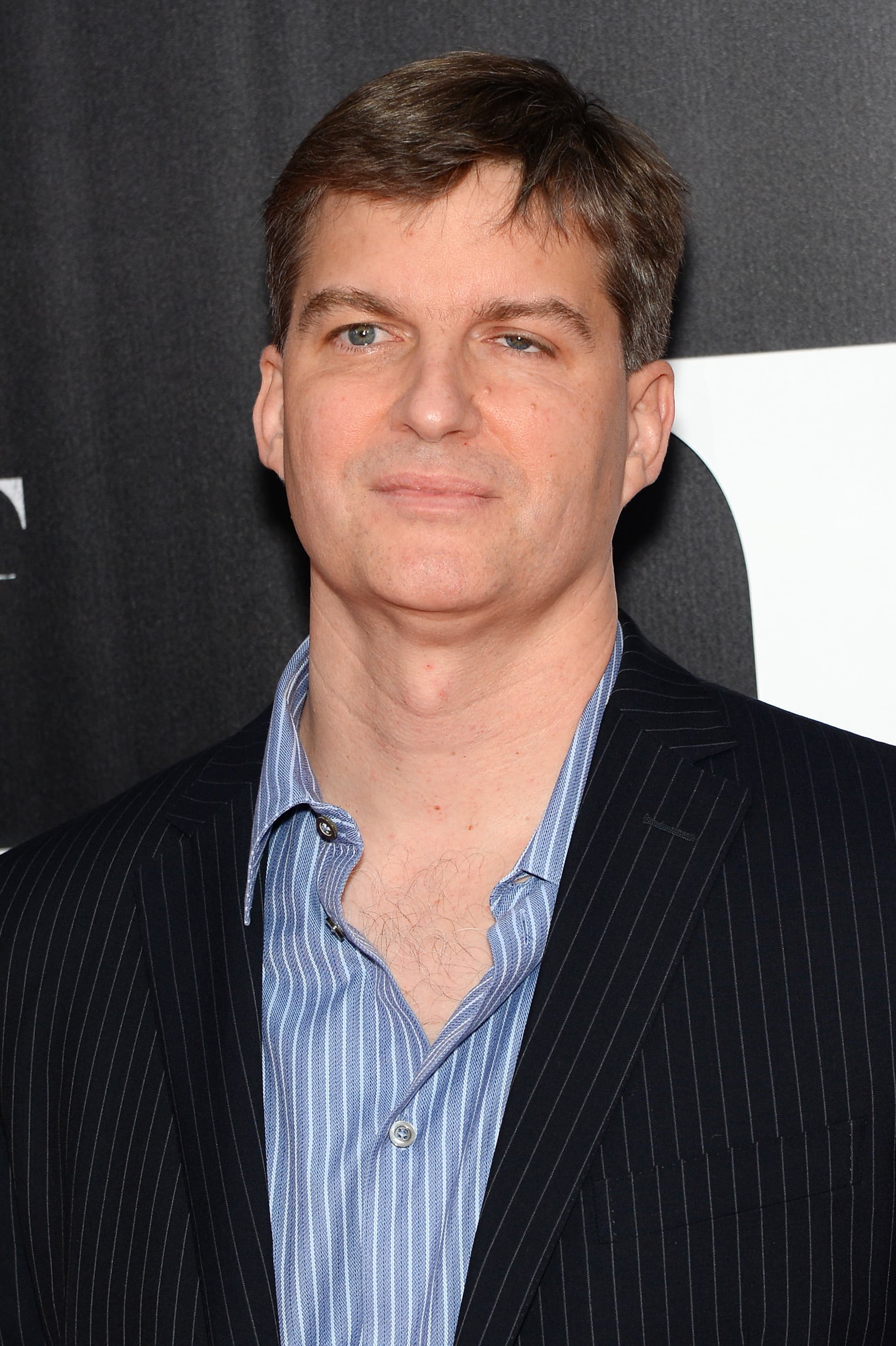

FTX collapse an instance of ‘greed and FOMO,’ says short-seller Carson Block

[ad_1]

Carson Block, founding father of brief promoting funding agency Muddy Waters, thinks the collapse of cryptocurrency change FTX below Sam Bankman-Fried is a “nice instance of greed and FOMO.”

Block informed CNBC’s “The Alternate” he had seen the enterprise trajectory of the previous billionaire and thought there was “clearly one thing fallacious.”

associated investing information

“[Bankman-Fried] went from zero to, I am value 20 billion {dollars}, I am placing our brand on main league baseball umpire uniforms and on the Miami Warmth space. It looks as if actually making an attempt exhausting to ascertain your self as a family identify.”

Bankman-Fried has not responded to a earlier CNBC request for remark. A spokesperson for FTX didn’t instantly reply.

Block stated he had issues about Alameda Analysis, the buying and selling agency SBF co-founded that was just lately revealed to have borrowed billions in FTX buyer funds with out their data and contributed to FTX’s chapter. Block stated a September 2021 article discovered Alameda’s belongings had been considerably within the cryptocurrency solana, which on the time was plunging in worth, elevating questions on its debt and supply of funds.

“When no one’s minding the shop and there is little or no regulation and it is an asset that’s of questionable actuality, that is what you get,” he stated.

Block is a crypto sceptic who described the current surge into the business as a bubble primarily based on a “suspension of disbelief.”

“To be able to have an infinite bubble, there wanted to be a wholly new asset class that no one might say, effectively this has occurred earlier than.”

He additionally stated it “wanted to be an asset that hardly has any worth.”

“Crypto, as I perceive it, there’s typically some worth within the fuel charges, however should you have a look at the worth at which these items commerce, we’re speaking the true worth is a sliver of all the worth of these items. So it has been a bubble and it has been unregulated,” he informed CNBC.

Block gained prominence for alleging and exposing cases of fraudulent accounting in U.S.-listed Chinese language corporations.

In February, Reuters reported he and different traders and hedge funds had been being probed by the U.S. Justice Division as a part of an investigation into brief promoting.

His feedback come amid a confrontation within the crypto sphere because it grapples with the current volatility.

At an occasion hosted by CNBC on Thursday, Changpeng Zhao, founding father of cryptocurrency change Binance, stated he was “shocked” that Bankman-Fried “lied to everyone,” and described his actions as “fraud.”

Zhao, who goes by “CZ,” additionally hit again at current feedback by economist Nouriel Roubini, who on Wednesday described him as one of many “seven Cs of crypto” together with “hid, corrupt, crooks, criminals, con males, carnival barkers.”

“Damaging power does not make it far in life and people folks will typically keep poor,” CZ stated.

In the meantime, FTX’s new CEO John Ray III, appointed to supervise its chapter proceedings, stated Thursday he had by no means seen “such a whole failure of company controls and such a whole absence of reliable monetary info as occurred right here.” Ray beforehand oversaw the chapter of power large Enron.

In a courtroom submitting, Ray stated he did “not have faith” within the accuracy of the steadiness sheets for FTX and Alameda Analysis, writing that they had been “unaudited and produced whereas the Debtors [FTX] had been managed by Mr. Bankman-Fried.”

Source link