It is Not All Unhealthy – Analysts Have Upgraded These 3 REITs

[ad_1]

After a number of months of deep worth declines and an avalanche of analyst downgrades, actual property funding belief (REIT) shares bottomed in mid-October and have been transferring greater ever since.

Even with REITs bouncing again for the previous month, many analysts have been reluctant to improve them till just lately. However with the marginally higher shopper worth index (CPI) and producer worth index (PPI) numbers out up to now two weeks, analysts are starting to heat as much as the REIT sector.

Listed here are three REITs which have had analyst upgrades inside the previous couple of weeks:

Prologis Inc. (NYSE: PLD) is a San Francisco-based industrial REIT that owns and manages industrial logistics properties throughout the U.S. and 18 different international locations. Based in 1983, Prologis has been a pacesetter in appreciation amongst REIT shares. Though Prologis has an annual dividend of $3.16, it’s extra growth- than income-oriented, and the annual dividend yield of two.8% is often properly under different REITs in its peer group.

From October 2017 to April 2022, Prologis gained roughly 210%. Only a few REITs matched that efficiency. However rate of interest hikes slammed Prologis’s inventory worth from $174 to a low of $98 in mid-October. It just lately closed at $113.65.

On October 17, Scotiabank analyst Nicholas Yulico upgraded Prologis from Sector Carry out to Sector Outperform however nonetheless lowered his worth goal from $137 to $116. On the time, Prologis was buying and selling round $105. Different analysts have just lately reinstated Purchase and Obese rankings on Prologis whereas projecting goal costs as excessive as $140.

Kite Realty Group Belief (NYSE: KRG) is an Indianapolis-based retail REIT with open-air and mixed-use properties from Vermont to California. Its strip malls are principally grocery store-anchored. Different tenants embody CVS Pharmacy Inc., The Recent Market, Greatest Purchase Co. Inc., Burlington, Ross Shops Inc. and Costco Wholesale.

Kite Realty just lately declared a dividend of $0.24 per share, a rise of 9% from the earlier quarter. Ahead funds from operation (FFO) of $1.89 simply covers the $0.96 annual dividend and presently yields 4.4%.

On Nov. 9, Financial institution of America Securities analyst Craig Schmidt upgraded Kite Realty Group Belief from Impartial to Purchase, whereas concurrently elevating his worth goal from $22 to $25. The 52-week vary is $16.42 to $23.35, and the newest closing worth was $21.62.

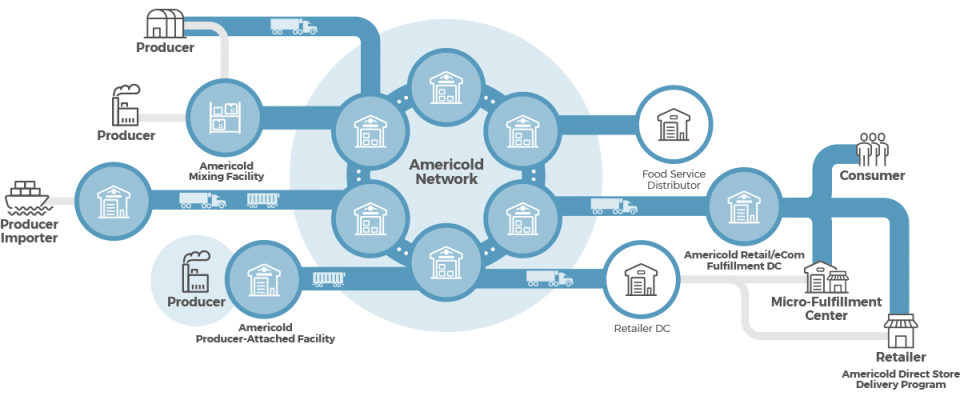

Americold Realty Belief Inc. (NYSE: COLD) is a storage REIT that makes use of superior expertise to chilly retailer meals for supermarkets, meals producers and worldwide meals and beverage organizations. It has 249 areas with completely different temperature zones. Its motto is, “From farm to fork and each step in between.” Its multifaceted community appears to be like like this:

On Nov. 3, Americold Realty Belief delivered its third-quarter working outcomes. FFO of $0.29 per share was greater year-over-year and exceeded analysts’ views by $0.04, however the firm missed analyst expectations on income by 1.3%.

However, on Nov. 14, Financial institution of America Securities analyst Joshua Dennerlein upgraded Americold Realty Belief from Impartial to Purchase and raised his worth goal from $27.50 to $33.50. In June, Dennerlein additionally upgraded Americold Realty Belief from Underperform to Impartial. No different analyst has upgraded it in 2022.

Americold Realty Belief has a 52-week vary of $21.49 to $33.50. Its current closing worth was $28.95. The annual dividend is $0.88, and the present yield is 3.03%. One other constructive is dividend progress, as Americold Realty Belief has raised its dividend by 57% over the previous 5 years.

REIT buyers shall be hoping to see extra analyst upgrades reported within the months forward, particularly on firms that may proceed bettering FFO numbers.

REITs are one of the crucial misunderstood funding choices, making it troublesome for buyers to identify unimaginable alternatives till it’s too late. Benzinga’s in-house actual property analysis staff has been working exhausting to determine the best alternatives in at the moment’s market, which you’ll achieve entry to without cost by signing up for Benzinga’s Weekly REIT Report.

Do not miss real-time alerts in your shares – be part of Benzinga Professional without cost! Strive the software that may allow you to make investments smarter, sooner, and higher.

© 2022 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Source link