As general cloud infrastructure market progress dips to 24%, AWS stories slowdown • TechCrunch

[ad_1]

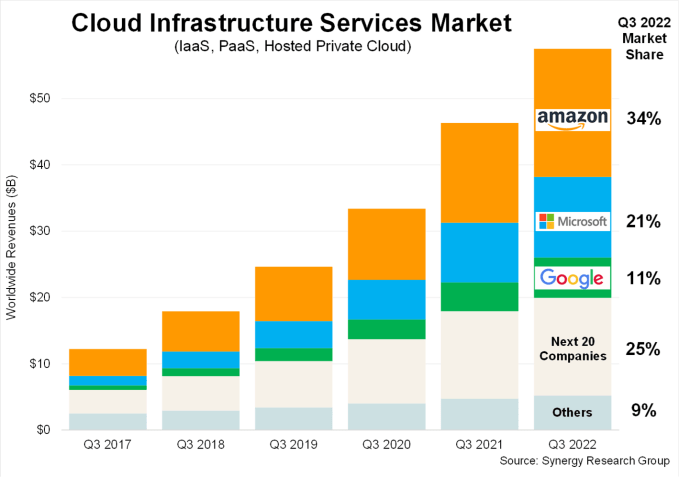

With the large three — Amazon, Microsoft and Google — reporting earnings this week, we discovered that the cloud infrastructure market topped $57 billion for the quarter, up $11 billion over the identical interval final yr.

That provides as much as 24% progress, in response to knowledge from Synergy Analysis. It won’t be the expansion we’re used to seeing from this market, however at a time of financial instability, it continues to carry out remarkably properly.

Nonetheless, it’s a step again from the times after we noticed progress steadily within the 30s. It’s even down from final quarter when the market grew 29%. So it’s truthful to say that progress is slowing in an space that’s seen explosive growth over the past a number of years.

Synergy chief analyst John Dinsdale attributed this slowdown to a number of components. Initially, there’s the legislation of huge numbers, which states that as a market measurement will increase, progress decreases. Once you mix that with a robust greenback affecting earnings outdoors the U.S. and a shrinking market in China, it’s having an impression.

“It’s a sturdy testomony to the advantages of cloud computing that regardless of two main obstacles to progress, the worldwide market nonetheless expanded by 24% from final yr. Had change charges remained secure and had the Chinese language market remained on a extra regular path, then the expansion charge share would have been properly into the thirties,” Dinsdale mentioned in a press release.

The opposite information right here is that of the large three, Google Cloud was the one one to achieve share, up a tick to 11%, because the work that CEO Thomas Kurian is doing to construct the enterprise continues to pay dividends. In the meantime, Amazon held regular because the market chief at 34%, good for round $19 billion for the quarter, with Microsoft in second at 21% with income of just about $12 billion. Google’s 11% got here in at round $6 billion.

However that doesn’t inform the entire story as Amazon’s cloud progress slowed to 27.5% within the quarter, down from 33% progress the prior quarter.

Because the chart beneath exhibiting third-quarter knowledge again to 2017 illustrates, the market has grown in leaps and bounds over the five-year interval, from simply over $10 billion to virtually $60 billion.

Picture Credit: Synergy Analysis

It’s additionally price noting that solely Google beat analysts’ expectations for cloud income, whereas each AWS and Microsoft got here up in need of their predictions. The same old caveats apply right here round numbers matching publicly reported quantities. Synergy counts public platform, infrastructure and hosted non-public cloud companies in its numbers. Complete income reported by particular person corporations may additionally embrace different parts, which Synergy doesn’t depend.

The very fact is that despite financial headwinds, the market stays surprisingly sturdy, and whereas corporations could also be searching for locations to chop, as we wrote again in June, it’s not that simple to cut back cloud spending as a result of it’s elementary to most companies nowadays. Most corporations born within the cloud aren’t going to all of the sudden construct a knowledge middle, and people within the midst of shifting to the cloud have to maintain shifting workloads due to all the advantages the cloud brings round enterprise agility.

Firms trying to lower spending can and must be searching for waste, however regardless, the cloud market will seemingly proceed to supply first rate numbers, even when the economics pressure down general income and gradual progress within the brief time period.

We often embrace Canalys knowledge as a method of comparability in these stories, however the knowledge was not out there but on the time we revealed. As quickly as Canalys publishes its knowledge, we are going to replace the article.

Source link