In all probability one of the best argument for investing some extra of our 401(okay)s within the inventory market proper now could be all of the folks telling us to not. As a basic rule, it’s been a very good time to be bullish when so many others are bearish.

And perhaps the second finest argument is the time of yr. The “Halloween Impact” is an actual factor. No person is aware of why, however inventory markets have produced most of their positive factors throughout the winter months, from Oct. 31 to April 30.

However let’s play satan’s advocate and ask: Realistically, how unhealthy may this bear market be? And I’m not speaking about how unhealthy it might be for short-term merchants or somebody on the lookout for a fast revenue. I’m eager about what it would imply for retirement buyers such as you (and me) — people who find themselves investing a long time forward?

Learn: The restrict for 401(okay) contributions will bounce almost 10% in 2023, however it’s not all the time a good suggestion to max out your retirement investments

To get an thought I cracked the historical past books—or, extra precisely, the historical past knowledge compiled and maintained by Robert Shiller, professor of finance at Yale College (and a Nobel Prize winner). He has efficiency numbers on U.S. shares going all the way in which again to the Grant administration.

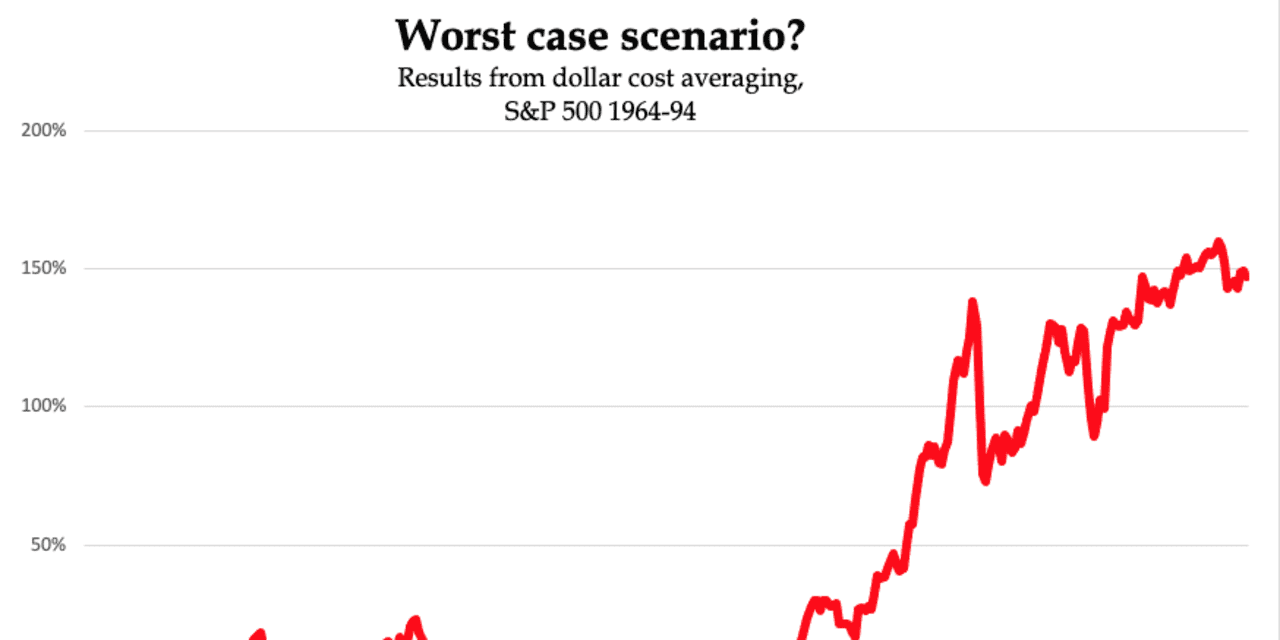

And I ran some evaluation based mostly on the way in which an increasing number of of us make investments: Specifically, by “dollar-cost averaging,” or throwing a modest (and equal) quantity into the market each single month, come rain or shine.

Opposite to fashionable opinion, the worst time for a daily investor to get into the market was not simply earlier than the notorious crash of 1929.

Sure, the inventory market collapsed then by almost 90% over the subsequent 4 years (in phases), or about 75% in actual, inflation-adjusted phrases once you embody dividends. However oh boy did it bounce again quick. From the 1932 lows it doubled your cash in a yr and it quadrupled your cash over 5 years.

Learn: What to do together with your money if you happen to’re retired or retiring quickly

Somebody who threw all of their cash into the market on the worst potential second, on the finish of August 1929, was truly again in revenue by 1936. And somebody who dollar-cost averaged their manner by means of the Crash of 1929 and the Nice Despair, even assuming they began at completely the worst time potential, was in revenue by the spring of 1933 and was up by about 50% by 1939.

However the actually, actually unhealthy time for normal buyers who greenback value averaged was the Nineteen Sixties and Seventies. As an alternative of a quick crash and bounce again, buyers throughout these a long time had a rolling catastrophe as shares fell behind roaring inflation for one of the best a part of 20 years.

Utilizing Professor Shiller’s knowledge, I ran a easy evaluation of what would have occurred to a dollar-cost common who began in 1964 and stored going for many years.

You’ll be able to see the consequence above.

It isn’t fairly. That exhibits the cumulative “actual” return on funding, which means the return after adjusting for inflation, for somebody who stored placing the identical quantity into the S&P 500 each month. (Oh, and we’re ignoring charges and taxes.)

Yikes!

Might this occur once more? Positive. Something may occur. Is it possible? In all probability not.

That is the worst case state of affairs on report. I’m enjoying satan’s advocate.

Truly the median actual return on the S&P 500

SPX,

+1.22%

over 30 years is just below 7%.

There are two caveats to keep in mind.

First, that is in “actual” phrases. What the chart reveals is that, other than a short plunge 1970 and a rocky interval within the mid-Seventies, a inventory portfolio roughly stored up with runaway inflation even by means of these completely abysmal a long time. You didn’t get forward of the 8 ball however you didn’t fall behind it. Small consolation, definitely, however value a point out.

Second, the lengthy, lean years have been then extravagantly compensated by the increase after 1982. Somebody who began investing for his or her retirement in 1964 and didn’t retire till the mid-Nineteen Eighties made a complete achieve on their funding of about 50% in actual, purchasing-power phrases. Somebody who invested over 30 years greater than doubled their cash.

The excellent news about bear markets, even lengthy bear markets, is that if we carry on investing throughout them we decide up shares on a budget.

That cash invested within the S&P 500 throughout the mid-Seventies? Over the subsequent 20 years it beat inflation by a staggering 700%.

“Even when buyers are caught within the worst potential time in historical past, by persevering with to take a position, they’re continually averaging down — they’re growing their return in the long term,” says Joachim Klement, funding strategist at Liberum. “They are saying compounding curiosity is the eighth surprise of the world. I might say dollar-cost averaging is the ninth.”