This is Easy methods to Play Tesla When Nice Is not Good Sufficient

[ad_1]

Electrical car producer Tesla (TSLA) reported the agency’s third quarter numbers for each manufacturing and deliveries on Sunday. The numbers have been excellent. In reality the agency set a brand new third quarter report for deliveries. The numbers simply weren’t what Wall Road was on the lookout for. The inventory has taken an early Monday morning hit.

For the third quarter, Tesla produced 19,935 Fashions S and X, whereas delivering 18,672 of them. Tesla produced 365,923 Fashions 3 and Y, whereas delivering 325,158 of them. That makes for whole manufacturing of 365,923 automobiles and deliveries (which some interpret as a proxy for gross sales) of 343,830.

Consensus had been for deliveries of virtually 358K in response to Bloomberg Information and for nearly 365K in response to FactSet. I had heard whisper numbers as excessive as 370K myself.

Within the press launch, Tesla does level out that supply volumes are traditionally skewed towards the tip of every quarter because of the regional batch constructing of automobiles. This quarter, Tesla transitioned to a extra even regional combine of producing every week, which led to a rise in automobiles nonetheless in transit at quarter’s finish.

Readers will recall that manufacturing was suspended on the Shanghai facility in July to ensure that the agency to make gear upgrades. Tesla additionally decreased headcount in August and introduced folks again to the workplace who have been working remotely. Numerous these by no means returned.

Earnings

Tesla additionally introduced within the press launch that the agency’s third quarter earnings will likely be launched after the closing bell on October nineteenth (now having 1987 flashbacks). Consensus view for the interval is for adjusted EPS of $1.05 inside a spread spanning from $0.77 to $1.23. This might be on income of $22.6B. The vary of expectations there runs from $18.4B to $25.6B. The yr in the past comps are EPS of $0.62 on income of $13.76B.

Exactly on consensus the quarter could be good for earnings development of 69% on income development of 64%.

Wall Road

Apparently, JP Morgan’s Ryan Brinkman who’s rated at one star (out of 5) by TipRanks, maintained his “promote” score on Tesla and his $153 goal value in response to the miss on deliveries. Brinkman wrote, “We stay cautious on valuation and proceed to see massive draw back to our value goal, together with the potential for a number of compression amidst rising competitors and fewer distinction vs. conventional automakers over time.”

On the opposite aspect of the token, Truist Securities’ William Stein, who’s rated at 5 stars by TipRanks, reiterated his “purchase” score whereas growing his goal value from $333 to $348.

4 star analyst Dan Ives of Wedbush, who additionally views TSLA as a “purchase” and has a goal value of $360 on the inventory, I feel summed it up for the bulls… “We imagine the unit set-up into 4Q may be very strong and will method large numbers which can be within the 475K+ vary. In a nutshell, this quarter was nothing to write down residence about and Wall Road will likely be disenchanted by the softer supply quantity in 3Q. That mentioned, we view this extra of a logistical pace bump somewhat than the beginning of a softer supply trajectory into 4Q/2023 and stay bullish on the Tesla story.”

My Ideas

I’m lengthy the inventory, so my bias is consistent with what Ives has mentioned. I’m including to that lengthy place on Monday. So, now you understand the place I stand earlier than continuing.

Popping out of the second quarter, Tesla ran with a present ratio of 1.43, and a fast ratio of 1.06 after accounting for inventories. Each ratios are wholesome. The agency doesn’t pad the stability sheet with “goodwill” or different intangible belongings. At the moment, long-term debt totaled $2.095B, whereas the agency’s web money place was $18.915B. Common readers understand how a lot I like a robust stability sheet. Tesla has a really sturdy stability sheet.

The agency ended the second quarter with a tangible e-book worth of $11.51 per share and that quarter was Tesla’s ninth consecutive order posting constructive money stream. The agency is basically, very basically sound. For my part, the one downside a fundamentals minded investor might have with the inventory is because the JP Morgan analyst mentioned… in valuation. The inventory, even accounting for this Monday morning low cost, nonetheless trades at 61 occasions ahead wanting earnings.

This makes Tesla for me, extra of a commerce than an funding.

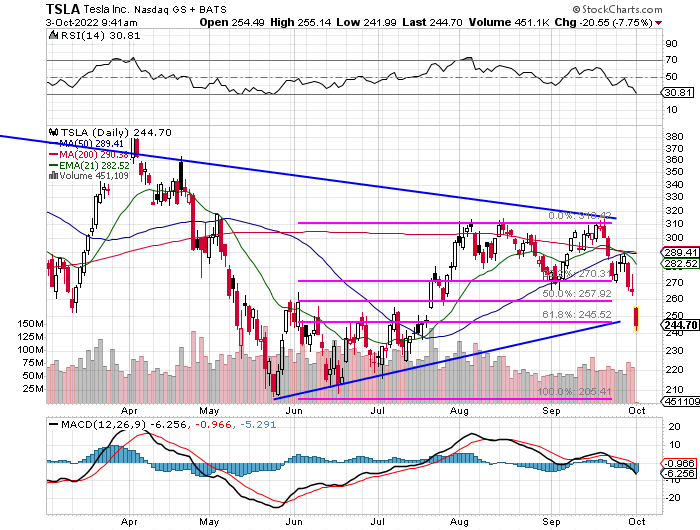

The collection of decrease highs since final November and the collection of upper lows since Might suggest the approaching of an explosive transfer in TSLA.

It’s considerably technically necessary that the 61.8% Fibonacci retracement stage ($245) of the Might via that triple prime at $310 does maintain. If it does, I’ll have a robust feeling that I’m on the correct aspect of the ball on this title.

My play, until I’m pressured by a severe break of this stage, is to play the title into these earnings in two and a half weeks. My goal could be the intersection of the 50 day and 200 day SMAs (round $290), however I’m possible out of the title after earnings both method.

Get an electronic mail alert every time I write an article for Actual Cash. Click on the “+Observe” subsequent to my byline to this text.

[ad_2]Source link