FTX’s FTT token plunges 80%, wiping out over $2 billion in worth

[ad_1]

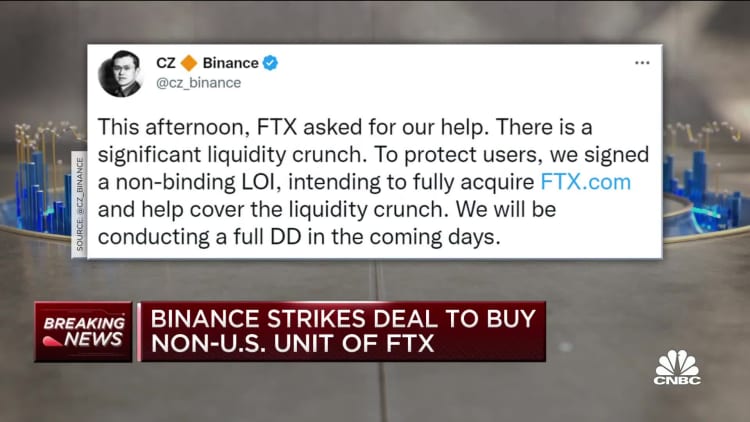

FTT, the token native to crypto change FTX, misplaced most of its worth after rival Binance, the world’s largest cryptocurrency agency, introduced plans to amass the corporate.

The coin traded at round $22 on Monday and sank beneath $5 Tuesday afternoon in New York. The selloff worn out greater than $2 billion in worth within the area of 24 hours.

Binance CEO Changpeng Zhao, referred to as CZ, wrote in a tweet to his greater than 7 million followers that he expects FTT to be “extremely risky within the coming days as issues develop.”

Cryptocurrencies as a category sank on Tuesday, with bitcoin and ethereum each plunging greater than 10%. Shares of crypto change Coinbase additionally skilled a double-digit proportion drop, whereas Robinhood, which merchants use to purchase and promote crypto, fell by about 19%.

“It is in all probability probably the most dramatic deal I’ve ever seen within the historical past of the crypto business,” stated Nic Carter, a accomplice at Citadel Island Ventures, which focuses on blockchain investments. “It consolidates mainly the 2 largest offshore exchanges into one entity, an absolute coup for CZ and Binance — and actually a catastrophe for FTX.”

The settlement between the 2 firms is non-binding and follows what FTX CEO Sam Bankman-Fried referred to as “liquidity crunches” at his agency, which was valued at $32 billion in a financing spherical earlier this 12 months.

The acquisition impacts solely the non-U.S. companies for FTX. The U.S. division will stay impartial of Binance. Nevertheless, in accordance with a 2021 audit, the U.S. a part of FTX accounted for simply 5% of complete income. FTX relies within the Bahamas, the place Bankman-Fried resides.

Like many crypto firms, FTX created its personal token referred to as FTT, which might be bought like bitcoin although it wasn’t as broadly accessible. House owners of FTT have been promised decrease buying and selling prices and the power to earn curiosity and rewards like waived blockchain charges. Whereas buyers can revenue when FTT and different cash enhance in worth, they’re largely unregulated and are notably prone to market downturns.

In 2019, Binance introduced a strategic funding in FTX and stated that as a part of the deal it had taken “a long-term place within the FTX Token (FTT) to assist allow sustainable development of the FTX ecosystem.”

Due to Binance’s central place in crypto and its massive possession of FTT, the corporate had specific sway over FTX and the market’s view on the corporate. Investor confidence in FTX was rocked over the weekend when Zhao tweeted that Binance would promote its holdings of FTT.

Zhao stated Binance had about $2.1 billion price of FTT and BUSD, its personal stablecoin.

“As a consequence of current revelations which have got here to gentle, we’ve got determined to liquidate any remaining FTT on our books,” he stated.

FTT, which peaked at round $78 in September 2021, was buying and selling at near $25 the day earlier than Zhao’s tweets. It plunged beneath $16 on Monday after which fell off a cliff after the deal obtained introduced Tuesday. In response to CoinMarketCap, the worth of FTT’s circulating provide is about $735 million, down from $2.9 billion on Monday.

Bankman-Fried stated that within the 72 hours main as much as Tuesday morning, there had been roughly $6 billion of internet withdrawals from FTX, in accordance with Reuters. On a mean day, internet inflows are within the tens of hundreds of thousands of {dollars}.

“The truth that Sam was prepared to do that deal means that FTX was deeply impaired when it comes to the run on the financial institution that started within the final 48 hours,” stated Carter. “We do not know precisely what the difficulty was, whether or not they have been lending out or playing with person deposits.”

FTX didn’t reply to CNBC’s a number of requests for remark.

Earlier on Tuesday, FTX had halted withdrawals from its platform, after spooked buyers tried to tug their funds — in a transfer that resembled the collapse of different crypto corporations this 12 months, together with Celsius, Voyager Digital and Three Arrows Capital.

Information on FTT sparked concern about Alameda Analysis, Bankman-Fried’s buying and selling agency and sister firm to FTX. A report final week on the state of Alameda’s funds confirmed a big portion of its stability sheet is concentrated in FTT and its varied actions leveraged the token as collateral. Alameda has disputed that declare, saying FTT represents solely a part of its complete stability sheet.

“If the worth of FTT goes approach down, then Alameda might face margin calls and all types of stress,” stated Jeff Dorman, chief funding officer at digital asset agency Arca. “If FTX is the lender to Alameda then everybody’s going to be in bother.”

— CNBC’s Kate Rooney and Tanaya Macheel contributed to this report.

[ad_2]

Source link