Can Amgen Lastly Make an Upside Breakout?

[ad_1]

Pharmaceutical large Amgen Inc. (AMGN) has been buying and selling sideways within the $250-$260 space many instances since April. The $64,000 query is whether or not AMGN can stage an upside breakout.

Let’s test the charts and the by-product indicators for a solution.

Within the day by day bar chart of AMGN, under, we are able to see that the shares are poised to check the $255-$260 space once more. Costs are buying and selling above the rising 50-day transferring common line and above the rising 200-day line. The buying and selling quantity has been regular however we’re standing look ahead to a surge in buying and selling quantity to offer validity to an upside breakout.

The On-Stability-Quantity (OBV) line has been regular since July and is near a brand new excessive. The Shifting Common Convergence Divergence (MACD) oscillator is bullish.

Within the weekly Japanese candlestick chart of AMGN, under, we are able to see that the $260 degree has been chart resistance for a very long time. Rally failures date again to the early a part of 2020. Costs are again above the rising 40-week transferring common line.

The weekly OBV line exhibits us a really sturdy rise from late 2021 and tells us that patrons of AMGN have been very aggressive. The MACD oscillator is popping up for what I’d anticipate to be a brand new outright purchase sign.

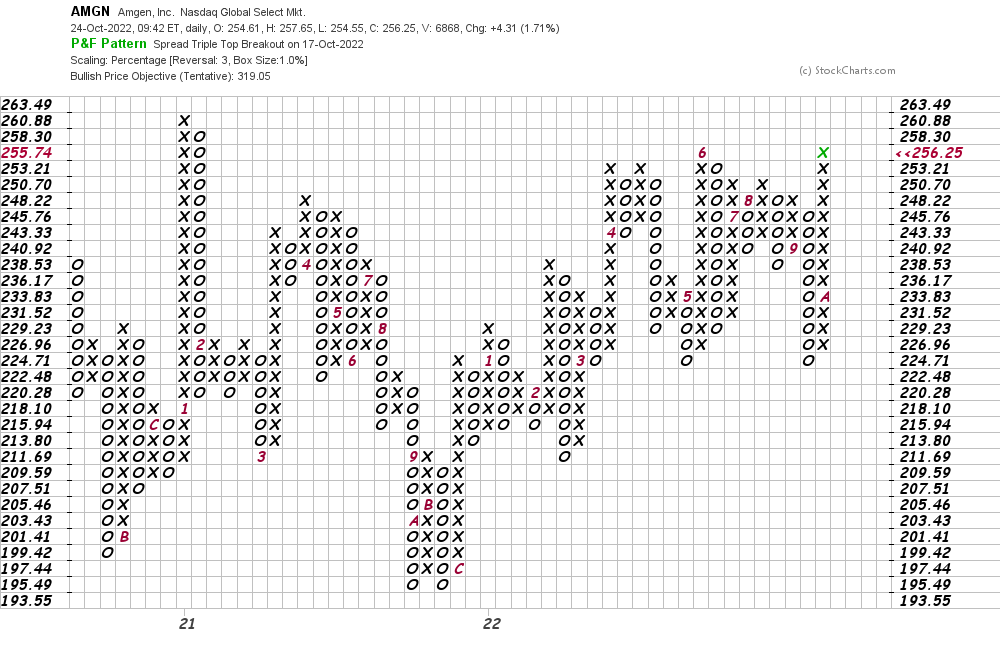

On this day by day Level and Determine chart of AMGN, under, we are able to see a possible value goal within the $319 space.

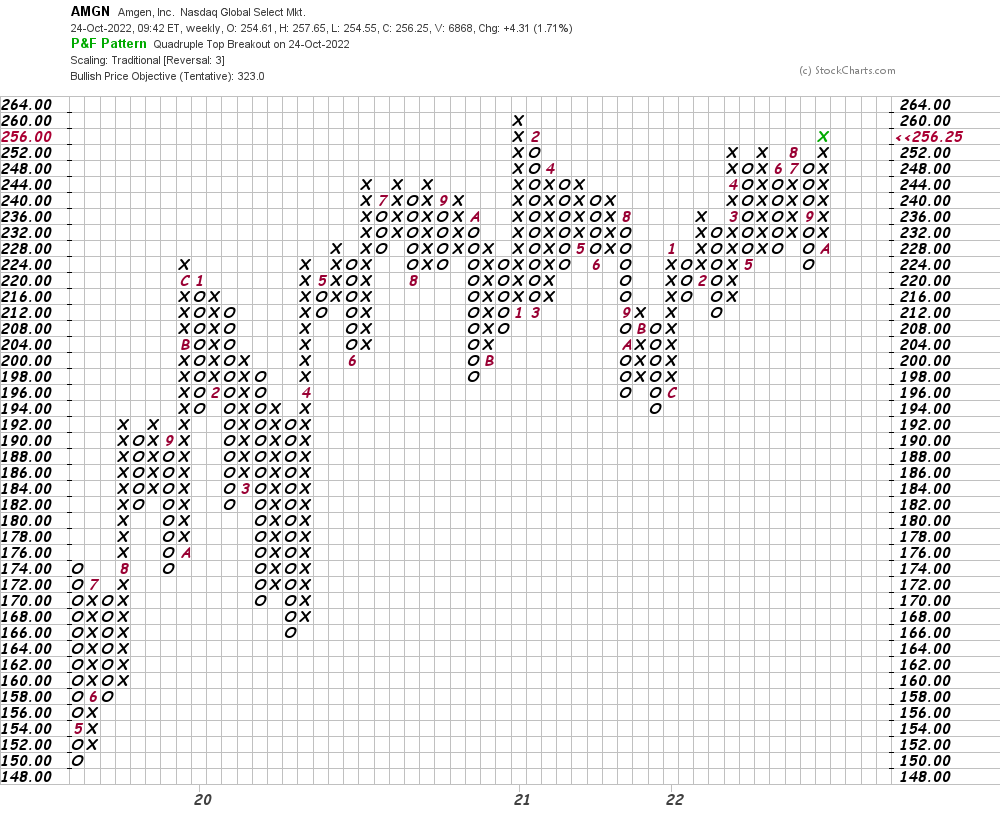

On this weekly Level and Determine chart of AMGN, under, we are able to see a $323 value goal.

Backside-line technique: Aggressive merchants might go lengthy AMGN on energy above $264. The $319 to $323 space is our first value goal.

Get an e mail alert every time I write an article for Actual Cash. Click on the “+Comply with” subsequent to my byline to this text.

[ad_2]Source link