Fed can stay with S&P 4,500 with stage set for a robust rally

[ad_1]

niphon

Shares have been “obliterated” and the current inventory positive factors seem like greater than a easy bear-market rally, Fundstrat Tom Lee says.

For a lot of 2022 the consensus appeared to be a drop within the S&P 500 (SP500) (NYSEARCA:SPY) to three,200. However investor notion of threat is now not one-sided, with inflation pressures easing and the Fed changing into extra knowledge dependent, Lee wrote in a notice.

The S&P “is down -20% in nominal phrases, however down -28% on ‘actual phrases’ (CPI adjusted),” Lee mentioned. “The Fed has received. Shares have been obliterated.”

“However this additionally means a 50% rally in equities would nonetheless depart shares -15% on a ‘actual foundation’ – in different phrases, S&P 500 4,500 would nonetheless be in line with Fed’s targets of tightening monetary situations.”

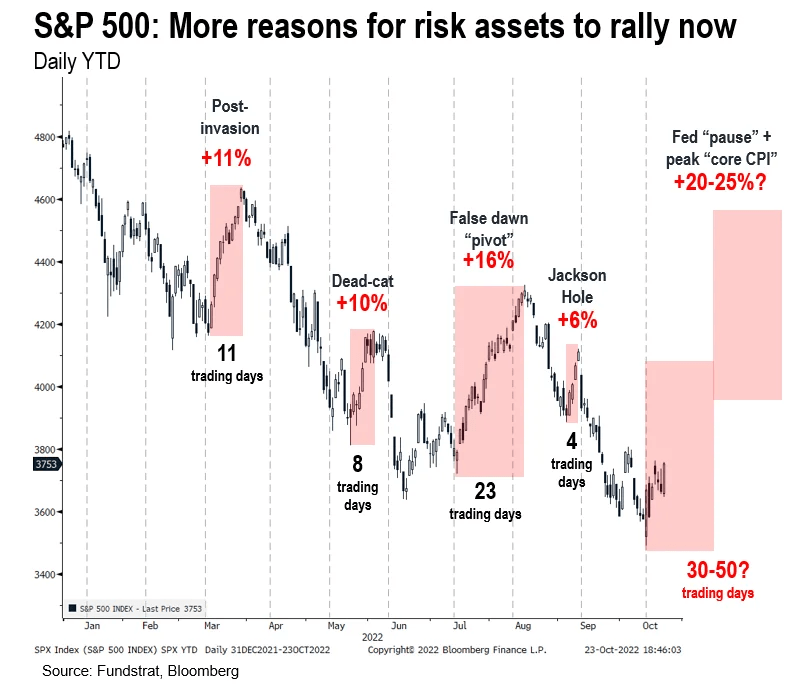

Even “if this proves to be a ‘bear rally,’ the elements are in place for a rally far stronger than the “June pivot hopes” rally, which lasted 23 buying and selling days and rose +16%,” Lee added.

Through the June pivot rally, solely headline CPI had peaked, whereas JOLTs confirmed openings/employees at about 2. Now that ratio is 1.67 and falling, whereas extra economists are calling for “substantial declines” in core CPI, Lee famous.

As well as, “investor positioning is way extra bearish now than anytime in 2022.”

“Taken collectively: doesn’t it make sense a rally ought to exceed the ‘false daybreak pivot’?,” Lee mentioned, including, “contemplate a attainable 30-50 day rally and 20-25%?”

The one “fly within the ointment” is the continued surge in 10-year yields (US10Y) (TBT) (TLT).

BofA consumer flows present buyers persevering with to pile into single shares.

Source link