Apple companions with Goldman Sachs to introduce high-yield financial savings accounts for Apple Card holders • TechCrunch

[ad_1]

Apple is taking a giant step in the direction of providing extra banking providers to its clients. The corporate introduced at present it’s partnering with Goldman Sachs to quickly launch a brand new Financial savings account function for its Apple Card credit score cardholders which can permit them to save lots of and develop their “Day by day Money” — the cashback rewards which can be earned from their Apple Card purchases. Within the months forward, Apple says cardholders will have the ability to routinely save this money in a brand new, high-yield Financial savings account from accomplice Goldman Sachs which is accessible with Apple Pockets. Prospects will have the ability to switch their very own cash into this account, as effectively.

The account can have no charges, minimal deposits or minimal steadiness necessities, Apple notes, which might make the account considerably aggressive with quite a lot of neobanks which are sometimes used as a means for purchasers to park their digital money and earn cash by curiosity funds.

Apple, in its press launch this morning, didn’t but say what rate of interest can be paid out on these high-yield accounts, nevertheless. At the moment, rivals are providing APY’s within the vary of two.20%-3.05%, per knowledge from Bankrate. Some are going even larger, Investopedia knowledge signifies, citing APYs topping 3.1% at current.

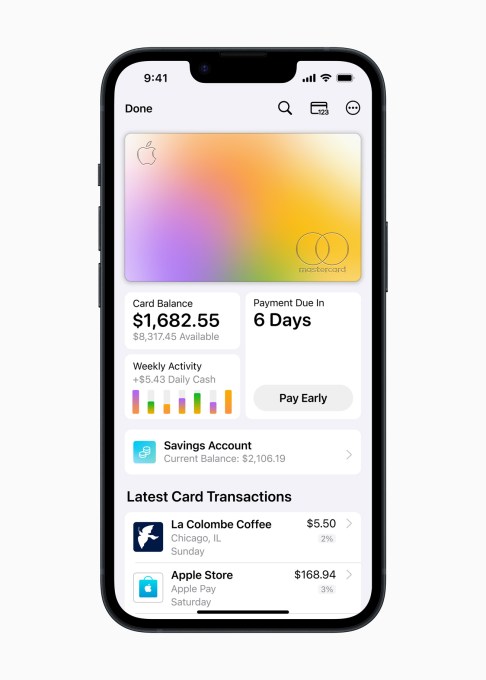

Picture Credit: Apple

When the brand new providing launches, Apple Card customers will have the ability to arrange and handle their Financial savings account straight within the present Apple Pockets cell app. From that time ahead, all of the Day by day Money they earn by Apple Card purchases might be routinely deposited into this account, until clients change this to as a substitute have the money added to their Apple Money card in Pockets, as they do at present. This selection may be switched at any time, Apple says.

An in-app Financial savings dashboard will show the account steadiness and curiosity accrued over time.

At the moment, Apple pays 3% cashback on Apple Card purchases made utilizing Apple Pay at choose retailers, together with Apple itself, in addition to Uber/Uber Eats, Walgreens, Nike, Panera Bread, T-Cellular, ExxonMobil, and Ace {Hardware}. Apple Card purchases will obtain 2% cashback when Apple Pay is used and 1% again when the titanium card is used or when a digital card quantity is used to buy on-line.

Cardholders gained’t need to rely solely on their Apple Card purchases to fund their new Financial savings accounts, nevertheless. Apple says that clients will have the ability to deposit extra funds by a linked checking account or their Apple Money steadiness. They’ll additionally withdraw this money at anytime, by transferring it again to that very same linked checking account or Apple Money card, with out having to pay charges.

With the launch of the Apple Card, Apple has been shifting steadily into the funds market, permitting it to ascertain a extra direct reference to its clients because it ramps up its “providers” enterprise, which sees it promoting subscriptions to quite a lot of choices, together with Apple Music, Apple TV+, Apple Arcade, iCloud+, Apple Information+, Apple Health+ and extra. It’s additionally trying to make Apple Pay a extra viable choice for buying on-line, with information that it’ll introduce an Affirm competitor, Apple Pay Later, for splitting up purchases into 4 interest-free funds. This providing is delayed till 2023, nevertheless, Bloomberg reported.

In the meantime, Goldman Sachs has been shifting in the direction of changing into a extra standard financial institution, with its Marcus by Goldman Sachs product, which introduced final 12 months it had reached a milestone of over $100 billion in buyer deposits after 5 years of operation. The partnership with Apple will give it one other angle into the buyer deposits market.

Apple didn’t supply a precise launch date for its high-yield Financial savings account, both, saying solely it might arrive within the “coming months.”

“Financial savings allows Apple Card customers to develop their Day by day Money rewards over time, whereas additionally saving for the longer term,” stated Jennifer Bailey, Apple’s vp of Apple Pay and Apple Pockets, in an announcement. “Financial savings delivers much more worth to customers’ favourite Apple Card profit — Day by day Money — whereas providing one other easy-to-use instrument designed to assist customers lead more healthy monetary lives.”

Source link