Ntropy raises money to normalize and classify transaction knowledge • TechCrunch

[ad_1]

Ntropy, an organization providing an API that enriches transaction knowledge for monetary providers companies, immediately introduced that it raised $11 million in a Collection A spherical led by Lakestar with participation from QED Buyers and January Buyers. CEO Nare Vardanyan says that the funding shall be put towards rising the corporate’s group, particularly within the areas of market, product and engineering.

Ntropy was co-founded by Vardanyan and Ilia Zintchenko, who began working collectively on concepts for the service 2018 and launched it in 2020. Zintchenko beforehand co-founded Mindi, a workload administration system for knowledge facilities, whereas Vardanyan was an investor at AI seed, a London-based enterprise agency specializing in AI and machine studying startups.

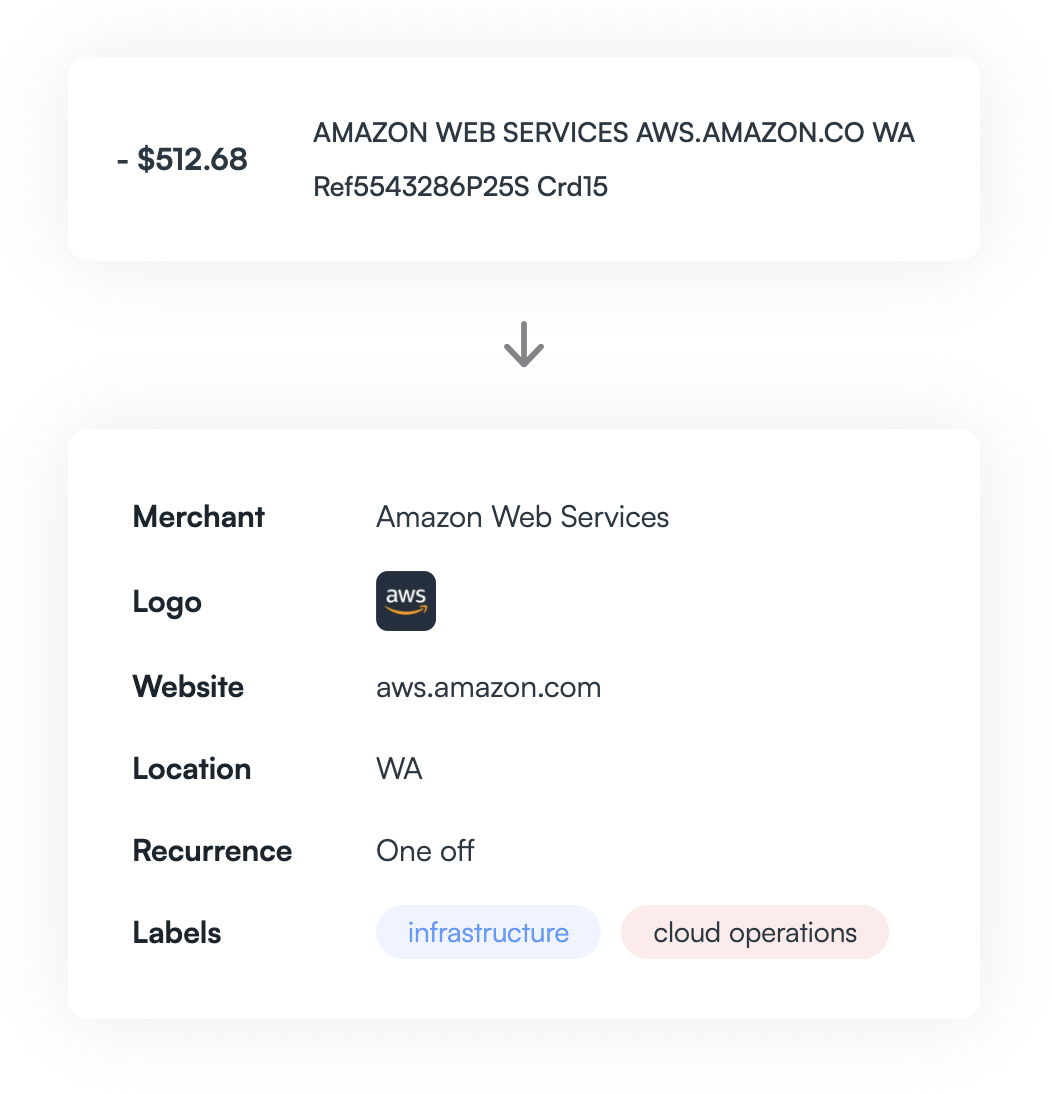

With Ntropy, Vardanyan and Zintchenko intention to chop down on the time and assets wanted for fintech corporations like Wayflyer, Teampay, Belvo and Monarch (all of that are Ntropy clients) to contextualize and normalize monetary transactions. Usually, fintechs must create a supply of fact for transactions manually, constructing guidelines or fashions to categorise and act on service provider, class and memo knowledge and preserve and replace these guidelines and fashions. Ntropy makes an attempt to automate features of this with pure language processing applied sciences.

Picture Credit: Ntropy

“Fixing a legacy drawback, akin to monetary transaction standardization and contextualization, we’re utilizing among the newest machine studying methods,” Vardanyan informed TechCrunch in an e-mail interview. “Our pipeline combines floor fact from skilled people, international service provider databases, search engines like google and yahoo and language fashions educated on a condensed model of the net to course of banking knowledge throughout 4 totally different continents and six-plus totally different languages.”

Vardanyan claims that each one this interprets to extra approvals for loans and mortgages, really automated accounting and quicker funds.

“Regardless of incumbents akin to Visa and Mastercard and next-generation fintechs like Dave or Cashapp, processing tons of of hundreds of thousands of transactions in-house is an unsolved drawback,” she continued. “The intelligence layer on prime of banking knowledge is an rising class and we’re first movers.”

There don’t seem like many rivals within the transaction enrichment house but, though Vardanyan says that a number of are brewing (with out naming names). Ntropy is leveraging this pole place to safe strategic partnerships, together with — and notably — with Plaid as their companion for enterprise and worldwide transaction enrichment. (Ntropy joined Plaid’s answer companion program earlier this yr.)

“We’re an organization born throughout the pandemic, and raised our seed funding proper within the midst of among the worst markets within the final ten years till now after we closed our Collection A,” Vardanyan mentioned. “The timing has made fundraising more difficult. Nevertheless, it’s additionally a proof level and vote of confidence for having assembled one of many strongest machine studying groups in monetary providers and seeing rising quantities of natural demand from the market. The slowdown will have an effect on our pondering round gross margins and burn fee, identical to some other firm, in addition to choices round prioritizing enterprise earlier within the lifecycle versus the lengthy tail of VC-backed startups that has been a pure ramp after we simply launched and works nice in a booming setting.”

Ntropy has 21 workers at present and plans to rent 9 by the top of the yr.

Source link