Bitcoin on monitor for 1% weekly loss amid broader warning as FTX contagion continues

[ad_1]

Olemedia/iStock by way of Getty Pictures

Bitcoin (BTC-USD) is on monitor to finish the week ~1% decrease, with buyers remaining cautious because the contagion from the implosion of troubled cryptocurrency change FTX continues.

The highest crypto fell to an over two-year low of $15.6K earlier this week and will doubtlessly slide additional.

“There’s doubtless extra to come back from the FTX collapse and contagion results, to not point out different scandals that may very well be uncovered. This may increasingly proceed to make crypto merchants very nervous and depart the foundations supporting value extraordinarily shaky,” mentioned OANDA analyst Craig Erlam.

Current on-chain knowledge from IntoTheBlock confirmed that 24.6M BTC addresses (~51%) have been in detrimental territory, the most important share of “out-of-the-money” addresses for the reason that begin of the pandemic downturn.

The worldwide cryptocurrency market cap stands at $831.94B, down 0.26% over Thursday, in keeping with CoinMarketCap.

FTX fallout continues

Sam Bankman-Fried, ex-CEO of FTX, ran the platform as his “private fiefdom”, FTX counsel James Bromley reportedly mentioned within the agency’s first chapter listening to. He added {that a} massive portion of FTX’s property might have been stolen or has gone lacking.

It was additionally disclosed that FTX and associates held $1.24B money – greater than debtors disclosed. The corporate owed ~$3.1B to its 50 largest collectors.

Turkey is the following nation to step up scrutiny on FTX, with authorities searching for to grab the property of Fried. In the meantime, a Texas regulator launched a probe into whether or not movie star endorsements of FTX violated securities legal guidelines.

Enterprise capitalist Bradley Tusk informed CNBC that enterprise capitalists will step up their due diligence sooner or later following the FTX meltdown.

Genesis International Capital, the crypto lending unit of brokerage Genesis, reportedly employed funding financial institution Moelis to discover the way it can shore up its liquidity. Given its publicity to FTX, Genesis has been scrambling to boost money and will have to file for chapter safety.

Regulatory information

Amid rising requires elevated scrutiny of the crypto area, sure U.S. lawmakers reiterated that Constancy Investments ought to rethink letting retail purchasers put a portion of their financial savings into bitcoin (BTC-USD).

A bunch of legislators additionally urged monetary regulators to evaluate SoFi’s (SOFI) crypto buying and selling actions, to which the agency responded by saying it’s “totally compliant” with legal guidelines. Morgan Stanley believes the event raises the percentages of SoFi (SOFI) exiting crypto solely.

New York Governor Kathy Hochul signed a two-year moratorium on Proof-of-Work mining, making it the primary state to partially ban PoW mining.

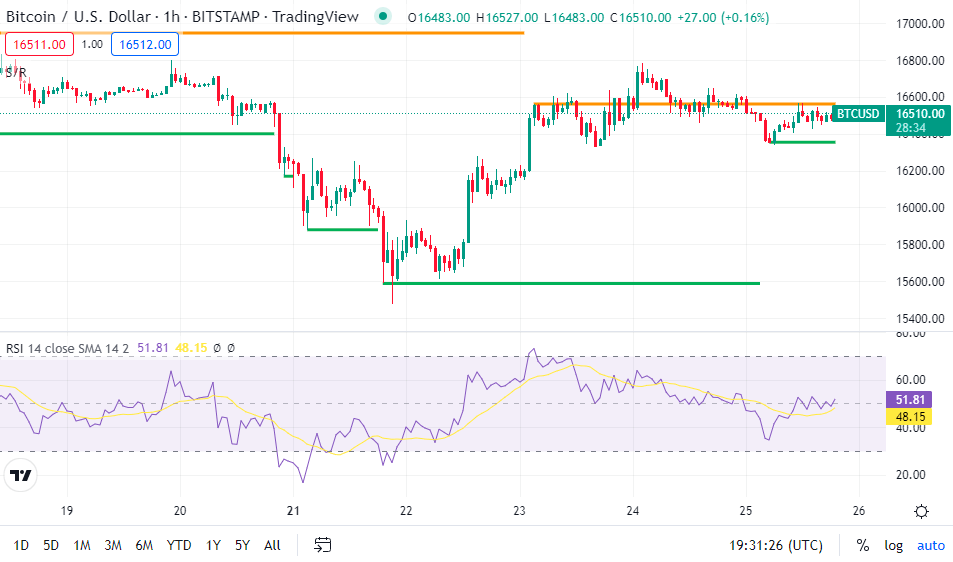

Bitcoin value

Bitcoin (BTC-USD) dipped 0.32% to $16.53K at 2.40 pm ET, whereas ether (ETH-USD) fell 0.53% to $1.20K.

Bitcoin (BTC-USD) seems to be forming a assist stage at ~$15.6K, however OANDA’s Erlam mentioned it’s doubtless that the $10K stage may very well be examined once more within the days forward.

SA contributor Pinxter Analytics in a bearish evaluation mentioned there is probably not a backside to bitcoin (BTC-USD) costs because the crypto is not backed by something tangible. Conversely, The Digital Pattern is bullish, however warned that it’s a speculative funding.

Cathie Wooden, a long-time crypto bull, reiterated her forecast that bitcoin (BTC-USD) value will attain $1M by 2030.

Billionaire investor Invoice Ackman has taken a U-turn on his views on cryptos, saying they’re “right here to remain”.

Crypto-related shares that ended within the pink on Friday embrace: Marathon Digital (MARA) -4.6%, Riot Blockchain (RIOT) -3.7%, Coinbase (COIN) -2.8%, Bitfarms (BITF) -1.1%, BitNile (NILE) -1%.

Source link