Devon Power Is Knocking on New Highs Forward of Earnings

[ad_1]

Devon Power Corp. (DVN) has been a brilliant spot in our suggestions and we advisable the lengthy facet again on July 7, 2021.

Let’s test on the charts and indicators forward of the discharge of earnings figures after the shut of buying and selling Tuesday.

On this each day bar chart of DVN, under, we are able to see a big bullish or ascending triangle sample over the previous 5 months. Costs are roughly two-thirds of the best way via the sample or to the apex and that is when costs usually make their breakout. DVN is buying and selling above the rising 50-day shifting common line and above the rising 200-day shifting common line.

The On-Stability-Quantity (OBV) line has been bottoming the previous 4 months. The Transferring Common Convergence Divergence (MACD) oscillator is bullish.

Within the weekly Japanese candlestick chart of DVN, under, we see a bullish setup. Costs are in a longer-term uptrend and commerce above the rising 40-week shifting common line.

The OBV line exhibits a protracted rise and isn’t removed from making its personal new excessive. The MACD oscillator has crossed to the upside for a recent outright purchase sign.

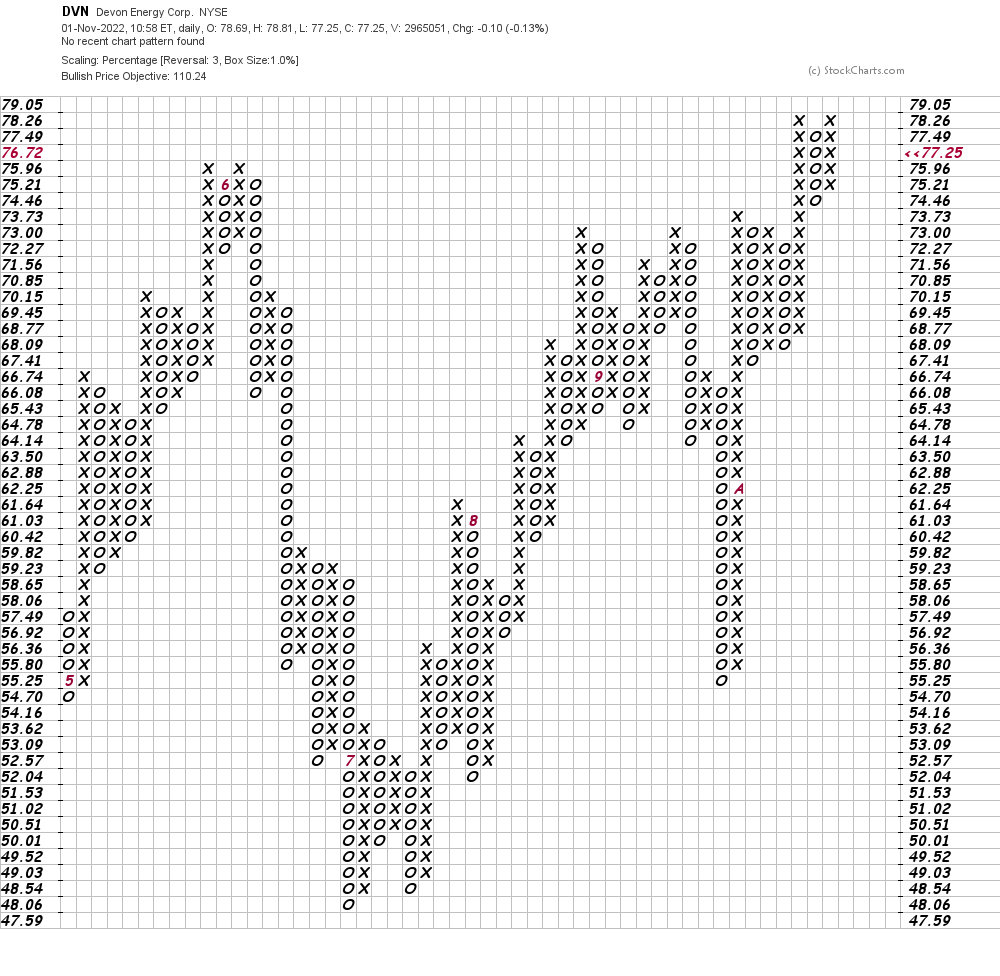

On this each day Level and Determine chart of DVN, under, we are able to see an upside worth goal within the $110 space.

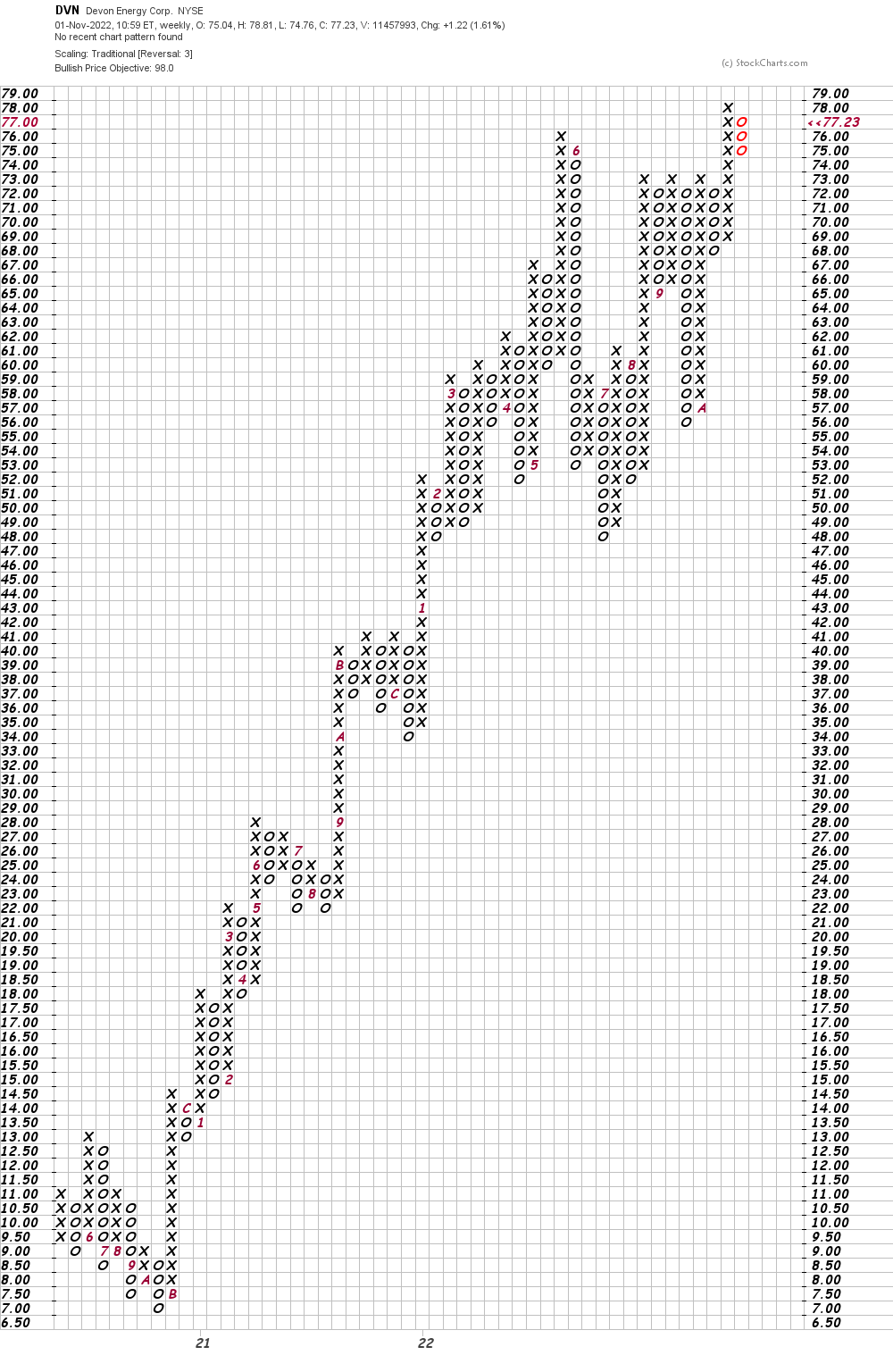

On this weekly Level and Determine chart of DVN, under, we are able to see a worth goal of $98.

Backside-line strategy: I’ve no particular information of what DVN will probably be telling shareholders this quarter however the charts are presently bullish. Merchants who’re lengthy DVN from decrease ranges ought to proceed to carry however increase promote stops to $69. The $98 space is our nearest worth goal now.

Get an e mail alert every time I write an article for Actual Cash. Click on the “+Comply with” subsequent to my byline to this text.

[ad_2]Source link