Goldman Sachs among the many most optimistic on Wall Avenue that U.S. will keep away from recession

[ad_1]

MicroStockHub

Goldman Sachs believes the U.S. will most probably keep away from a recession in 2023, placing it within the minority amongst Wall Avenue forecasters, who usually suppose a downturn is probably the most possible state of affairs.

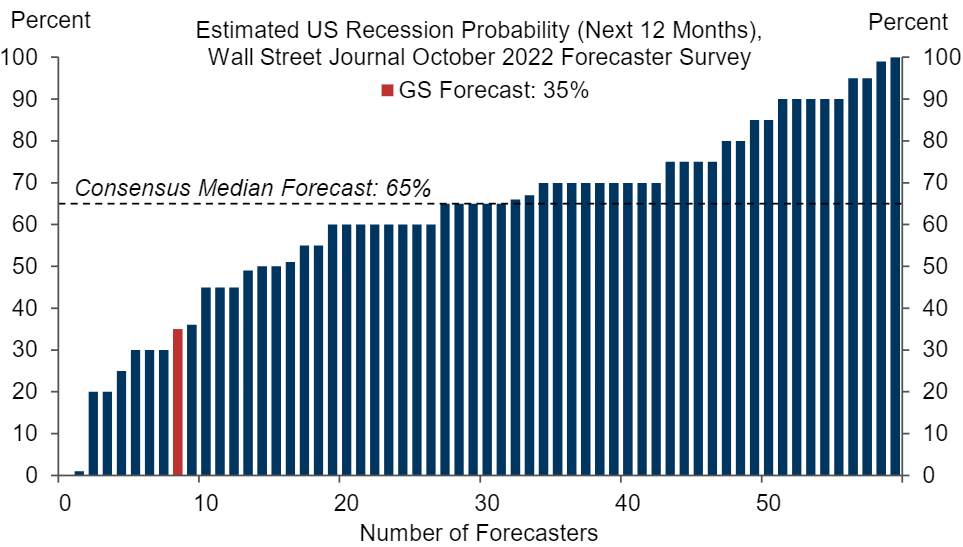

In line with an investor word put out this week, the funding financial institution thinks there exists a 35% probability that the U.S. will face a recession. In the meantime, Goldman estimates that the median forecast determine of Wall Avenue consultants sits round 65%.

“We expect a US recession is much less probably than the median forecaster does,” Goldman mentioned, backing up this declare with the next graph, which exhibits its recession estimate on the low finish of printed predictions:

See chart beneath:

Moreover, the word highlighted that Goldman is “above consensus on U.S. development.” For 2022, Goldman predicts U.S. actual GDP development of 1.9% in comparison with the consensus determine of 1.8%. The establishment continues that view into 2023 because it sees GDP development at 1.0% versus the 0.4% consensus determine.

These days, hope that the Federal Reserve will be capable to again off its aggressive rate-hiking marketing campaign, fed by tamer-than-expected inflation statistics final week, have impressed the key averages (SP500), (DJI), (COMP.IND), and their mirroring ETFs (NYSEARCA:SPY), (NYSEARCA:VOO), (IVV), (NYSEARCA:DIA), and (NASDAQ:QQQ), to rebound from their October lows.

For the opposite aspect of the recession argument, Russell Investments believes that the U.S. shouldn’t be in a downturn in the meanwhile however greater than probably shall be by the tip of 2023.

Source link