Residence costs cooled at a report tempo in August, S&P Case-Shiller says

[ad_1]

Residence costs are nonetheless greater than they have been a 12 months in the past, however features are shrinking on the quickest tempo on report, in response to one key metric, because the housing market struggles underneath sharply greater rates of interest.

Costs in August have been 13% greater nationally in contrast with August 2021, in response to the S&P CoreLogic Case-Shiller Residence Value Index. That’s down from a 15.6% annual achieve within the earlier month. The two.6% distinction in these month-to-month comparisons is the most important within the historical past of the index, which was launched in 1987, which means worth features are decelerating at a report tempo.

The ten-city composite, which tracks the largest housing markets in the US, rose 12.1% 12 months over 12 months in August, versus a 14.9% achieve in July. The 20-city composite, which features a broader array of metropolitan areas, was up 13.1%, in contrast with a 16% enhance the prior month.

Home for Sale by Proprietor, Forest Hills, Queens, New York.

Lindsey Nicholson | UCG | Common Photos Group | Getty Photos

“The forceful deceleration in U.S. housing costs that we famous a month in the past continued in our report for August 2022,” wrote Craig Lazzara, managing director at S&P DJI, in a launch. “Value features decelerated in each considered one of our 20 cities. These knowledge present clearly that the expansion fee of housing costs peaked within the spring of 2022 and has been declining ever since.”

Main the worth features in August have been Miami, Tampa, Florida, and Charlotte, North Carolina, with year-over-year will increase of 28.6%, 28% and 21.3%, respectively. All 20 cities reported lower cost rises within the 12 months led to August versus the 12 months led to July.

The West Coast, which incorporates a number of the costliest housing markets, noticed the most important month-to-month declines, with San Francisco (-4.3%), Seattle (-3.9%) and San Diego (-2.8%) falling essentially the most.

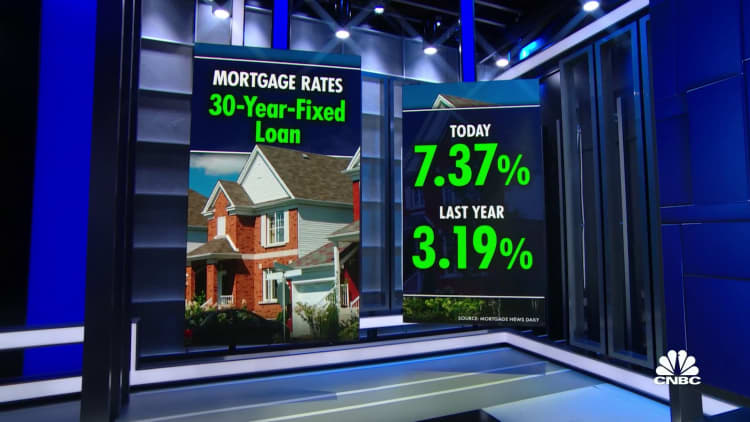

A fast bounce in mortgage charges from report lows this 12 months has turned the as soon as red-hot housing market on its heels. The typical fee on the favored 30-year fastened residence mortgage began this 12 months proper round 3%. By June it stretched over 6% and is now simply greater than 7%, in response to Mortgage Information Each day.

“With month-to-month mortgage funds 75% greater than final 12 months, many first-time consumers are locked-out of housing markets, unable to seek out properties with budgets which have misplaced $100,000 in buying energy this 12 months,” mentioned George Ratiu, senior economist at Realtor.com.

He additionally famous that greater residence costs mixed with greater rates of interest are holding would-be sellers from itemizing their homes. They look like locked in to their decrease charges.

Source link