Meta is not one of many 20 greatest U.S. corporations

[ad_1]

Mark Zuckerberg throughout Metaverse dialog on CNBC

Supply: CNBC

Sixteen months after Fb crossed $1 trillion in market cap, becoming a member of an unique membership consisting of Apple, Microsoft, Alphabet and Amazon, its father or mother firm Meta is price lower than Residence Depot and barely greater than Pfizer and Coca-Cola.

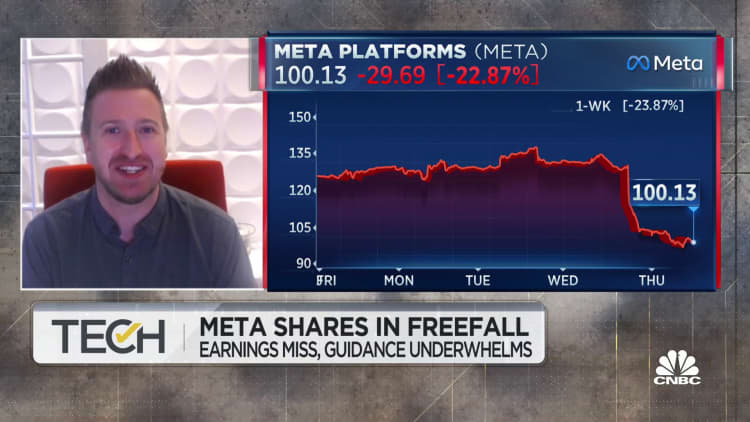

Removed from Fb’s Massive Tech days, Meta is not among the many 20 most beneficial U.S. corporations after the inventory sank 23% on Thursday. The corporate has shed 70% of its worth this 12 months and 74% for the reason that inventory peaked in September 2021, totaling over $730 billion in market cap misplaced. It is buying and selling at its lowest since early 2016, when Barack Obama was nonetheless president.

The gorgeous collapse of Meta’s share value is paying homage to the dot-com bust days, however far greater by way of worth erased from a single firm. The slide started late final 12 months as indicators of a sputtering economic system began to emerge, and accelerated in early 2022 after the corporate stated Apple’s privateness change to iOS would end in a $10 billion income hit this 12 months.

Founder and CEO Mark Zuckerberg has been unable to cease the bleeding and solely appears to be making issues worse. Since altering the corporate identify to Meta a 12 months in the past Friday, Zuckerberg has stated its future is the metaverse, a digital universe of labor, play and schooling. However buyers simply see it as a multibillion-dollar cash pit, whereas the core promoting enterprise shrinks — Fb is forecasting a 3rd consecutive drop in income for the fourth quarter.

A considerably perplexed Zuckerberg acknowledged on Wednesday’s earnings name that “there are plenty of issues happening proper now within the enterprise and on the planet.”

“There’s macroeconomic points, there’s plenty of competitors, there’s advertisements challenges particularly coming from Apple, after which there’s a number of the longer-term issues that we’re taking up bills as a result of we consider that they will present larger returns over time,” Zuckerberg stated. “I recognize the persistence and I believe that those that are affected person and make investments with us will probably be rewarded.”

Meta now trades for simply thrice income, lower than one-third of its five-year common. It is now price half as a lot as Berkshire Hathaway and has a smaller market cap than corporations together with UnitedHealth, Chevron, Eli Lilly, Procter & Gamble, Financial institution of America and AbbVie.

The opposite 4 tech corporations that propelled previous the trillion-dollar mark are all nonetheless there and stay the 4 most beneficial U.S. companies, regardless that they’ve taken massive hits this 12 months as effectively alongside the remainder of the market.

Inside tech, the opposite two corporations Meta has fallen behind are Tesla and Nvidia. Subsequent on the checklist could be Oracle, which is at the moment valued at simply over $200 billion, or $70 billion under Meta.

WATCH: This can be a true bet-the-company second for Zuckerberg

Source link