Did Tesla’s delivery-inspired selloff create a shopping for alternative?

[ad_1]

Win McNamee

Earlier this week, Tesla (NASDAQ:TSLA) skilled its largest one-day selloff in 4 months, at the same time as the general inventory market staged a considerable rebound on rising hopes that the Federal Reserve may be nearing the top of its rate-hiking cycle. Shares of Elon Musk’s electrical automobile maker dropped after the corporate reported Q3 deliveries that had been under market expectations.

Given the present market dynamics, did the latest decline in TSLA create a shopping for alternative?

Q3 Supply Numbers

The Austin, Texas-based Tesla (TSLA) produced extra automobiles in Q3 than it delivered, with the latter quantity coming in under what analysts had predicted. In line with an organization announcement on Monday, TSLA produced 365,923 automobiles and delivered 343,830 automobiles in the course of the three-month interval. In the meantime, Wall Avenue was anticipating deliveries of 357,938.

Whereas deliveries missed expectations, the Q3 complete nonetheless represented 35% progress from Q2 and a rise of 42.5% in comparison with the identical interval final 12 months.

TSLA share had been hit onerous by the supply shortfall. The inventory dropped 8.6%, including to its year-to-date declines. Whereas share bounced again by 2% in Tuesday’s intraday motion, TSLA has misplaced greater than 20% since hitting a one-month excessive on Sept. 21.

Greater image, shares of the EV maker have dropped about 38% for 2022 as an entire.

Even with this year-to-date slide, TSLA nonetheless stays an outperformer throughout the EV automaker area. In 2022, Lucid Group (LCID) and Rivian (RIVN) have each fallen greater than 60%, whereas Nio (NIO) has dipped about 50%.

Is TSLA a Purchase?

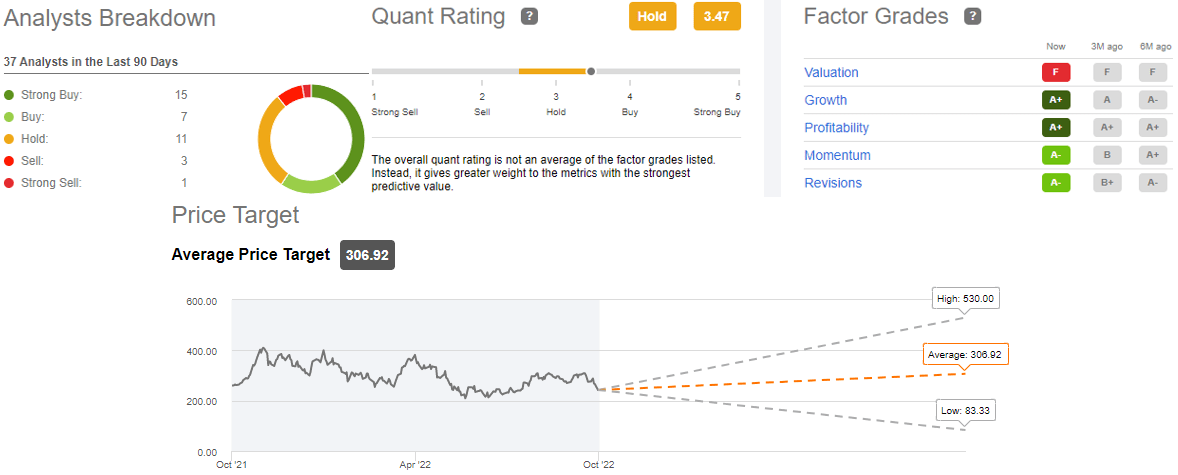

Wall Avenue holds a usually bullish view of TSLA. Of the 37 analysts surveyed by Searching for Alpha, 15 of them have categorised the inventory as a Robust Purchase. In the meantime, one other seven labeled the corporate as a Purchase.

Of these analysts who’ve voiced a less-than-bullish view, 11 see TSLA as a Maintain, whereas 3 have issued Promote rankings. A single analyst believes the EV maker is a Robust Promote.

Turning to cost targets, analyst have a mean determine of $306.92 on the inventory. This consists of outlier ranges of $530.00 a share on the excessive aspect and $83.33 to the draw back. In the intervening time, TSLA hovers close to the $255.

Searching for Alpha’s Quantitative Rankings present a extra conservative stance than the Avenue as an entire. The system for grading quantitative measures a few inventory places Tesla as a Maintain.

Valuation supplies the principle sticking level, because the Quant Rankings grade Tesla (TSLA) as an F on this entrance. Aside from that, its rankings had been comparatively constructive. TSLA obtained an A+ on the subject of each progress and profitability, whereas additionally receiving an A- when seen by way of the momentum lens.

See the breakdown under:

Searching for Alpha contributor Dominic Rinaldi is somebody who stays within the bullish camp, putting a Robust Purchase ranking on TSLA. Explaining the upbeat opinion, Rinaldi said: “Tesla demonstrated it has a expertise dominance in AI, robotics, computing, and manufacturing.”

On the identical time, fellow SA contributor Livy Funding Analysis tagged TSLA with a Robust Promote, outlining that the corporate’s supply miss is just the start of a delayed slide.

Source link