Charts Recommend a Doable Turning Level for the Markets

[ad_1]

All the main fairness indexes closed larger Monday with constructive NYSE and Nasdaq internals as buying and selling volumes declined from the prior session. All closed at or close to their intraday highs with one violating its near-term downtrend line as one other generated a bullish crossover sign.

Whereas the chart progress on Monday’s rally was modest, a powerful open on Tuesday morning implies the potential technical enchancment which we’ve been ready for to turn into extra inspired to behave on the info alerts.

The sentiment information are on brilliant inexperienced lights as the group could be very bearish and the ETF merchants are extremely leveraged quick. We consider that the group will probably begin reversing its course as they pile again in and shorts will should be coated.

Additionally of be aware, valuation has turn into extra affordable with a pleasant uptick in ahead 12-month consensus earnings estimates.

Index Charts Recommend Doable Turning Level

On the charts, all the main fairness indexes closed larger Monday with constructive NYSE and Nasdaq internals.

All closed at or close to their intraday highs because the Russell 2000 (see above) managed to shut above its near-term downtrend line, turning impartial from detrimental. The remainder stay in downtrends.

Nevertheless, given the constructive opening Tuesday morning, extra violations of downtrends could also be within the providing.

Cumulative market breadth remains to be detrimental and beneath its 50-day shifting common on the All Change, NYSE and Nasdaq.

The Dow Jones Transports gave a bullish stochastic crossover sign as the remainder stay oversold that will flip bullish ought to the markets shut larger Tuesday.

Sentiment Information Stays on Very Bullish Indicators

The info discover the McClellan Overbought/Oversold Oscillators dropping again to impartial from Monday’s rally (All Change: -22.14 NYSE: -27.45 Nasdaq: -19.97).

The proportion of S&P 500 points buying and selling above their 50-day shifting averages (contrarian indicator) rose to 7% and remains to be on a really bullish sign.

The Open Insider Purchase/Promote Ratio lifted to 114.15. Whereas it stays impartial, it has proven a constant rise in insider shopping for over the previous a number of days and is simply shy of turning bullish.

Importantly, the detrended Rydex Ratio, (contrarian indicator), stays on a really bullish sign at -3.50. It’s nonetheless at a degree that has solely been exceeded 5 instances prior to now 10 years because the ETF merchants proceed their prolonged leveraged quick publicity, and in our opinion, might want to cowl.

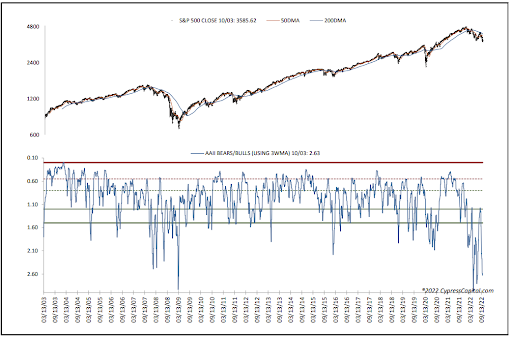

This week’s AAII Bear/Bull Ratio (contrarian indicator) rose to 2.63 and remains to be on a really bullish sign as effectively, with bears outnumbering bulls by greater than 2 to 1.

The AAII Bear/Bull Ratio is 2.63 (very bullish)

The Traders Intelligence Bear/Bull Ratio (opposite indicator) is 34.3/25.4 and in addition bullish.

Market Valuation and Yields

Of significance, the ahead 12-month consensus earnings estimate from Bloomberg for the S&P 500 noticed a pleasant elevate to $234.18 per share. As such, its ahead P/E a number of is 15.7x and at a reduction to the “rule of 20” ballpark honest worth of 16.4x.

The S&P’s ahead earnings yield is 6.37%.

The ten-Yr Treasury yield closed decrease at 3.65%. We view help as at 3.5% with resistance at 4.0%.

Our Close to-Time period Market Outlook

Monday’s notable power mixed with Tuesday’s projected motion has lastly shifted the charts to some extent that following the info alerts could also be performed with the next diploma of confidence.

Get an electronic mail alert every time I write an article for Actual Cash. Click on the “+Comply with” subsequent to my byline to this text.

[ad_2]Source link