Greater than $2 trillion in inventory choices expire Friday with put-call ratio close to ranges unseen since 2001

[ad_1]

Fairness choices value $2.1 trillion in notional worth are set to run out on Friday within the newest month-to-month occasion the place weekly and month-to-month choices tied to single shares, fairness indexes and exchange-traded funds expire, risking an explosion of volatility throughout markets.

Each month, a group of analysts from Goldman Sachs publishes a breakdown of the choices which might be expiring. And one of the notable particulars from this month’s report is a chart exhibiting how a lot buying and selling has shifted to choices contracts with 24 hours or much less left earlier than they expire.

Buying and selling in a majority of these choices now represents 44% of all buying and selling in choices linked to the S&P 500 index. They now commerce a median of $470 billion in notional worth per day, in accordance with Goldman.

GOLDMAN SACHS

Choices straight linked to the S&P 500 make up a plurality of all fairness choices expiring within the U.S. on Friday, as Goldman illustrated within the chart under.

GOLDMAN SACHS

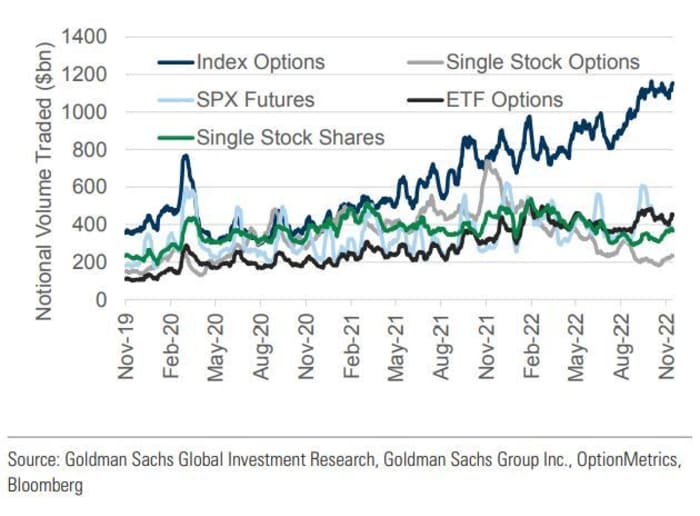

One other notable pattern in equity-derivatives buying and selling this 12 months has been growing buying and selling in choices linked to indexes and exchange-traded funds. Beforehand, traders had favored choices linked to particular person shares. However buying and selling quantity in these choices has declined this 12 months, though it stays elevated in comparison with its pre-pandemic stage.

GOLDMAN SACHS

Buyers will likely be paying significantly shut consideration to Friday’s choices expiration after the fairness put-call ratio — which measures buying and selling quantity of sure equity-linked choices in contrast with buying and selling quantity in equity-linked calls — exploded to ranges unseen since 2001 earlier this week.

Most equity-linked choices expire after the shut of the buying and selling day, however some index-linked choices expire within the morning, in accordance with CME Group.

One month in the past, Nomura’s Charlie McElligott informed shoppers that skilled merchants are more and more shopping for choices with in the future to expiration or much less, a buying and selling technique that he mentioned first gained notoriety on the favored subreddit “Wall Road Bets.”

See: Wall Road is driving explosive volatility in shares by ‘YOLO-ing’ into choices on the point of expiring

Source link