Transferring cash in a digital world

[ad_1]

“The frequent denominator throughout virtually all post-pandemic behavioral shifts is the rising significance of digital funds,” says Paul Fabara, government vice chairman and chief danger officer at Visa, whose worldwide networks dealt with an estimated $13 trillion value of transactions final yr.

“Covid compelled a market that was already rising to enormously speed up,” says Fabara. As of 2021, 76% of adults globally have an account with a monetary establishment or cell cash supplier, up from 68% in 2017 and 51% in 2011, in response to the World Financial institution’s World Findex Database. That quantity contains 71% of adults in growing international locations. In high-income economies, practically 95% of adults both made or acquired digital funds in 2021. In India, 80 million adults made their first digital fee through the pandemic; in China, 100 million.

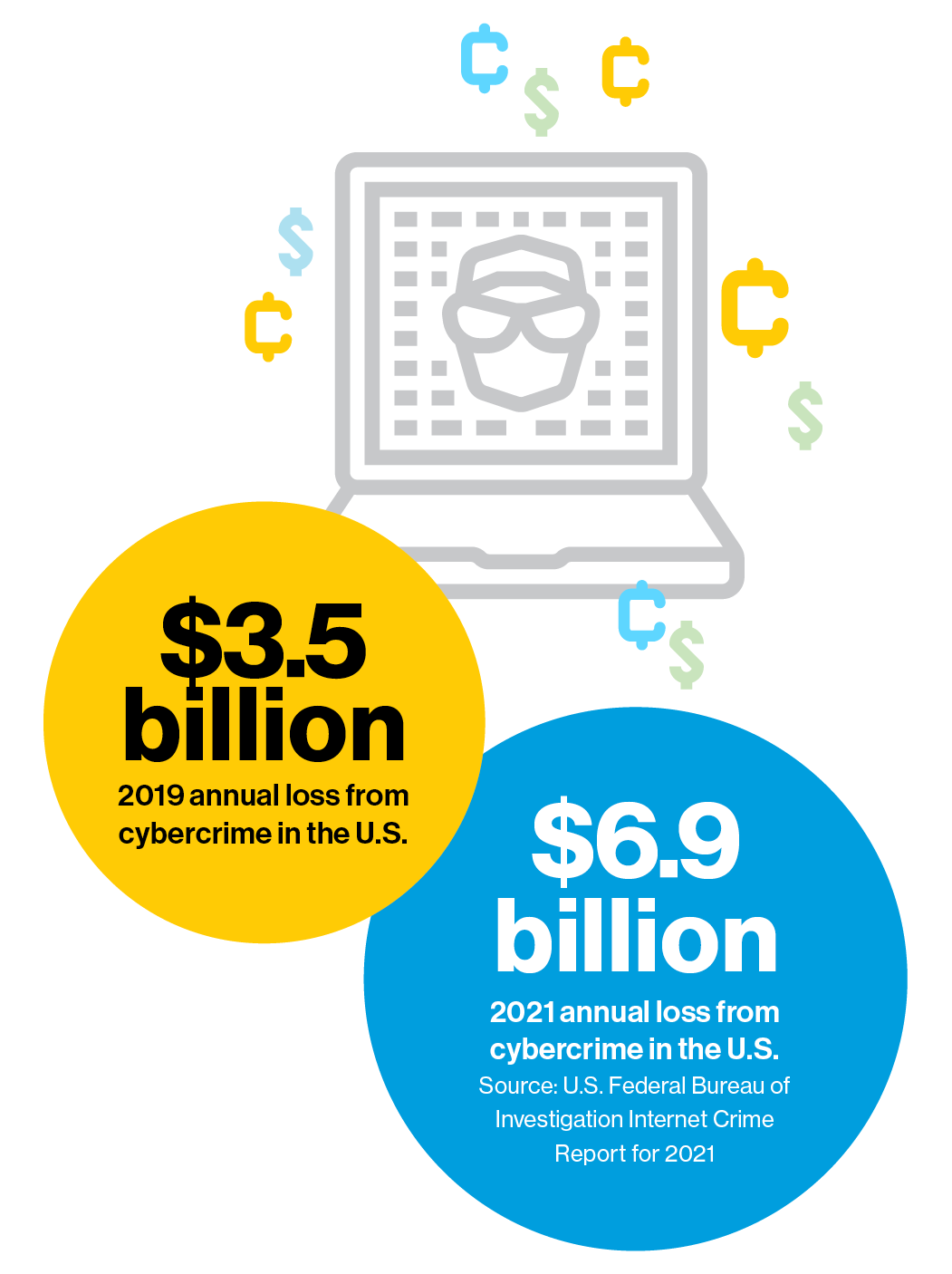

Fraudsters famously go the place the cash is, and their on-line actions are increasing proper together with the expansion in digital transactions. Annual losses from cybercrime within the U.S. practically doubled between 2019 and 2021, from $3.5 billion to $6.9 billion, in response to the FBI’s Web Crime Report for 2021. Fortifying our on-line world in opposition to theft and fraud has all the time been pressing, and the post-pandemic growth in transactions intensified issues.

Driving digital transactions

Enterprise-to-business prospects are starting to insist on the identical seamless real-time transactions they count on as customers, says Aaron Press, analysis director of worldwide fee methods at IDC, who tracks the event and adoption of real-time funds. “If you concentrate on the way in which you store on-line for private issues or pay your folks utilizing a mobile-to-mobile app, these expectations are discovering their means into the enterprise setting,” he says.

Finish-to-end digital transactions are right here to remain. An MIT Know-how Assessment Insights survey of worldwide enterprise leaders discovered excessive curiosity in digital fee applied sciences throughout every type and sizes of companies. Though 36% of respondents are simply getting began with digital funds, 43% count on to increase their choices over the subsequent 18 months, and lots of are venturing into cross-border transactions (37%) and cryptocurrency (18%).

What’s driving companies to all-digital funds? The most important share of survey replies, 70%, point out companies prioritize enhancing buyer expertise by providing a number of fee choices and saving prospects time. Respondents need the advantages of operational enhancements (48%) and reductions in processing prices (37%). Many need expanded choices for securing funds (36%) and personalised provides to prospects (35%).

“Digital funds are extra environment friendly and dramatically scale back errors,” says Press. “You’re a lot much less prone to fill out one thing the fallacious means, as a result of there are checks and balances throughout the system.”

Obtain the total report.

This content material was produced by Insights, the customized content material arm of MIT Know-how Assessment. It was not written by MIT Know-how Assessment’s editorial employees.

Source link