Nasdaq, S&P, Dow futures bounce round as charges swing

[ad_1]

Scott Olson/Getty Pictures Information

Inventory index futures reversed course and are barely greater Thursday helped by some bullish earnings, however risky yields are additionally having an affect.

The S&P futures (SPX) are +0.1% and Dow futures (INDU) are +0.2%. Nasdaq 100 futures (NDX:IND) have slid 0.1% following Tesla’s top-line miss with logistical points hitting deliveries.

AT&T helped sentiment because it beat on the highest and backside strains.

The S&P is dealing with tactical resistance at 3,706-3,740 and at 3,807, however there’s nonetheless assist on the 200-week transferring common and 50% retracement at 3,600-3,500, BofA says.

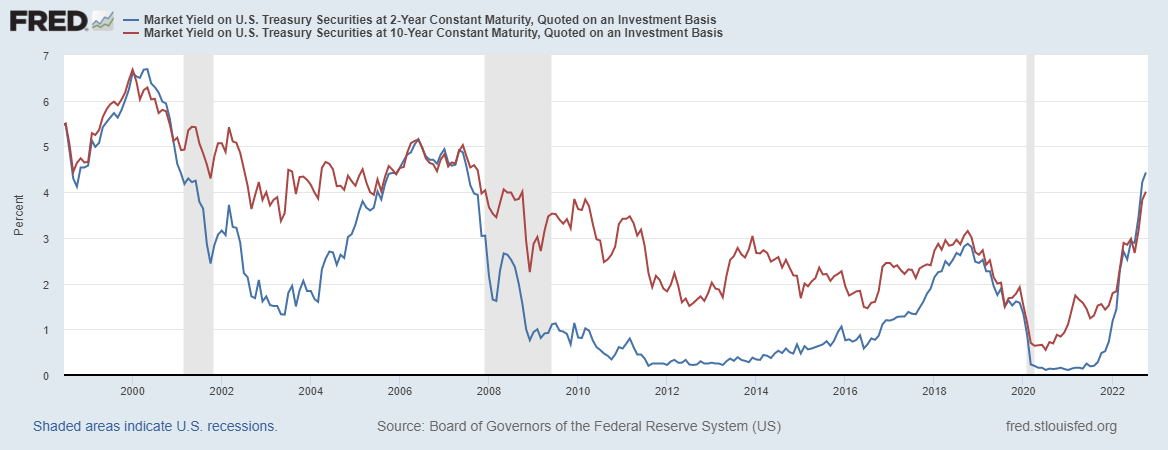

Charges are off highs. The ten-year Treasury yield (US10Y) is up 1 foundation level to 4.14% and the 2-year yield (US2Y) is up 2 foundation level to 4.57% having topped 4.60% earlier.

“The 10yr Treasury yield now appears fairly snug above 4%,” ING stated. “It’s been above earlier than previously week, however this transfer appears extra decisive, a relentless and regular tick-by-tick, one-day-move, from 4% in the direction of 4.15%.”

“This newest transfer convincingly again above 4% for the US 10yr is but extra affirmation that the low-rates atmosphere could be very a lot behind us. Even the US10yr actual yield is now threatening to breach above 1.7%, and possibly will hit 2% on this cycle. That’s actually getting again to the form of ranges we have been used to earlier than the GFC.”

Extra Fed officers are on the bully pulpit immediately forward of the blackout interval this weekend, with Philly Fed President Patrick Harker and governor Michelle Bowman talking.

October Philly Fed manufacturing index numbers arrived decrease than forecasted at -8.7 in comparison with -5.

Weekly jobless claims fell by 12K to 214K in comparison with the consensus determine of 235K.

After the beginning of buying and selling, September figures on present house gross sales arrive, following weaker housing information yesterday, with forecasts in search of a drop to a charge of 4.7M.

“The US economic system will not be particularly rate of interest delicate, however after all housing is the one sector the place rising charges have a direct and swift affect on exercise,” UBS’ Paul Donovan stated.

Amongst different lively shares, IBM is gaining following upbeat outlook.

Source link