What to anticipate from Halliburton Q3 earnings? (NYSE:HAL)

[ad_1]

Ronald Martinez

Halliburton (NYSE:HAL) is scheduled to announce Q3 earnings outcomes on Tuesday, October twenty fifth, earlier than market open.

The world’s largest supplier of hydraulic fracturing beat Q2 estimates for earnings and revenues and posted its largest quarterly revenue in almost 4 years because it almost offered out of kit within the North American market.

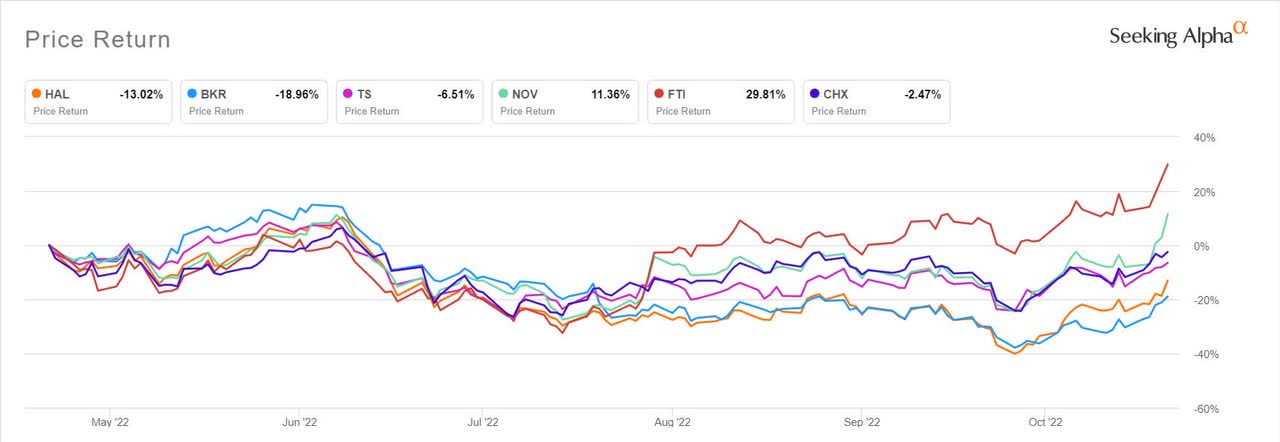

Haliburton and different associated shares have been hit by a tumble in crude oil costs amid a strengthening U.S. greenback and fears of a recession.

WTI crude oil slides beneath $80/bbl in September for the primary time since January. OPEC+ agreed earlier this month to chop manufacturing by 2M bbl/day, the most important minimize since 2020, because it seeks to halt the slide in oil costs.

The inventory has an SA Quant score of Maintain however Wall Road analysts and SA authors have been extra constructive, viewing Halliburton as a Purchase. The OPEC+ manufacturing cuts will assist raise the inventory within the close to time period, and the corporate “could also be going right into a unbelievable 2 to 3-year interval following the current debt retirement” in line with one SA contributor’s evaluation.

One other evaluation suggests Halliburton will profit from rising oil & gasoline capital spending to fulfill ongoing demand and potential Russian provide disruptions, in addition to robust pricing within the US and the necessity to broaden manufacturing abroad.

In the meantime, peer Baker Hughes (BKR) posted better-than-expected adjusted Q3 earnings final week, saying lots of the “distinctive challenges” offered in 2022 “needs to be behind us” in 2023.

Over the past 3 months, EPS estimates have seen 4 upward revisions and 0 downward. Income estimates have seen 2 upward revisions and 1 downward. The consensus EPS Estimate is $0.56 (+100.0% Y/Y) and the consensus Income Estimate is $5.34B (+38.3% Y/Y).

Over the past 2 years, HAL has crushed EPS estimates 100% of the time and has crushed income estimates 63% of the time.

Source link