Economists downgrade UK development forecasts in wake of ‘mini-Funds’

[ad_1]

Analysts have downgraded their 2023 financial development forecasts for the UK within the wake of the “mini-Funds”, with many warning of little enchancment within the medium time period.

Chancellor Kwasi Kwarteng stated final month that the federal government needed to “flip the vicious cycle of stagnation right into a virtuous cycle of development”.

However many analysts suppose the federal government’s fiscal bundle, which despatched gilts and sterling tumbling, has piled a borrowing prices disaster on prime of an current dwelling prices disaster.

The economic system is predicted to contract 0.3 per cent subsequent yr, based on Consensus Economics primarily based on a mean of main forecasts — a major fall from the 0.1 per cent enlargement forecast in August.

Gaurav Ganguly, senior director of financial analysis at Moody’s Analytics, stated the federal government’s “current actions had made stagflation and a deep recession virtually inevitable”.

On the similar time, many economists see no enchancment within the medium-term outlook, with predicted annual common development fastened at 1.5 per cent, properly under the chancellor’s goal of two.5 per cent.

In reality, Ganguly stated there was a danger that medium-term development “developments decrease” as questions lingered “across the stability of the pound and the desirability of the UK as an funding location”.

Kallum Pickering, senior economist at Berenberg Financial institution, stated extra data on insurance policies over deregulation was wanted to make a full evaluation.

Nevertheless, he famous that with out some supply-side reform the tax cuts “can not increase UK potential development sooner or later”. He anticipated a 1.5 per cent contraction in financial development in 2023, reflecting a extra pessimistic view than the consensus.

He added that whereas tax cuts would help demand, the “confidence shock” and “important tightening in monetary situations” that adopted the federal government’s bulletins “will overwhelm any of their near-term results”.

The mini-Funds “is a transparent coverage failure, and due to this fact the economic system pays a value for that”, Pickering stated.

Economists from Berenberg, UBS, Goldman Sachs and HSBC are forecasting three quarters of financial contraction from the three months to September, adopted by both weak development or the economic system flatlining till the tip of subsequent yr.

That is regardless of the bundle of state vitality help, which can freeze common family vitality payments at £2,500 a yr for 2 years.

Prime minister Liz Truss’s cancellation of the tax fee reduce for the very best earners, which accounts for £2bn within the £45bn bundle of cuts, was solely “a small a part of the equation”, stated Susannah Streeter, senior funding and markets analyst at asset supervisor Hargreaves Lansdown.

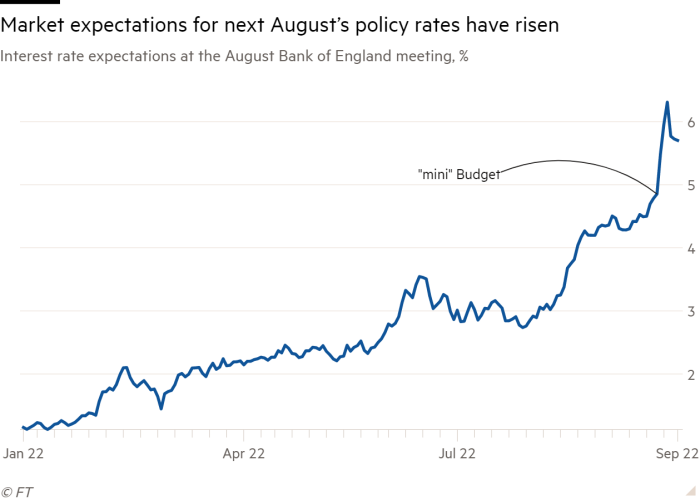

Markets are nonetheless pricing in that the Financial institution of England will increase rates of interest to above 5.5 per cent by August 2023. It is a sharp enhance on the present 2.25 per cent fee, and greater than a full share level above what was beforehand anticipated.

Ross Walker, chief UK economist at NatWest Markets, warned that the hikes within the financial institution fee had barely fed by to the actual economic system. “This hit is coming and its power will enhance,” he stated.

Even when persons are not instantly hit by rising charges they’ll most likely be apprehensive about what their mortgage funds will likely be in six months’ time or a yr, stated Martin Beck, chief financial adviser on the consultancy EY Merchandise Membership. This might trigger households to “spend much less and save extra”.

Some analysts predict present situations will result in a recession on the finish of subsequent yr, somewhat than this yr.

Ganguly stated the optimistic results of the tax cuts “can have light by this time subsequent yr” with the UK more likely to slip right into a deep recession lasting a number of quarters.

Streeter, famous that customers face “extreme cost-of-living headwinds” as a result of larger value of imports led to by the weaker pound.

These worries, she stated, can be compounded by fears about rising housing prices, at a time when many would already be grappling with larger vitality payments; “purse-tightening will proceed”, she stated.

Source link