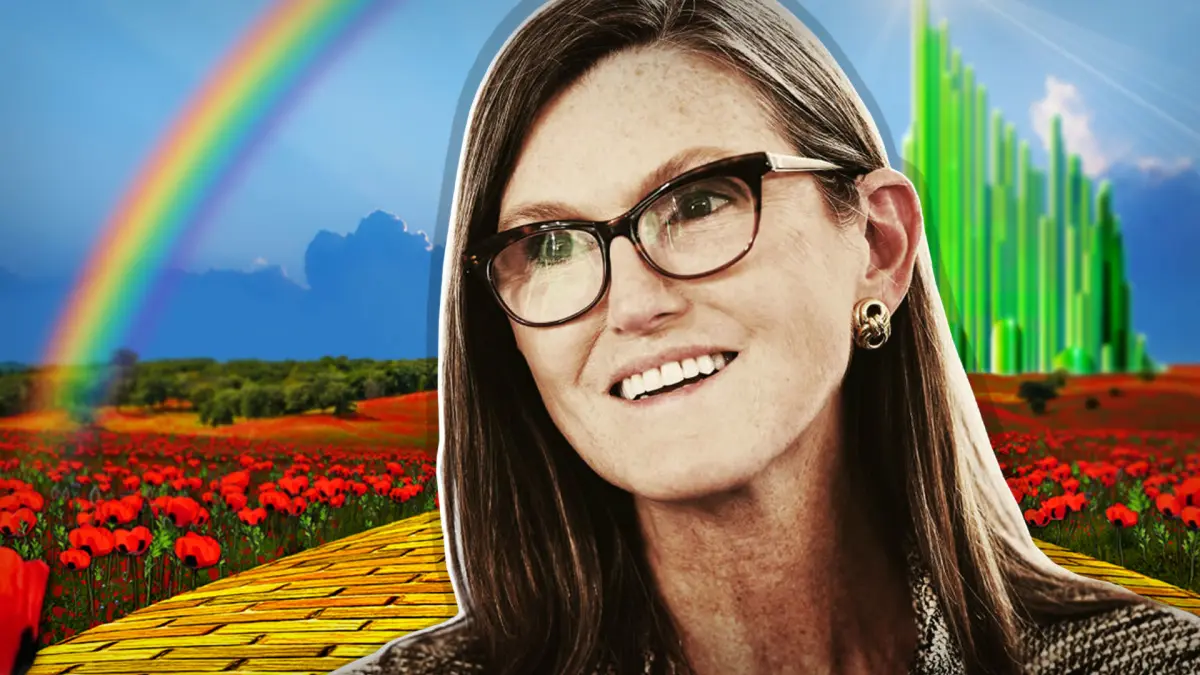

Cathie Wooden Strikes Gold on Bitcoin Funding

[ad_1]

Cathie Wooden’s exchange-traded funds (ETFs) could have hit the skids, however she has crushed it on bitcoin.

The Ark Funding Administration CEO purchased $100,000 value of bitcoin when it traded at $250, she instructed The What Bitcoin Did Podcast. As of Oct. 24 that may be value $7.7 million.

Wooden purchased on the affect of analysis by her mentor Arthur Laffer, a former economics professor and key financial official within the Reagan administration.

Turning to Wooden’s Ark ETFs, their efficiency hasn’t matched that of her bitcoin funding.

The funds have tumbled this yr, as their know-how inventory holdings suffered from weak earnings. Wooden has defended herself by noting that she has a five-year funding horizon.

And the five-year monitor document of her flagship Ark Innovation ETF (ARKK) may certainly give traders consolation as much as Might 9. The fund’s five-year return beat that of the S&P 500 till then. However the five-year annualized return of Ark Innovation totaled solely 2.14% by Oct. 21, far behind the S&P 500’s 9.75% return.

Wooden Misses Goal

The fund’s efficiency additionally falls far wanting Wooden’s objective for annualized returns of 15% over five-year durations.

Ark Innovation’s share value has tumbled 63% to this point this yr, and it’s down 78% from its February 2021 peak.

The $7.1 billion fund’s underperformance could lastly be beginning to push traders away. Ark Innovation suffered a web outflow of $450 million within the three months by Oct. 21, in line with VettaFi, an ETF analysis agency. Nevertheless it has nonetheless registered an influx of $591 million over the past six months.

You would possibly marvel why so many traders have caught with Wooden, regardless of her mediocre returns. The truth that she had one spectacular yr actually helps. Ark Innovation ETF skyrocketed 153% in 2020.

Additionally, Wooden has change into one thing of a rock star within the funding world, showing regularly within the media. She is clearly clever and articulate, explaining monetary ideas in ways in which novice traders can perceive.

Criticism of Wooden

Nonetheless, Wooden has her detractors. On March 29, Morningstar analyst Robby Greengold issued a scathing critique of Ark Innovation.

“ARKK exhibits few indicators of enhancing its threat administration or skill to efficiently navigate the difficult territory it explores,” he wrote.

Wooden countered Greengold’s factors in an interview with Magnifi Media by Tifin. “I do know there are firms like that one [Morningstar] that don’t perceive what we’re doing,” she mentioned.

If Wooden’s funding efficiency rebounds, her true believers will say, “I instructed you so.” If it doesn’t, will probably be fascinating to see how lengthy traders are keen to stay along with her.

In latest buying and selling, Ark Innovation purchased 66,190 shares of electrical car titan Tesla (TSLA) Oct. 20, value $13.7 million as of that day’s shut.

Tesla has slumped 41% yr to this point and is the second largest holding of Ark Innovation ETF.

Additionally Oct. 20, Ark Innovation dumped 59,252 shares of semiconductor big Nvidia (NVDA) , value $7.2 million as of that day’s shut.

)();

[ad_2]

Source link

Recent Posts

Basement Waterproofing with Epoxy Flooring: A Must-Have for Murrieta Homeowners

Basement waterproofing is a critical account for homeowners in Murrieta, CA, and for good reason.…

Studying the World of Terong123 Games

Here you are in the thrilling universe of Terong123 Games! Imagine walking into a realm…

Unique Home Decor Shops in Fort Worth

Hello to both Fort Worth locals and those just passing through! If your living space…

The Fascinating World of Long-Necked Cats

First, let's clarify what we mean by "long-necked cats." We're talking about decorative figurines or…

Tips for Winning the Cambodia Lottery

Hey there! So, you're interested in trying your luck with the Cambodia Lottery. Well, you're…

The Evolution of QQKuda Slot Machines

Typically, the journey of slot machines started in the vibrant era of the late 19th…