How does bitcoin fare in a 4% cash market panorama? (Cryptocurrency:BTC-USD)

[ad_1]

Douglas Rissing

As many central banks throughout the globe additional embrace their interest-rate mountaineering marathon, bitcoin (BTC-USD), a gauge for threat urge for food and general sentiment, might hold seeing downward strain. The identical goes for different threat property like equities.

The U.S. Federal Reserve, particularly, lifted its benchmark lending charge by one other 75 foundation factors for a 3rd straight time on Wednesday, bringing it to three.00%-3.25%, its highest level in 14 years. However the central financial institution is not stopping its tightening cycle there because it struggles to curb inflationary pressures.

Its dot plot, a carefully watched abstract of expectations for the long run outlined by 19 members of the Fed’s Federal Open Market Committee, signaled a path for considerably elevated rates of interest in contrast with the earlier predictions issued in June. Financial policymakers count on the fed funds charge to high 4% by the top of the yr. And in 2023, most officers see the important thing charge peaking at a degree between 4.50% and 5% (the terminal charge).

The Fed would not anticipate beginning to reduce charges till 2024.

The world’s largest digital token by market cap (BTC-USD), in flip, wobbled between features and losses after the Fed’s charge determination, however ended up sliding in direction of the top of the session as market contributors received antsy about holding such speculative property in a rising rate of interest atmosphere, particularly bitcoin which has already dropped 60% year-to-date.

“Does it imply cryptocurrency buyers have to brace for greater than a yr of a steady downtrend? By no means. On the one hand, the probabilities that we’re nearing the top of this bear market did get considerably decrease,” stated Anto Paroian, CEO and govt director at crypto hedge fund ARK36.

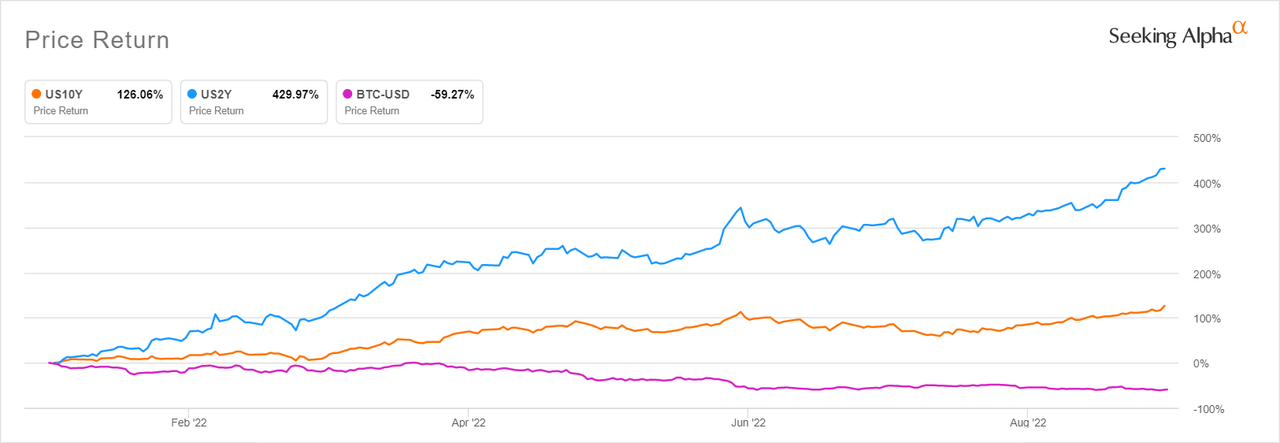

Because the Fed tightens financial coverage through charge hikes, shopper’s borrowing prices elevated concurrently, so a few of them – particularly decrease earnings earners – will likely be pressured to liquidate their holdings in threat property as they worry a recession is coming to fruition. Thus, it isn’t stunning to see threat asset costs fall in a rate-increasing regime, if historical past serves as any information. For a visible of this concern, check out how bitcoin (BTC-USD) has fared with surging Treasury yields (US10Y) (US2Y) YTD within the chart under.

Throughout bitcoin’s (BTC-USD) enormous ascent to its peak of $68.9K in November 2021, rates of interest had been hovering close to all-time lows as outsized fiscal stimulus “got here to the rescue” within the face of the Covid-19 pandemic. Shares, too, spiked because the “easy-money” regime spurred bids throughout dangerous property. However in an aggressive pivot to hawkish financial coverage to tame inflation, bitcoin has since nosedived to $18.9K as of Friday afternoon, about the identical degree because the bull market high in 2017.

“The danger cycle wanted to finish for bitcoin to be seen for what it’s. Like SPACs, dangerous IPOs, crypto and NFTs, it was the product of a greed cycle. Positive there are nonetheless a whole lot of hype males and establishments with an curiosity in propping it up, However the pool of higher fools is shrinking,” Mark Dow, a proprietary world macro dealer, wrote in a latest Twitter post.

However given bitcoin’s (BTC-USD) short-lived historical past, it is doable that the token can finally react extra positively to rising yields if “web2 institutional buyers grow to be agency believers in borderless & decentralized financial world of web3,” Khaleelulla Baig, founder and CEO of KoinBasket, instructed Looking for Alpha through e mail. “Bitcoin in the long term will show to be inflation hedge,” he added.

SA contributor Clem Chambers exhibits two charts that sign bitcoin might fall to $15K in 2022.

[ad_2]

Source link