Crypto miners hit arduous in digital asset business’s downturn

[ad_1]

Crypto mining firms are coming underneath heavy stress from this 12 months’s digital asset downturn because the excessive value of vitality and the flatlining worth of cash pushes extra names near the monetary cliff edge.

Nasdaq-listed Core Scientific warned final week it may file for chapter safety as its money sources could be depleted by the top of the 12 months. On Monday, London-listed Argo Blockchain echoed that gloomy outlook, saying it might be compelled to stop operations after a crucial fundraising fell by.

These warnings got here solely weeks after US’s Pc North, which operated information centre providers for miners, filed for chapter, owing as much as $500mn and blaming robust market situations.

Their dire monetary conditions present how crypto mining — the method by which cash are generated and transactions are verified — is subsequent in line to really feel the impression of the crash within the worth of standard cryptocurrencies similar to bitcoin over the previous 12 months.

What’s crypto mining?

The act of using a big community of computer systems to work collectively to resolve cryptographic calculations that confirm cryptocurrency transactions. Usually, one celebration will clear up the puzzle, often called a hash, that creates the following block within the chain. The others will confirm it. In return for sustaining the blockchain, miners are rewarded with new tokens for being the primary to resolve the cryptographic proof. In addition they gather transaction charges.

Learn extra within the FT crypto glossary.

The downturn has already claimed a sequence of once-prominent crypto corporations similar to lending platform Celsius Community and Three Arrows Capital, the hedge fund.

“The crypto winter is having unfavorable ramifications for the general ecosystem, together with the miners. It’s a series response as this lengthy chilly crypto winter continues,” stated Dan Ives, managing director of Wedbush Securities.

Business analysts and executives have questioned the sustainability of mining particularly after costs of main tokens have been rangebound since June. Bitcoin has hardly ever risen above $21,000 after reaching a excessive of virtually $70,000 late final 12 months.

Miners play a vital position within the operation of so-called “proof of labor” tokens similar to bitcoin. They confirm new blocks on blockchains, successfully taking up the position as guarantor that offers are reliable in a system that bypasses third events similar to banks and exchanges. In return for mining, they’re rewarded with new tokens. Ether, the world’s second-biggest crypto token, just lately moved away from the kind of system that requires miners.

Many miners had been enticed by ever-rising costs for cash. When the worth of bitcoin crashed in 2021, firms poured cash into shopping for mining tools, together with quick computer systems that suck up massive quantities of energy. Hut 8, a mining firm, added 9,592 machines for mining within the first quarter of 2022, rising its capability by practically a 3rd.

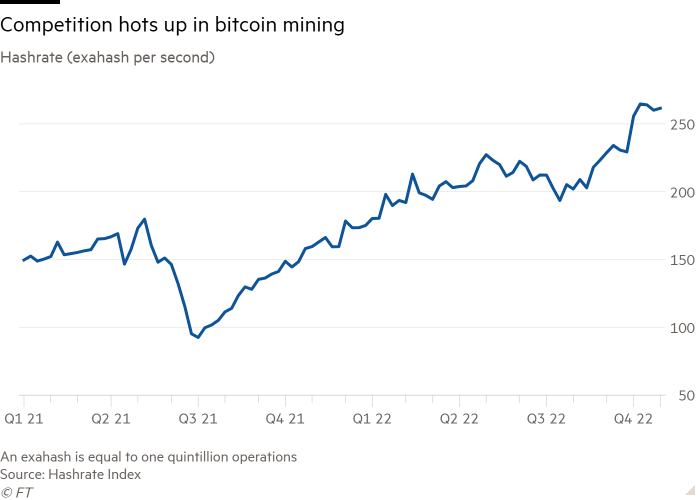

The additional mining capability has arrived available on the market simply as the worth has tumbled, which means miners are racing tougher to win the token. Bitcoin’s complete hashrate, the computing energy directed in direction of mining, has elevated by 57 per cent within the final 12 months to a document 260 exahash — or quintillion — operations a second, based on Hashrate Index.

The excessive value of vitality has additionally caught many out and punctured miners’ ambitions. Miners race in opposition to one another to resolve advanced mathematical puzzles and earn bitcoin. They expend massive quantities of vitality no matter whether or not or not they declare the bitcoin earlier than their rivals. Argo admitted that vitality prices for its Texas facility had been practically thrice the common worth for August.

That has been exacerbated by the specter of vitality blackouts within the US. In July, Argo, Core Scientific and Riot Blockchain scaled again their Texas operations, as demand for vitality threatened to overwhelm the facility grid.

“The underside line is the competitors has been rising just lately, though energy prices are excessive and the bitcoin worth is form of steady . . . I believe they’re nonetheless worthwhile, however the revenue spreads are shrinking,” stated Chris Brendler, a senior analysis analyst at DA Davidson, an funding financial institution. He stays optimistic on some miners, together with Stronghold Digital Mining, which has shed greater than 95 per cent of its worth prior to now 12 months.

Situations might not enhance within the brief time period. For the reason that Ethereum “Merge” in September made Ethereum mining successfully out of date by switching to a distinct system for transaction verification, firms similar to Hive and Hut 8 stated they deliberate to fill their capability with bitcoin mining.

Furthermore, in lower than two years the rewards for mining bitcoin is anticipated to halve, in a four-yearly occasion that’s preset into bitcoin’s code.

“The one method for miners to extend their bitcoin manufacturing by the upcoming halving is to develop capability a lot sooner than their rivals,” stated Jaran Mellerud, an unbiased crypto mining analyst.

Click on right here to go to Digital Property dashboard

Source link