CVS Might Decline One other 20% From Right here

[ad_1]

CVS Well being (CVS) is down sharply Friday — about 10% — in response to stories that it is in talks to amass main care chain Cano Well being (CANO) and a Medicare Benefit plan downgrade. Let’s leap to the charts to see what they’ll inform us.

Within the every day bar chart of CVS, under, we will see that the shares have gapped decrease this Friday. Costs are buying and selling under the cresting 50-day and 200-day shifting common traces however extra importantly costs have damaged their June nadir.

The every day On-Steadiness-Quantity (OBV) line turned decrease in early August providing you with a “heads up” that sellers had been being extra aggressive forward of this present sharp decline. The Transferring Common Convergence Divergence (MACD) oscillator turned bearish in late September.

Within the weekly Japanese candlestick chart of CVS, under, we would not have this week’s purple (bearish) candlestick plotted however utilizing your creativeness we will see a bearish lopsided double-top sample. The draw back worth goal from this sample is within the $75-$70 space. The slope of the 40-week shifting common line has turned adverse (bearish).

The OBV line is pointed down. The MACD oscillator is weak and near crossing under the zero line.

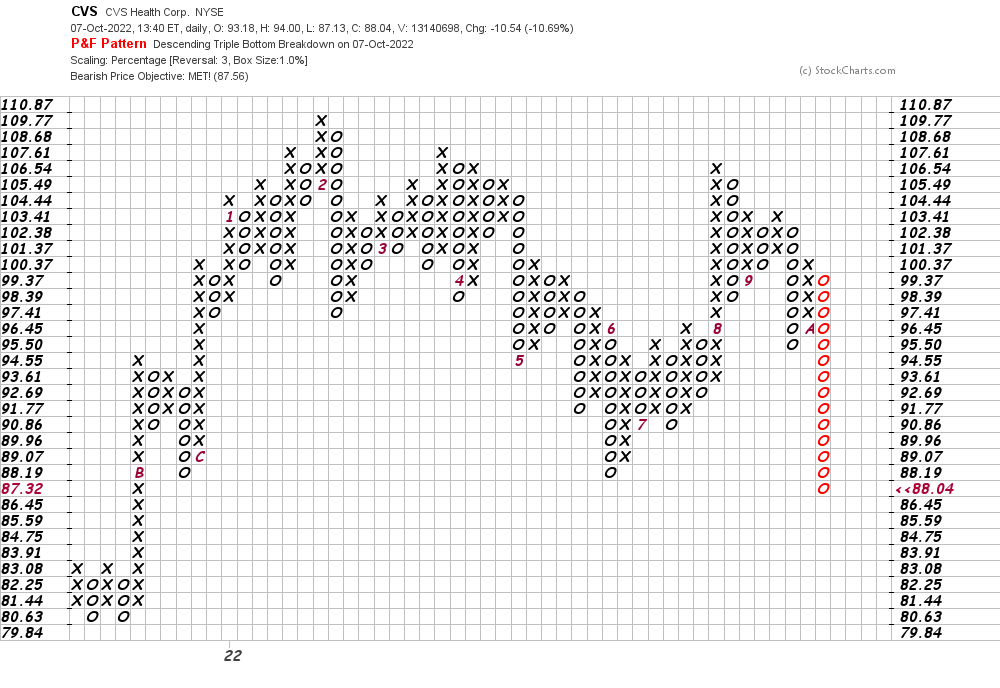

On this every day Level and Determine chart of CVS, under, we will see that the shares have met a draw back worth goal within the $88 space. No hole right here on such a chart.

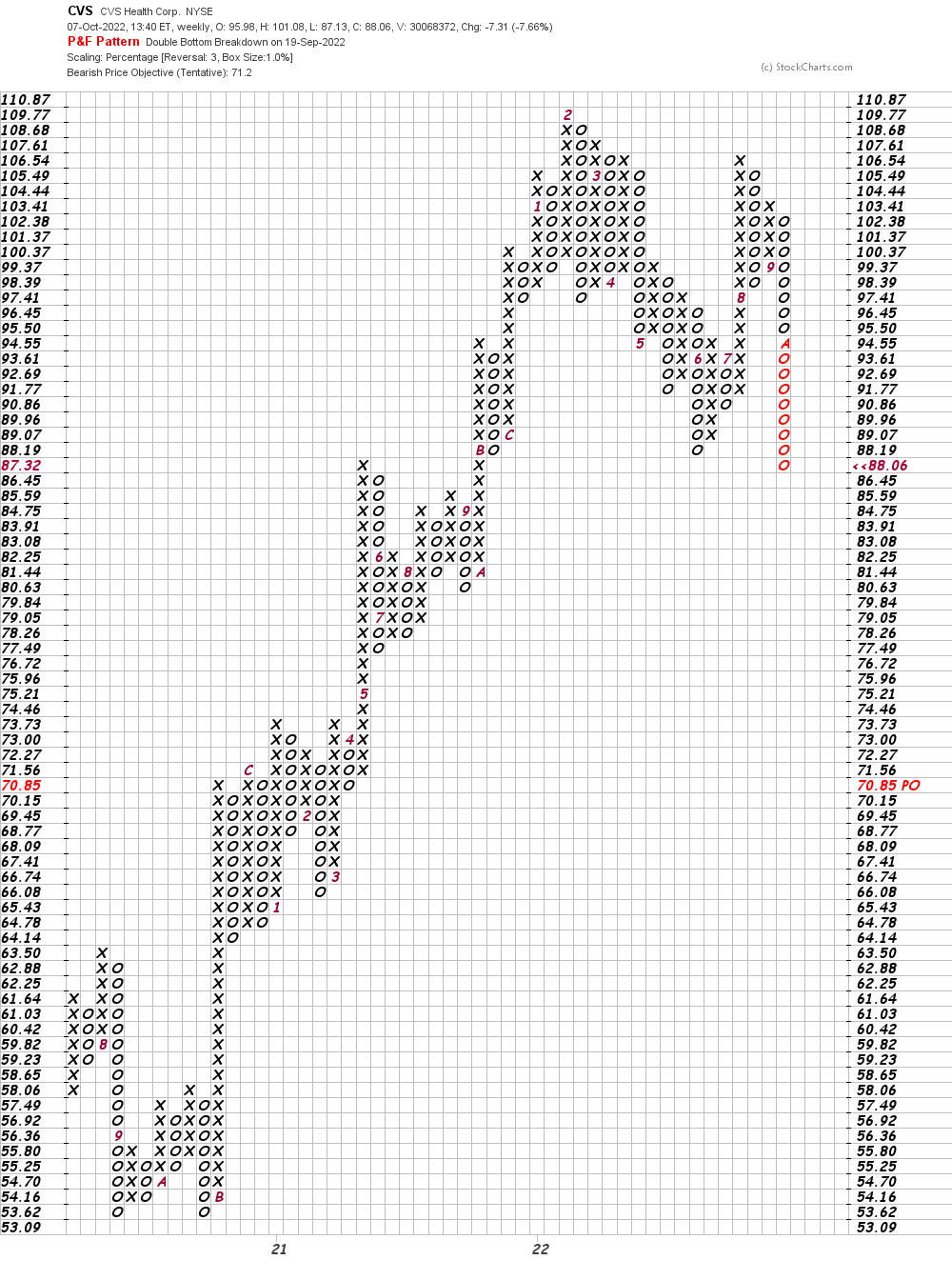

On this weekly Level and Determine chart of CVS, under, we will see a possible draw back worth goal within the $71 space.

Backside-line technique: CVS has damaged down from a prime formation. Count on additional declines with a tentative worth goal of $71. Stand apart.

Get an e mail alert every time I write an article for Actual Cash. Click on the “+Observe” subsequent to my byline to this text.

[ad_2]Source link