Canadian shopper borrowing edges up amid excessive inflation, rates of interest

[ad_1]

AsiaVision

Shopper borrowing in Canada inched greater in September from a 12 months in the past, remaining regular and near pre-pandemic ranges, as inflation continues to eat away at their disposable earnings and financial savings, in accordance with TransUnion’s Q3 2022 Credit score Trade Insights report dated Tuesday.

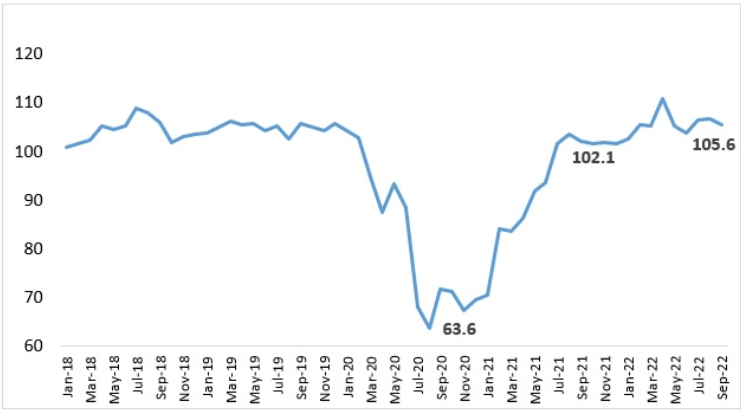

Particularly, TransUnion stated its Credit score Trade Indicator gained 3.5 factors to 105.6 year-over-year in September, up barely from the Q2 rating of 103.8, after peaking at 110.8 in April.

The quarterly rise in CII was largely pushed by “robust credit score exercise on account of steadiness progress and continued greater spend ranges” that have been possible pushed up by looming inflation pressures, stated Matt Fabian, director of economic companies analysis and consulting at TransUnion in Canada.

Then again, the index was “offset considerably by slowing credit score demand in a excessive rate of interest surroundings, with lenders additionally being extra cautious in anticipation of continued macroeconomic headwinds,” he added. And “an growing rate of interest surroundings continues to extend the price of sure debt which places further stress on some customers,” therefore spend ranges have elevated.

Inflation was the largest concern within the eyes of Canadian customers, with 69% of households apprehensive that prime shopper costs will have an effect on their funds within the subsequent six months, in accordance with TransUnion’s Q3 Shopper Pulse. And 55% of households indicated their incomes weren’t maintaining with the tempo of inflation.

Within the U.S., shopper credit score expanded lower than anticipated in September.

Source link