Purchase yesterday and go away? Stifel sees a misplaced decade for the S&P 500

[ad_1]

gremlin

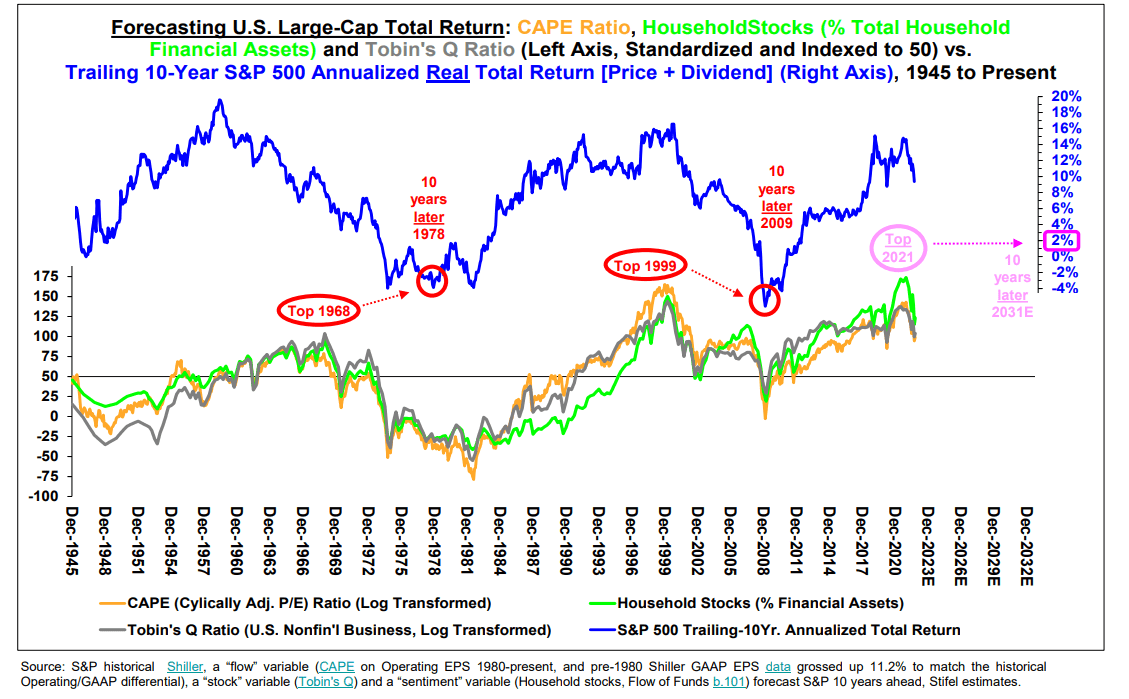

The broader market might get pleasure from a near-term bounce, however trying long term there can be nearly no return for shares, in response to Stifel’s fairness buying and selling desk.

From “the Jan-2021 S&P 500 (SP500) (NYSEARCA:SPY) excessive (4,800 nominal, 5,100 actual) we see the P/E ratio halved the ten years 2021 to 2031E offset by EPS doubling in the identical interval (7.2% CAGR), leaving the S&P 500 value about flat in 2031 versus 2021 in actual or nominal phrases,” strategist Barry B. Bannister wrote in a word. “On this interval Worth (IWD) ought to out-perform Progress (IWF) many (however not all) years.” (Emphasis added.)

“The ‘inform’ for this state of affairs can be if commodities (COMT) (FTGC) are in a ‘secular bull market’ with greater highs/greater lows for ~10 years.”

However a 10-year secular bear market with range-bound buying and selling within the S&P presents the next alternatives, Bannister says:

- Energetic (not broad passive) administration in a range-bound 2020s decade for equities

- Promote development (IWF) after S&P 500 rallies, accumulate worth (IWD) after declines

- Defensives throughout slowdowns, cyclicals throughout recoveries

- Small cap worth (SLYV) (VBR) in reflationary recoveries, Small cap development (SLYG) (VBK) in disinflation

- Macro hedge funds, or market impartial lengthy/brief fairness hedge funds

- If greenback (DXY) (UUP) (USDOLLAR) is weaker, non-U.S. markets over-weight Worth elements

- Coated name choice writing when the range-bound index nears the highest of channel

- Different funding (e.g., exhausting belongings, together with actual property and CTAs)

- A concentrate on cash-on-cash return with shorter-term money payback necessities

“A recession is weak revenue, gross sales, manufacturing, funding and jobs; we don’t see such a ‘traditional’ U.S. recession till ~3Q23E,” Bannister added. “That’s subsequent yr’s downside: whether or not recessions are attributable to coverage or shocks, the S&P 500 solely plunges when recessions begin.

Morgan Stanley’s Mike Wilson stated the present inventory rebound might see one other 10% from right here.

Source link