[ad_1]

By

BRUCE KAMICH

CCL

Within the every day bar chart of CCL, beneath, we are able to see that the shares have traveled decrease and decrease the previous 12 months. Costs made a low in July after which a really weak bounce earlier than Friday’s hole decrease and sharp decline. Buying and selling quantity soared above 200 million shares telling us there was a rush to get out the door. The slope of each the 50-day and the 200-day transferring averages are adverse.

Within the weekly Japanese candlestick chart of CCL, beneath, we are able to see a bearish image. The shares are in a longer-term decline as they commerce beneath the bearish 40-week transferring common line. There isn’t any close by chart help.

The weekly OBV line inched up for a couple of weeks however that advance most likely ended Friday. The weekly MACD oscillator is beneath the zero line and more likely to cross to the draw back for a recent promote sign.

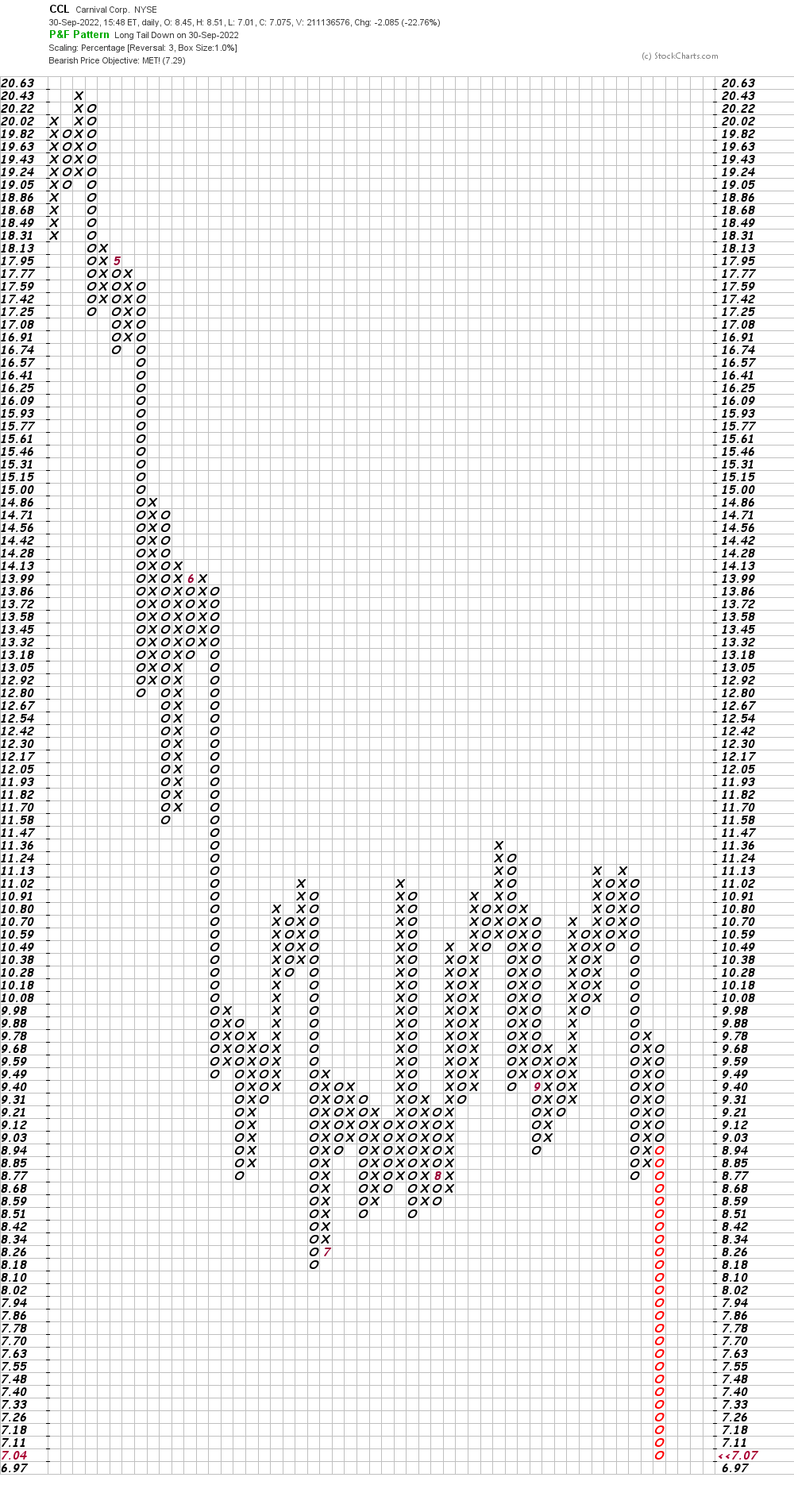

On this every day Level and Determine chart of CCL, beneath, we are able to see that the shares reached a draw back value goal round $7.

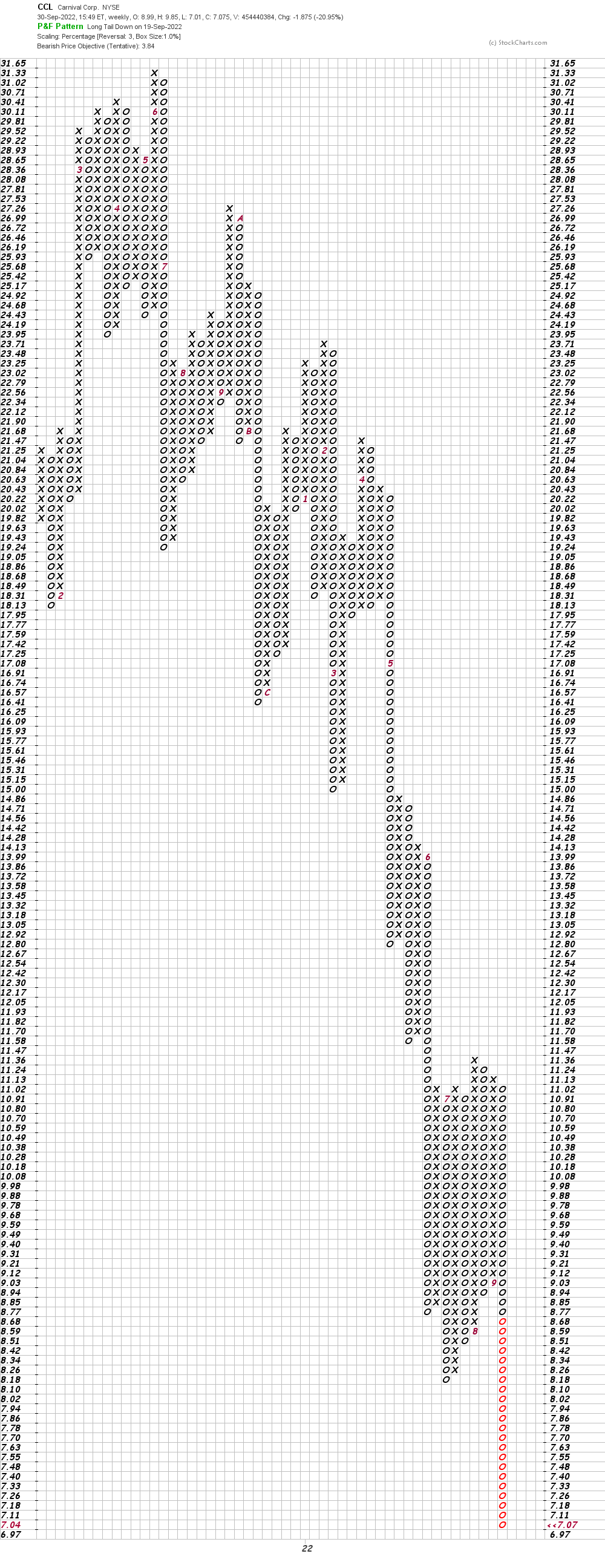

On this weekly Level and Determine chart of CCL, beneath, we are able to see a value goal round $3.84.

Backside-line technique: The weak inventory market efficiency could have you ever dreaming about occurring a cruise to get away from all of it, however the inventory charts of CCL are weak and possibly headed nonetheless decrease. Keep away from the lengthy facet of CCL.

Get an e mail alert every time I write an article for Actual Cash. Click on the “+Observe” subsequent to my byline to this text.

If in case you have questions, please contact us right here.

E mail despatched

Thanks, your e mail to has been despatched efficiently.

Oops!

We’re sorry. There was an issue making an attempt to ship your e mail to .

Please contact buyer help to tell us.

Please Be a part of or Log In to E mail Our Authors.

E mail Actual Cash’s Wall Avenue Execs for additional evaluation and perception

Already a Subscriber? Login

Source link