forward of midterm elections subsequent month.

Worldwide benchmark Brent crude futures traded at $92.82 a barrel throughout Wednesday afternoon offers in London, up round 1.1%. U.S. West Texas Intermediate futures, in the meantime, stood at $87.37, virtually 1% larger.

OPEC+ will maintain its subsequent assembly on Dec. 4.

White Home ‘disillusioned’

The White Home mentioned in a press release that Biden was “disillusioned by the shortsighted choice by OPEC+ to chop manufacturing quotas whereas the worldwide financial system is coping with the continued destructive impression of Putin’s invasion of Ukraine.”

It mentioned that Biden had directed the Division of Vitality to launch one other 10 million barrels from the Strategic Petroleum Reserve subsequent month.

“In gentle of immediately’s motion, the Biden Administration may also seek the advice of with Congress on further instruments and authorities to cut back OPEC’s management over vitality costs,” the White Home mentioned.

The assertion added that the OPEC+ announcement served as “a reminder of why it’s so important that the USA cut back its reliance on international sources of fossil fuels.”

To make certain, the burning of fossil fuels, comparable to coal, oil and gasoline, is the chief driver of the local weather emergency.

Talking at a information convention, OPEC Secretary-Basic Haitham Al Ghais defended the group’s choice to impose a deep output lower, saying OPEC+ was in search of to offer “safety [and] stability to the vitality markets.”

Requested by CNBC’s Hadley Gamble whether or not the alliance was doing so at a value, Al Ghais replied: “Every part has a value. Vitality safety has a value as effectively.”

‘Selfishly motivated’

Vitality analysts mentioned the precise impression of the group’s provide cuts for November was more likely to be restricted, with unilateral reductions by Saudi Arabia, the United Arab Emirates, Iraq and Kuwait more likely to do the principle job.

What’s extra, analysts mentioned it’s at present tough for OPEC+ to kind a view greater than a month or two into the long run because the vitality market faces the uncertainty of extra European sanctions on non-OPEC producer Russia — together with on transport insurance coverage, value caps and diminished petroleum imports.

“In its personal phrases, OPEC’s mission is to make sure an enough pricing surroundings for each customers and producers. But the choice to cut back output within the present surroundings runs counter to this goal,” Stephen Brennock, a senior analyst at PVM Oil Associates in London, mentioned in a analysis word.

“Additional squeezing already-tight provides might be a slap within the face for customers. The selfishly motivated transfer is aimed purely at benefiting producers,” he added. “Briefly, OPEC+ is prioritising value above stability at a time of nice uncertainty within the oil market.”

Rohan Reddy, director of analysis at World X ETFs, advised CNBC that the group’s choice to impose manufacturing cuts might see oil costs rally again to $100 a barrel — assuming no main bouts of Covid globally and the U.S. Federal Reserve not changing into unexpectedly hawkish.

“As a result of choice, volatility will seemingly return to the market, and regardless of considerations in regards to the resilience of the worldwide financial system, the oil market is tight, all of which ought to function a tailwind for costs within the fourth quarter,” Reddy mentioned.

He added that whereas a return to $100 oil is feasible, “a extra seemingly situation within the brief time period is that oil costs hover within the $90 to $100 vary because the market digests financial information releases.”

—CNBC’s Emma Graham contributed to this text.

Source link